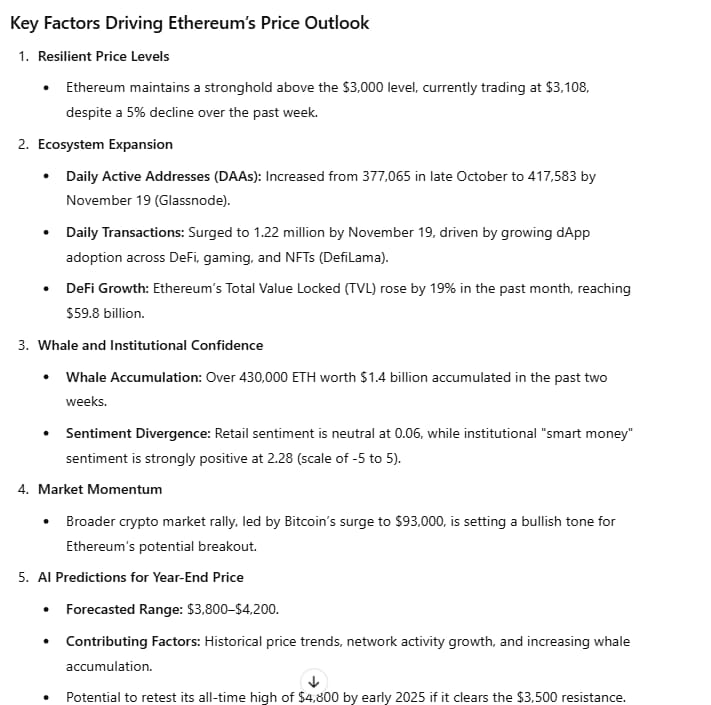

Ethereum (ETH) has maintained its place above the essential $3,000 degree, at present buying and selling at $3,108.

Whereas Bitcoin (BTC) has surged to a powerful $94,902 and altcoins like Solana (SOL) and Dogecoin (DOGE) have captured consideration with their sharp positive factors, Ethereum’s efficiency has been extra subdued, posting a modest 5% decline over the previous week.

Regardless of this short-term dip, Ethereum’s underlying fundamentals stay sturdy. Whale accumulation and surging decentralized utility (dApp) exercise are fueling optimism for a possible rally, with ETH projected to succeed in $3,800 to $4,200 by year-end.

What’s driving Ethereum’s value outlook?

Ethereum’s increasing ecosystem is a cornerstone of its bullish outlook. Community exercise has surged, with day by day energetic addresses (DAAs) climbing from 377,065 in late October to 417,583 by November 19, based on DefiLlama.

This enhance underscores rising adoption throughout Ethereum’s mainnet and scaling options like Arbitrum (ARB), Optimism (OP), and Polygon (POL, previously MATIC).

Each day transaction volumes mirror this development, rising to 1.22 million by November 19, as reported by DefiLlama.

This surge is primarily pushed by the growing use of Ethereum-powered dApps in sectors equivalent to decentralized finance (DeFi), gaming, and NFTs.

In the meantime, Ethereum’s Complete Worth Locked (TVL) in DeFi protocols has jumped by 19% previously month to $59.8 billion, additional solidifying its place as a number one blockchain platform.

Bullish sentiment from whales and good cash

Institutional gamers and Ethereum whales are displaying vital confidence within the asset. Prior to now two weeks alone, whales have accrued 430,000 ETH value $1.4 billion.

Moreover, sentiment information reveals a stark distinction between common buyers and institutional contributors. Whereas the final crowd sentiment for ETH stays impartial at 0.06, good cash sentiment stands at an optimistic 2.28 on a scale of -5 to five.

This rising institutional confidence aligns with predictions of an upside breakout as whales and different giant buyers place themselves for Ethereum’s subsequent value rally.

The broader cryptocurrency market can be witnessing robust momentum, with Bitcoin main the cost. Nonetheless, Ethereum’s slower motion could also be non permanent as its rising utility and community upgrades place it for an upside breakout.

AI prediction for Ethereum’s year-end value

For an in depth evaluation, Finbold offered market projections to ChatGPT-4o for a year-end ETH value prediction.

Leveraging historic value tendencies, community exercise, and sentiment evaluation, AI instruments forecast Ethereum might finish the yr between $3,800 and $4,200. Key contributing components embrace its sturdy ecosystem development and growing adoption.

Whereas Ethereum could face resistance across the $3,500 degree, clearing this hurdle might pave the best way for a retest of its 2021 all-time excessive of $4,800 in early 2025.

In abstract, Ethereum’s fundamentals, supported by rising community exercise and robust whale confidence, counsel an imminent breakout.

With a year-end goal of $3,800 to $4,200, ETH stays a compelling asset for buyers eyeing substantial returns amid a booming cryptocurrency market.

Featured picture through Shutterstock