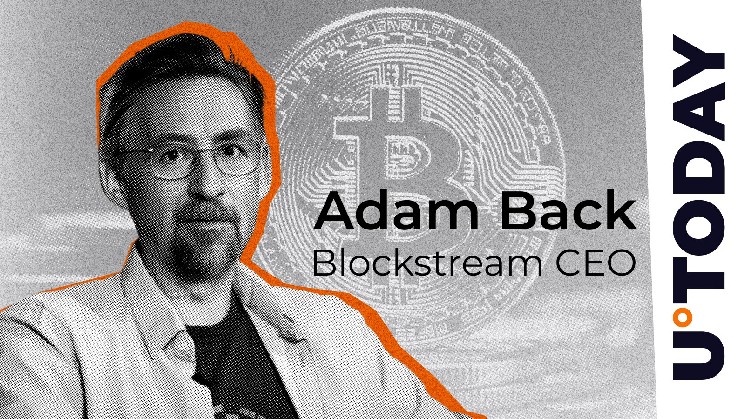

Not many posts from 2013 nonetheless get circulated in crypto circles in 2025, however one which did this week comes from a widely known determine – Adam Again – and it’s getting consideration for one purpose: it nonetheless reads like one thing somebody would publish at this time.

Again then, Bitcoin (BTC) had simply crossed $100, and other people on boards have been questioning if that they had already missed the chance to purchase. Again stepped in with what appeared like a mixture of technical perspective and straight-up frequent sense.

He identified that even when somebody purchased at $30 or $100, they might doubtless nonetheless really feel early in 10 years. No hype, only a measured take from somebody who had been cited within the Bitcoin white paper by Satoshi Nakamoto himself.

Quick ahead 12 years, and the publish popped again up on social media. Screenshots unfold rapidly, with customers stating how related it nonetheless felt. After all Again seen it and added his personal up to date touch upon the scenario.

Now, in 2025, he says individuals are nonetheless considering they’re late to the sport, and that the identical confusion he noticed again in 2013 remains to be on the market – this time coming from institutional gamers, fund managers and complex retail buyers. That confusion, he provides, is likely one of the major causes Bitcoin stays undervalued, though it isn’t $100 anymore, however $100,000.

Eventually the constructing institutional and ETF curiosity goes to hit the provision squeeze. Timing is tough, however Bitcoin fundamentals are inevitable.

— Adam Again (@adam3us) April 18, 2025

Again factors to knowledge exhibiting that on-exchange Bitcoin is steadily reducing — confirmed by most main analytics platforms. Much less obtainable BTC, extra institutional curiosity by means of ETF merchandise and a VC surroundings pushing into Bitcoin infrastructure, significantly round layer-2 options; that’s the present state, in Again’s view.

On the similar time, he attracts a transparent line between Bitcoin and altcoins. His subsequent feedback counsel that the altcoin cycle is previous its peak, whereas the Bitcoin dominance index has doubled over the previous few years.