Ethereum (ETH) has as soon as once more grow to be the point of interest of market hypothesis, surging to $3,400 after a close to 6% acquire in a single day, with its market capitalization now standing at $409.77 billion.

As January attracts to an in depth, merchants and institutional gamers alike are eyeing Ethereum’s short-term prospects, with AI-powered fashions presenting a blended however intriguing forecast for its trajectory by January 31, 2025.

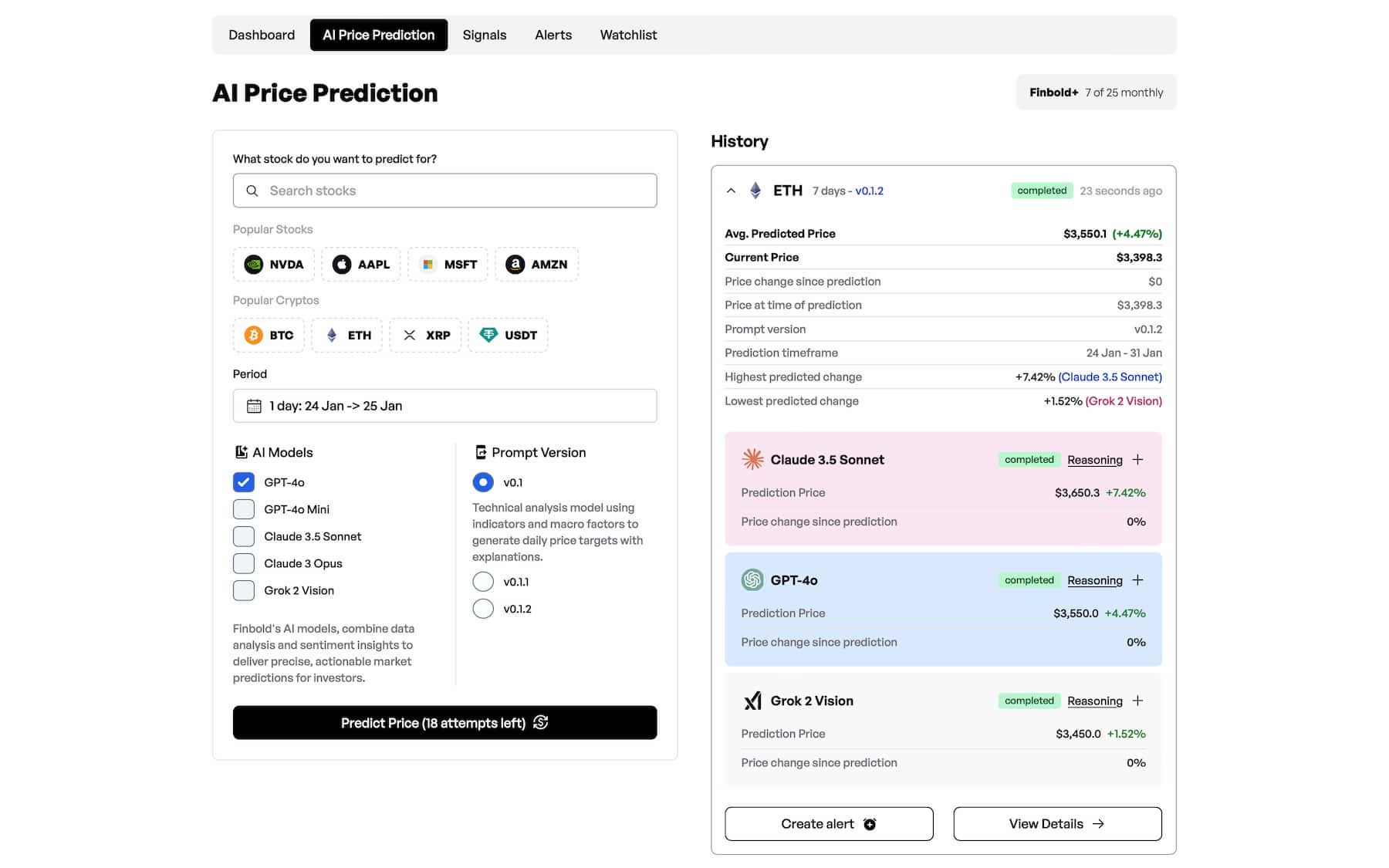

Synthetic intelligence-powered analytics paint a multifaceted image of ETH’s potential value evolution. Projections derived from Finbold’s AI analytical fashions forecast Ethereum buying and selling inside a band of $3,450 to $3,650 by January 31, 2025.

