Because the solar rises on Sunday, March 2, 2025, bitcoin lingered beneath the $90,000 threshold at $85,803 globally, but South Korea’s markets defied the development, with BTC commanding a 2.18% premium to achieve $87,673—a resilient divergence in an in any other case tempestuous local weather.

Three Months, One Pattern: South Korea’s Bitcoin Valuation Outpaces World Markets

Bitcoin has navigated an unforgiving week, compounding a 30-day descent of 18.1%, as geopolitical tremors tied to Trump’s tariff insurance policies injected volatility into monetary markets. Towards this backdrop, South Korea’s BTC valuations have persistently outpaced world averages all through February, crafting a story of localized defiance.

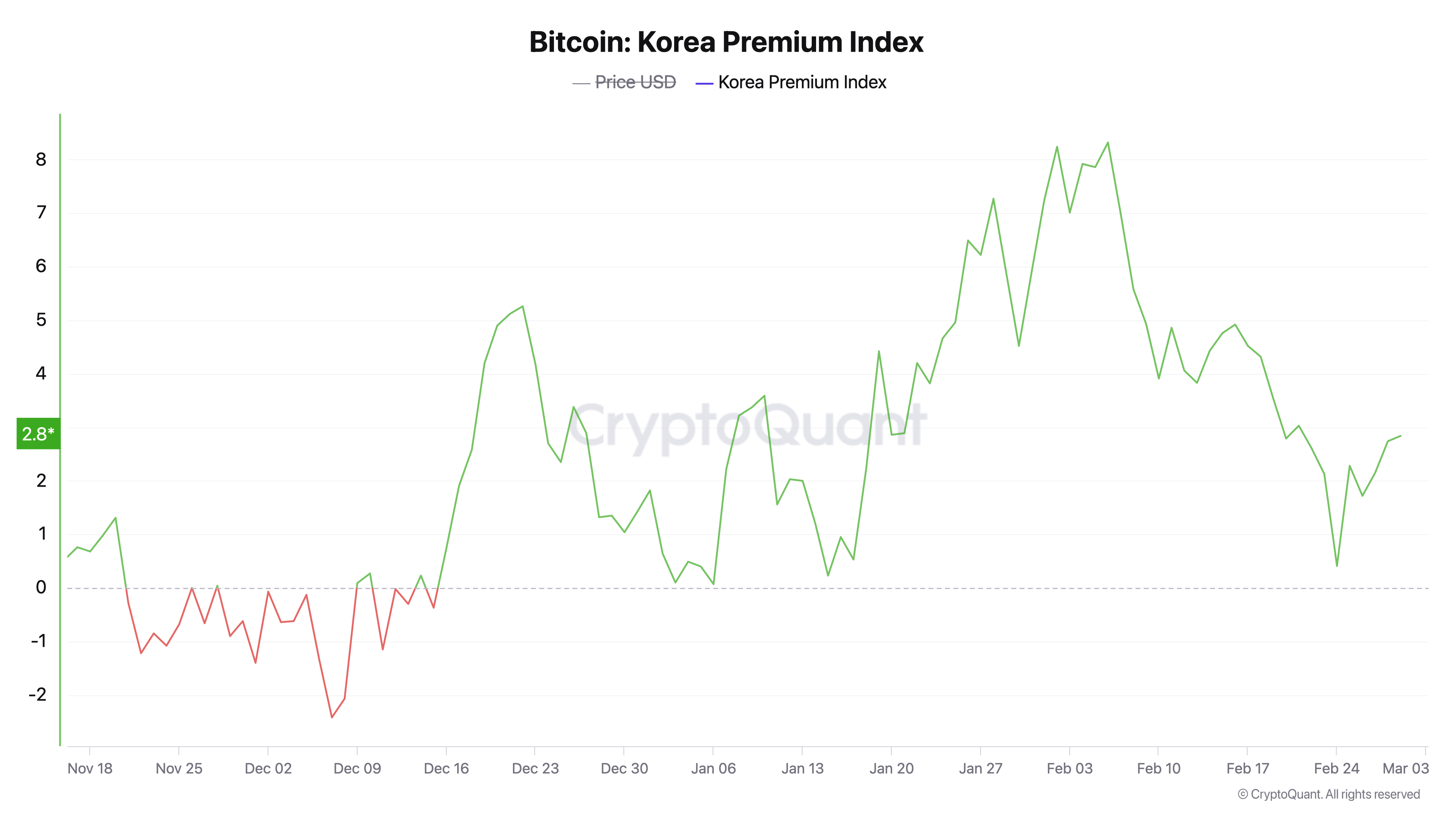

Historic knowledge from cryptoquant.com reveals this premium phenomenon has persevered since Dec. 16, 2024, threading a story of distinction between regional enthusiasm and broader market trepidation. By the shut of December, the bitcoin premium in South Korea reached 5.26%, and by the top of January 2025, it had risen to 7.27%. It didn’t cease there; on Feb. 8, the premium attained an 8.32% excessive relative to the weighted world common.

South Korea’s bitcoin premium diminished late February and into early March, resting at 2.84% on March 1 earlier than tapering to 2.18% as of Sunday, March 2, per present metrics. By 8 a.m. Jap Time (ET) that day, the nation’s BTC valuation eclipsed world averages by $1,870—a persistent and current worth anomaly.

Parallel to this, the Coinbase Premium Index and Hole, hosted on cryptoquant.com, oscillated by means of February, its erratic undulations hinting at U.S. buyers’ cautious inertia. Notably, since Feb. 24, the index has languished in destructive territory, framing a stark trans-Pacific distinction: South Korean merchants propelled demand with vigor, whereas their American counterparts exercised restraint.

Past stablecoins’ dominance, the U.S. greenback stays BTC’s foremost buying and selling associate, although the South Korean gained trails carefully behind, accounting for 3.20% to five.6% of worldwide transactions prior to now week. Day by day buying and selling volumes for the euro, Canadian greenback, and British pound pale beside the gained’s brisk exercise. Stablecoins command the lion’s share of BTC quantity, trailed by the buck and the gained—a trio that’s been shaping crypto’s liquidity hierarchy over the past yr.