Ethereum (ETH) considerably outshined Bitcoin (BTC), treasured metals, bonds, high commodities, and the equities market in July. Though Bitcoin worth reached a brand new all-time excessive (ATH) in July, the second-largest crypto posted an enormous 48% acquire for the month, strongly outperforming Bitcoin’s 7.9% rally and pushing proper up in opposition to the essential $4,000 resistance stage.

In line with an evaluation by Ecoinometrics, the “risk-on” sentiment that lifted all markets in July clearly favored Ether essentially the most. A key driver for this outperformance was the large success of the brand new U.S. spot Ethereum ETFs, which pulled in roughly $5.4 billion in internet inflows all through the month, fueling intense shopping for stress.

Bitcoin did properly in July however the highlight belongs to Ethereum.

Threat-on sentiment was in full swing, with U.S. inventory indices and Bitcoin hitting new highs.

However by way of uncooked returns, Ethereum was the outlier.

It’s nonetheless properly beneath its all-time excessive, however renewed ETF exercise… pic.twitter.com/CNy6shcU32

— ecoinometrics (@ecoinometrics) August 1, 2025

On-Chain Information Exhibits ETH Demand Nonetheless Excessive

At the same time as the value has seen a minor pullback, on-chain metrics present that demand for Ethereum has remained extremely robust. In line with market information evaluation from Santiment, the Ethereum community noticed an enormous spike in its every day lively addresses, reaching 841,100, the very best stage seen previously 12 months.

On the identical time, giant institutional gamers are actively accumulating. On-chain tracker EmberCN famous that SharpLink Gaming despatched $108 million in USDC to Galaxy Digital with the particular function of shopping for extra Ether. Within the final day alone, SharpLink added shut to fifteen,000 ETH, taking its whole stash to 464,000 ETH, price about $1.62 billion.

Associated: Ethereum ETFs Begin August with First Outflow, Ending 20-Day Streak

This sort of institutional confidence is constructed on a number of elements: Ethereum’s place as the most important and steady sensible contract platform, its flawless report of zero community downtime, and the latest celebration of its ten-year anniversary.

Ethereum Outlook for August

After being rejected from the $4,000 resistance on the finish of July, Ethereum has had a smooth begin to August. Nevertheless, historic information suggests the month might nonetheless finish in constructive territory for the asset.

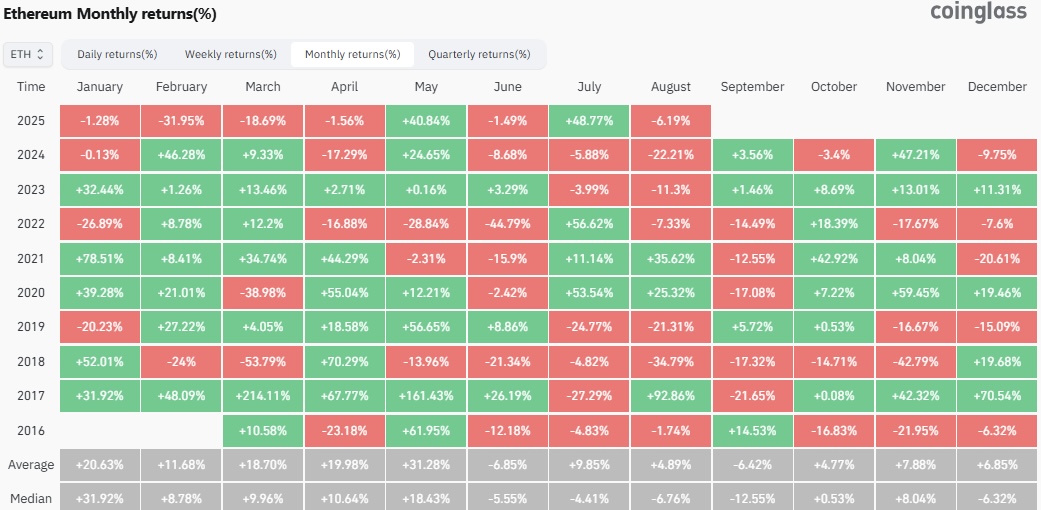

Supply: CoinGlass

In line with market information evaluation from coinglass, Ether worth has recorded a median month-to-month return of 4.89% in August since its inception. With the 2025 bull market exhibiting extra traits akin to the 2017 crypto summer time, which noticed Ether rally 92% in August, a bullish sentiment is palpable.

Associated: Bitcoin Dominance Hits 3-Yr Excessive However Faces Historic August-September Hunch

From a technical evaluation standpoint, ETH worth is properly primed to achieve a brand new ATH in August if the $4k resistance is breached. Furthermore, the 4-hour Relative Energy Index (RSI) is at its oversold stage amid a macro bullish outlook.

Disclaimer: The data introduced on this article is for informational and academic functions solely. The article doesn’t represent monetary recommendation or recommendation of any sort. Coin Version will not be answerable for any losses incurred because of the utilization of content material, merchandise, or companies talked about. Readers are suggested to train warning earlier than taking any motion associated to the corporate.