Asdrubal Oliveros, a neighborhood economist, claims that almost 80% of all of the crude offered by Venezuela is being paid for utilizing stablecoins, particularly USDT. He careworn that cryptocurrency has develop into a primary a part of the Venezuelan oil coverage, however that the nation is going through difficulties in liquidating these funds.

Analyst: Most Venezuelan Oil Gross sales Are Settled Utilizing USDT

The Information

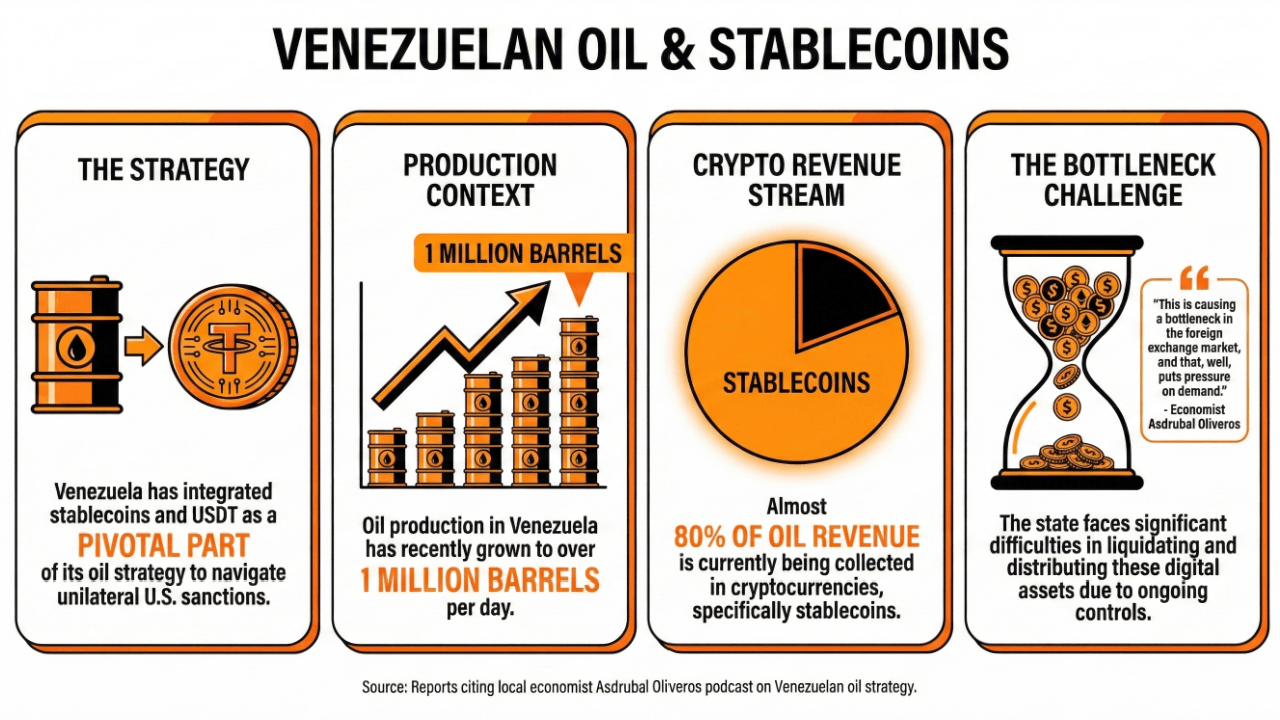

Venezuela has built-in stablecoins and USDT as a pivotal a part of its oil technique, in response to native experiences.

Asdrubal Oliveros, a neighborhood economist, referred to the related place that these digital belongings play within the present Venezuelan oil financial system, given the difficulties it faces due to the unilateral sanctions exerted by the U.S. authorities.

In a current podcast, the place Oliveros highlighted that oil manufacturing grew to over 1 million barrels per day, he detailed the ties that this sector has developed with the cryptocurrency financial system.

Oliveros said:

Essentially the most direct hyperlink this 12 months to the crypto sector comes from there as a result of finally, virtually 80% of oil income is being collected in cryptocurrencies, in stablecoins.

Nonetheless, he careworn that this improvement has additionally triggered issues for the Venezuelan administration, which is going through difficulties in liquidating and distributing these digital belongings attributable to ongoing controls.

“That is inflicting a bottleneck within the overseas alternate market, and that, properly, places stress on demand, drives up the worth, and that’s why we’ve got to be very cautious,” he concluded.

Why It Is Related

The Venezuelan oil sector receives over $12 billion yearly, with most of those exports going to China. The truth that such a big trade is being managed by stablecoins funds is a testomony to the maturity and the rising liquidity of those belongings in worldwide markets.

Moreover, it underscores the relevance of stablecoins as various belongings able to serving as settlement devices in commodity markets when conventional cost rails usually are not a viable possibility.

The Venezuelan oil trade jumped to the headlines final week as a result of ongoing unilateral “blockade” that the Trump Administration has imposed on Venezuelan oil, a improvement the Venezuelan authorities has labeled as piracy.

Learn extra: Bitcoin Pulls Again After Trump Designates Venezuela’s Authorities as a Terrorist Group

Trying Ahead

If sanctions proceed to be imposed and there’s no answer to the continuing political battle in sight, much more of those oil gross sales funds may come within the type of USDT, with Venezuela probably turning into an instance of an financial system pushed by stablecoin earnings.

FAQ

-

How are stablecoins utilized in Venezuela’s oil financial system?

Venezuela has built-in stablecoins, significantly USDT, into its oil technique, with practically 80% of oil income collected in cryptocurrencies. -

What challenges does Venezuela face with its cryptocurrency funds?

The Venezuelan state encounters difficulties in liquidating and distributing digital belongings, making a bottleneck within the overseas alternate market. -

How important is the oil sector’s income in relation to stablecoin funds?

The Venezuelan oil trade generates over $12 billion yearly, primarily exporting to China and more and more counting on stablecoin funds as a settlement methodology. -

What implications does this pattern have for the way forward for Venezuela’s financial system?

If sanctions persist, Venezuela might additional rework into an financial system pushed by stablecoin earnings, highlighting the rising function of digital belongings in commodity markets.