For years, Bitcoin miners increasing throughout the USA discovered that entry to low cost energy and industrial land didn’t assure group acceptance. Now, as AI hyperscalers and builders race to construct power-dense knowledge facilities, they’re encountering related native resistance over electrical energy demand, infrastructure prices and long-term environmental impression, in line with the most recent Miner Magazine publication.

The parallels have gotten more and more tough to disregard. Bitcoin mining initiatives usually promised job creation and a stronger native tax base, however these advantages didn’t at all times materialize, fueling opposition in a number of areas.

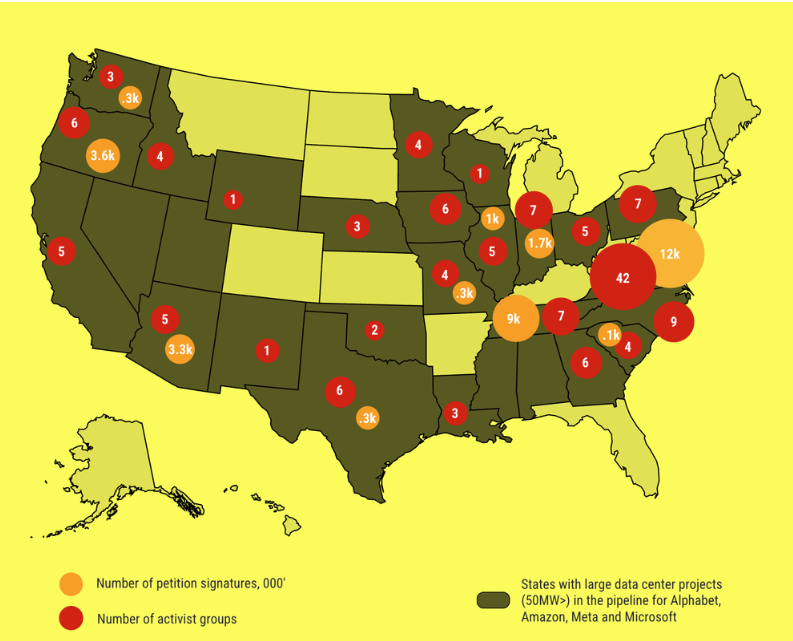

AI knowledge facilities are actually drawing most of the identical considerations, significantly in states reminiscent of Texas, Georgia, Illinois and Mississippi, the place residents and native officers are questioning the long-term prices of internet hosting energy-intensive infrastructure.

“Throughout the nation, native governments and residents are now not ready passively for assurances that AI infrastructure can be completely different,” Miner Magazine wrote.

In response, some communities are shifting to quickly halt new AI knowledge heart developments whereas officers overview zoning guidelines, backup era plans and the pressure on native infrastructure.

Business knowledge cited by Miner Magazine reveals that about $64 billion in US knowledge heart initiatives have already been delayed or blocked resulting from native opposition.

A map showcasing knowledge heart backlash in opposition to proposed growth plans by corporations reminiscent of Amazon, Meta, Microsoft and Google-parent Alphabet. Supply: Knowledge Middle Watchdog

Associated: Rural Texas group fails plan to turn out to be a metropolis to curb BTC miner noise

Microsoft and OpenAI chart new paths

Going through rising native resistance, corporations reminiscent of Microsoft and OpenAI are adopting extra community-oriented infrastructure methods to deal with the rising prices of energy era and grid upgrades related to their knowledge heart initiatives.

OpenAI has mentioned it would “pay its personal means” for power prices related to its increasing AI footprint, signaling a shift towards higher price accountability as communities and regulators scrutinize AI-driven electrical energy demand.

As Miner Magazine famous, the method sounds acquainted to the Bitcoin mining trade. Mining corporations that confronted native pushback have been usually compelled to renegotiate energy contracts and spend money on mitigation measures to exhibit clearer group advantages tied to their operations.

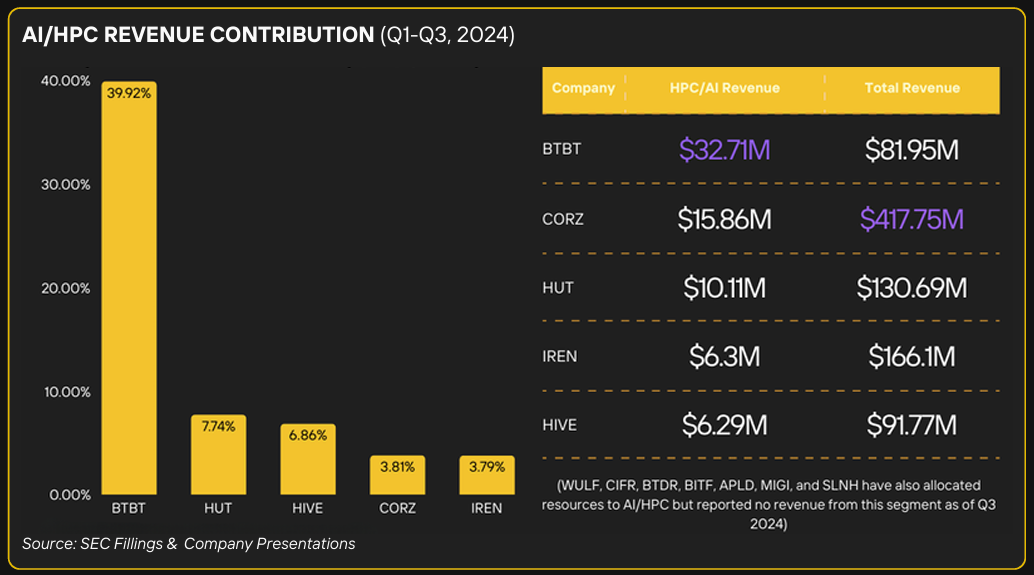

On the identical time, Bitcoin miners have been shifting towards AI and high-performance computing workloads for a number of years. Firms reminiscent of Hut 8, MARA Holdings, Riot Platforms, TeraWulf and HIVE Digital Applied sciences have pursued this shift amid intensifying competitors within the mining sector and tighter margins following the 2024 Bitcoin halving.

Strain within the bitcoin mining trade has pushed extra corporations to pivot towards AI and high-performance computing. Supply: Digital Mining Options

Associated: Bitcoin mining’s 2026 reckoning: AI pivots, margin stress and a battle to outlive