OpenAI’s GPT-4o mannequin means that Ethereum may attain as excessive as $3,550, citing sturdy alignment throughout key technical indicators such because the relative energy index (RSI) and easy transferring averages (SMA).

Claude 3 Opus, forecasts a attainable improve to $3,650, pushed by near-term profit-taking and dealer consolidation following Ethereum’s latest rally. In the meantime, Grok 2 Imaginative and prescient presents a stabilizing perspective, predicting ETH will marginally rise to $3,450, reflecting a market absorbing its latest volatility whereas awaiting the following catalyst.

The common predicted value for Ethereum from Finbold AI is $3,550.1, over 4% from ETH’s present value.

Ethereum developments

A lot of the optimism surrounding Ethereum’s future stems from its technical evolution and strategic positioning inside the broader blockchain ecosystem. Ethereum co-founder Vitalik Buterin has unveiled an bold scaling roadmap that focuses on the enlargement of Layer 2 (L2) options, blob scaling, and a renewed emphasis on Ethereum because the central financial engine of its ecosystem.

These developments purpose to handle Ethereum’s historic scalability challenges whereas bolstering its effectivity and throughput, securing its dominance in decentralized finance (DeFi).

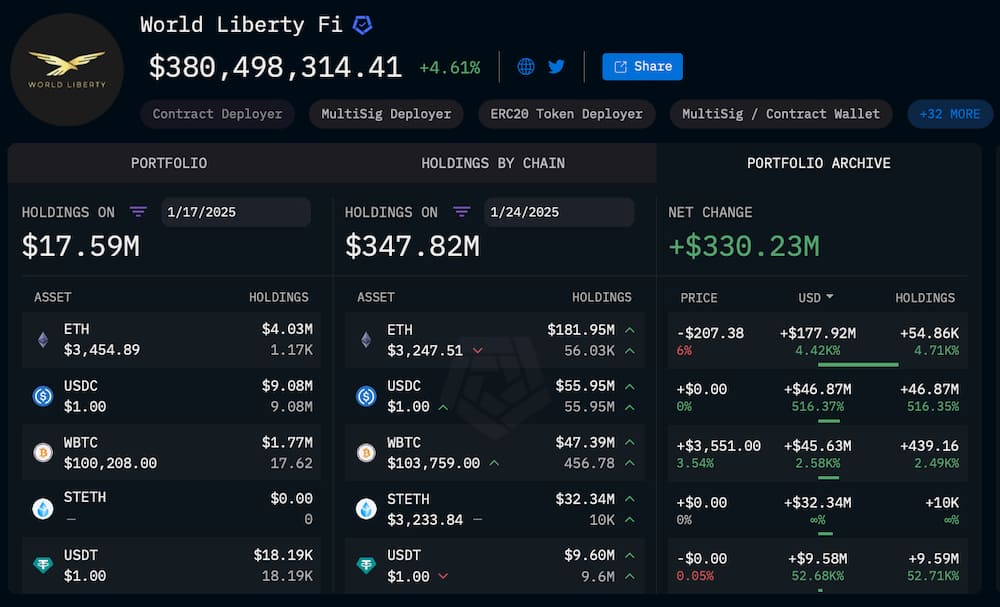

Concurrently, institutional accumulation is rising as a key driver of Ethereum’s value dynamics. In a putting present of confidence, World Liberty Monetary (WLFI)—a decentralized finance initiative backed by President Donald Trump—has considerably elevated its Ethereum holdings.

As of January 24, WLFI’s Ethereum steadiness has skyrocketed to $181.95 million, in comparison with simply $4 million per week prior.

World Liberty Fi’s accumulation contains an aggressive $33 million staked in Lido Finance (LDO) over the previous three days, with dedication to each Ethereum’s long-term potential and its staking ecosystem.

Featured picture through Shutterstock