Bitcoin miners noticed substantial shifts of their income throughout 2024, a pivotal 12 months marked by the community’s fourth halving occasion. As bitcoin’s block reward dropped from 6.25 BTC to three.125 BTC at block 840,000 in mid-April, the dynamics of mining profitability shifted dramatically, influencing income tendencies all year long.

From Peaks to Valleys: The Dramatic Income Shifts for Bitcoin Miners in 2024

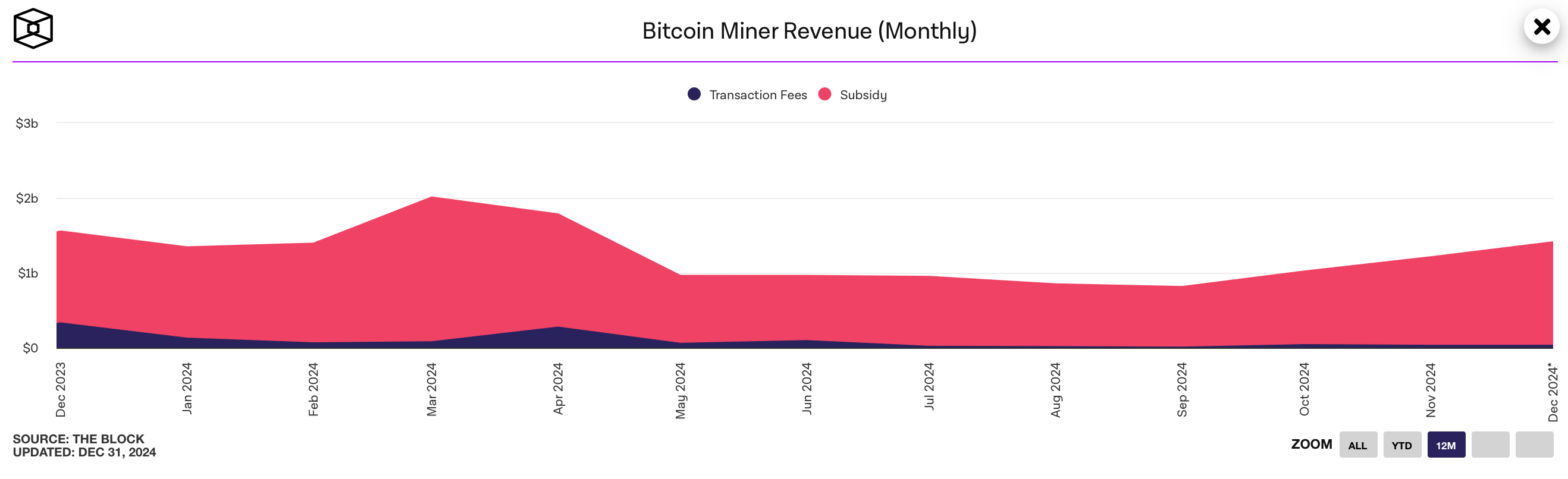

The 12 months started on a robust be aware for bitcoin (BTC) miners. Metrics collected from theblock.co’s mining knowledge exhibits January’s whole mining income reached $1.35 billion, with block subsidies contributing $1.21 billion. February noticed a modest rise to $1.39 billion, and March peaked pre-halving at $2.01 billion in whole income, $1.93 billion of which got here from block rewards. These robust earnings showcased the importance of block subsidies and hashprice previous to the halving occasion at block peak 840,000.

Following April’s halving, miners skilled a pointy income decline. April’s whole income was all the way down to $1.79 billion, as subsidies fell to $1.5 billion, reflecting the lowered block reward. By Could, income dropped under $1 billion for the primary time in 2024, totaling $964.24 million, with rewards contributing $899.39 million. This downward pattern continued via August, which marked the second-lowest income month this 12 months at $851.36 million.

September introduced additional challenges, with bitcoin miners’ whole income slipping to $815.7 million, the bottom level for block subsidies at $801.84 million. Nonetheless, miners noticed a gradual restoration within the fourth quarter. October’s income climbed to $1.02 billion, and November additionally surpassed the $1 billion mark at $1.21 billion, spurred by bitcoin’s value resurgence following the U.S. election.

December capped the 12 months with $1.41 billion in income, pushed by bitcoin’s value exceeding $108,000 in mid-December. December’s estimate may very well be a contact increased too as Dec. 31, 2024, is just not fairly completed. Whereas revenues improved considerably within the remaining quarter, they remained under pre-halving ranges. The subsidy portion of December’s income, $1.37 billion, highlighted the enduring significance of present block rewards regardless of the decrease fee.

