The ETH/BTC ratio, utilized by merchants to measure Ethereum’s relative power to Bitcoin, has remained in a decent consolidation vary since mid-Might. This highlights the altcoin’s continued underperformance towards the market chief.

Whereas this stagnation displays weakening investor urge for food for ETH, it additionally indicators a broader delay within the onset of a full-fledged altcoin season.

Altcoin Season on Maintain as ETH Struggles

Readings from the every day chart present that the ETH/BTC ratio has trended inside a slender vary since Might 13. It faces resistance at 0.026 whereas discovering assist at 0.023.

ETH/BTC Ratio. Supply: TradingView

This ratio measures ETH’s worth efficiency relative to BTC, indicating which asset is gaining worth sooner. Traditionally, sustained positive aspects within the ETH/BTC ratio have served as a precursor to broader altcoin rallies, as ETH typically leads the cost in capital rotation past BTC.

Nevertheless, the present sideways pattern means that merchants stay risk-averse and decide to remain concentrated in BTC, particularly as geopolitical tensions persist.

This pattern is noteworthy as a result of it raises considerations that the extremely anticipated altcoin season might be additional delayed.

In line with a June 18 submit on X by Crypto Fella, the analyst emphasised that the ETH/BTC chart is “crucial chart to take a look at” for anybody anticipating the return of altcoin season.

Readings from the chart offered present the pair hovering across the 0.024 degree, the place earlier cycle bottoms have fashioned. Comparable constructions in 2019 and 2020 noticed ETH rebound strongly relative to BTC after prolonged intervals of underperformance. Nevertheless, as Crypto Fella factors out, “we have to see some power earlier than we are able to see the large reversal.”

ETH/BTC Ratio. Supply: X

Due to this fact, a decisive break above the important thing resistance at 0.026 is essential to signaling the beginning of a broader altcoin resurgence.

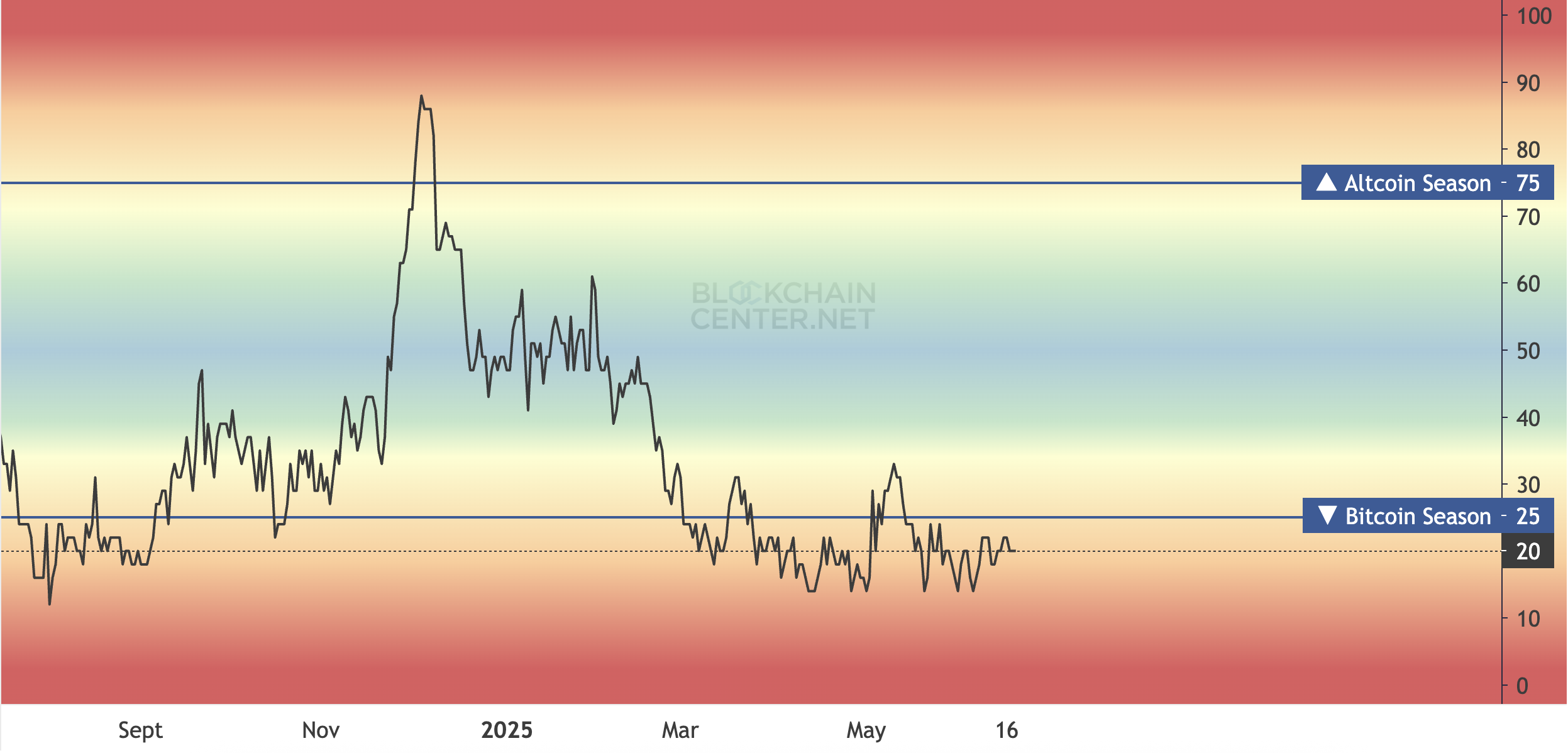

Furthermore, readings from the Altcoin Season Index point out that the market stays solidly in a BTC-dominated part. An altcoin season commences when at the least 75% of the highest 50 altcoins outperform BTC over a three-month interval.

Altcoin Season Index. Supply: Blockchain Middle

Solely 25% have managed to take action over the previous 90 days, displaying a transparent lag in altcoin efficiency and suggesting {that a} true altcoin season should be a good distance off.

ETH Struggles Under 20-Day EMA

ETH trades at $2,521 at press time, noting a modest 0.15% achieve over the previous day. On the ETH/USD one-day chart, the altcoin trades beneath its 20-day Exponential Transferring Common (EMA), confirming the bearish power amid rising geopolitical tensions within the Center East.

The 20-day EMA measures an asset’s common worth over the previous 20 buying and selling days, giving weight to latest costs. When worth trades beneath the 20-day EMA, it indicators short-term bearish momentum and suggests sellers are in management.

If this continues, ETH may fall to $2,424.

ETH Value Evaluation. Supply: TradingView

Nevertheless, if demand climbs, ETH’s worth may break above its 20-day EMA and rebound towards $2,745.