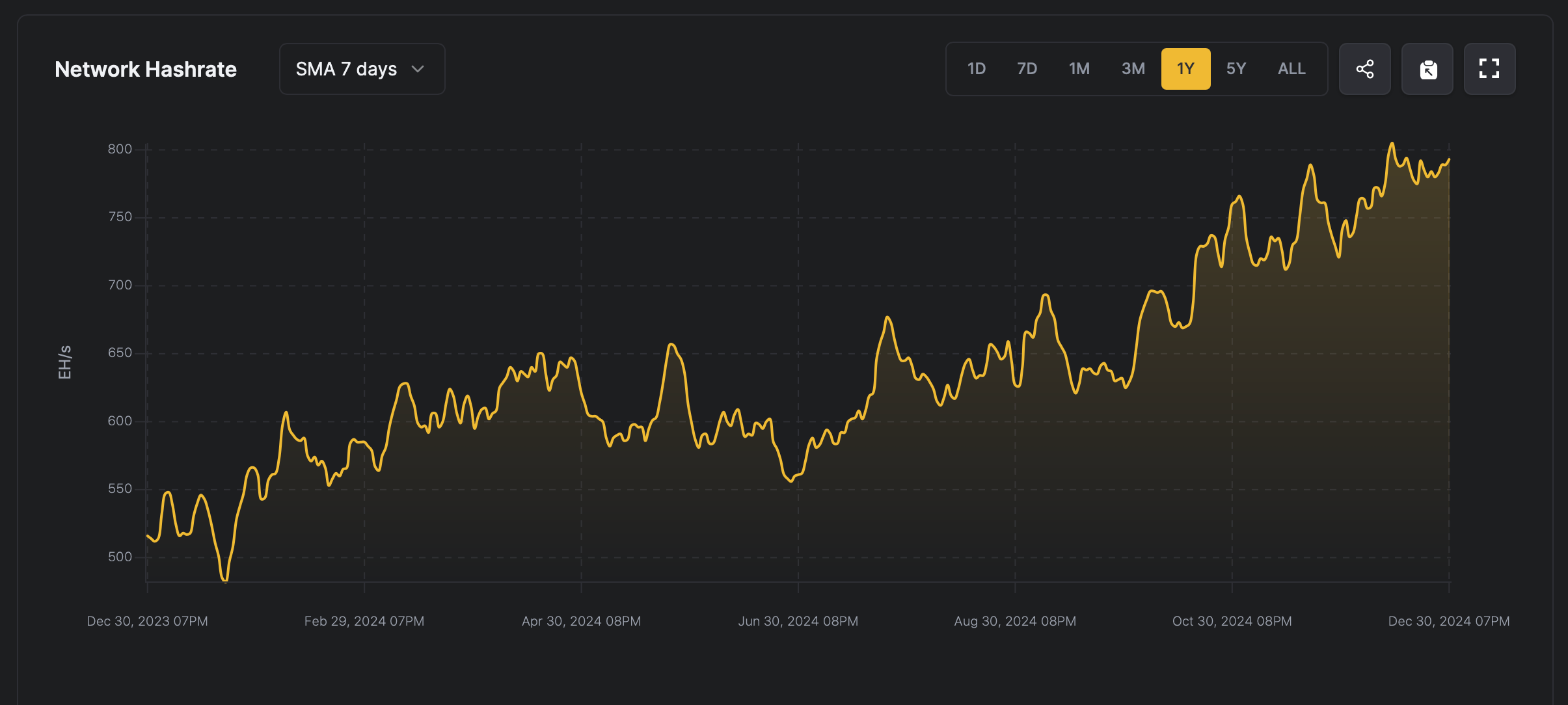

The timeline exhibits the halving occasion showcased the affect of lowered block rewards on miner earnings whereas highlighting the resilience of the sector. Whereas income shifted immensely this 12 months, miners nonetheless managed to interrupt information when it comes to computational energy. The hashrate managed to climb over 805 exahash per second (EH/s) this month in line with the seven-day easy shifting common (SMA).

Furthermore, Bitcoin’s community issue climbed sky-high this 12 months as effectively rising to an enormous 109.78 trillion after the issue change final evening. As bitcoin’s value rallied late within the 12 months, miners demonstrated adaptability in navigating new financial realities. Whether or not future years carry related volatility will rely largely on market tendencies and technological developments within the mining ecosystem.