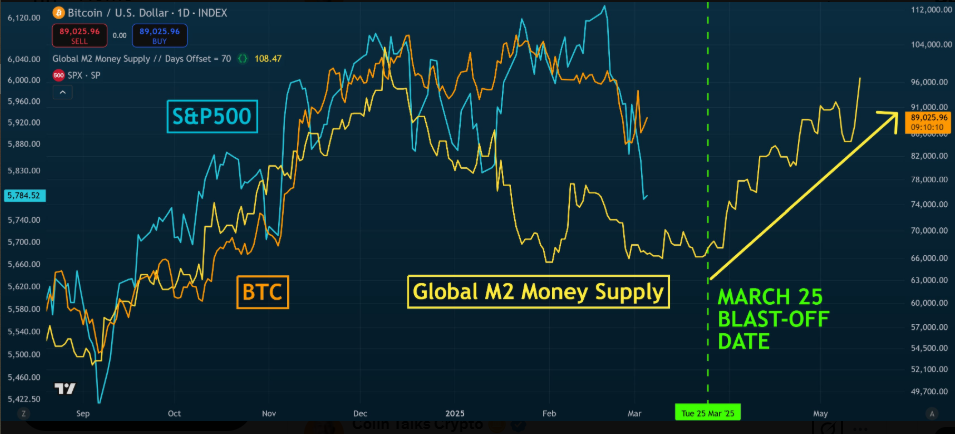

Current analyses by crypto consultants acknowledge that Bitcoin (BTC) value actions intently correlate with the worldwide M2 cash provide. Based mostly on this, they predict potential bullish momentum for the crypto market in late March.

With world liquidity increasing, analysts predict that Bitcoin and different digital belongings might expertise a major rally, beginning round March 25, 2025, and probably lasting till mid-Might.

International M2 and Its Affect on Bitcoin

The M2 cash provide represents a broad measure of liquidity, together with money, checking deposits, and simply convertible near-money belongings. Traditionally, Bitcoin has demonstrated a robust correlation with M2 fluctuations, as elevated liquidity in monetary markets usually drives demand for various belongings like cryptocurrencies.

Colin Talks Crypto, an analyst on X (Twitter), highlighted this correlation, pointing to a pointy improve in world M2. He described it as a “vertical line” on the chart, signaling an imminent surge in asset costs.

In response to his prediction, the rally for shares, Bitcoin, and the broader crypto market is anticipated to begin on March 25, 2025, and prolong till Might 14, 2025.

“The International M2 Cash Provide chart simply printed one other vertical line. The rally for shares, Bitcoin, and crypto goes to be epic,” he prompt.

Vandell, co-founder of Black Swan Capitalist, helps that world M2 actions instantly affect Bitcoin’s value. He notes that declines in world M2 are usually adopted by Bitcoin and cryptocurrency market downturns about ten weeks later.

Regardless of the potential for short-term dips, Vandell believes this cycle units the stage for a long-term uptrend.

“As seen not too long ago, when world M2 declined, Bitcoin & crypto adopted roughly 10 weeks later. Whereas additional draw back is feasible, this drawdown is a pure a part of the cycle. This liquidity shift will doubtless proceed all year long, setting the stage for the following leg up,” Vandell defined.

Equally, one other widespread analyst, Michaël van de Poppe, sees M2 growth as certainly one of 5 key indicators for an early market restoration. He emphasizes that with inflation now not the first focus and expectations of US Federal Reserve charge cuts, monetary circumstances have gotten extra favorable for Bitcoin.

“Backside line is: Inflation isn’t the prime matter, more likely to go down. FED charge cuts. The greenback to weaken massively. Yields to fall. M2 Provide to considerably increase. And as this course of began, it’s only a matter of time till altcoins and crypto choose up. Bull,” he acknowledged.

Historic Context and Projections

The correlation between Bitcoin’s value and world M2 development shouldn’t be new. Tomas, a macroeconomist, not too long ago in contrast earlier market cycles, notably in 2017 and 2020. On the time, important will increase in world M2 coincided with Bitcoin’s strongest annual performances.

“Cash provide is increasing globally. The final two main world M2 surges occurred in 2017 and 2020—each coincided with mini ‘all the pieces bubbles’ and Bitcoin’s strongest years. May we see a repeat in 2025? It will depend on whether or not the U.S. greenback weakens considerably,” Tomas noticed.

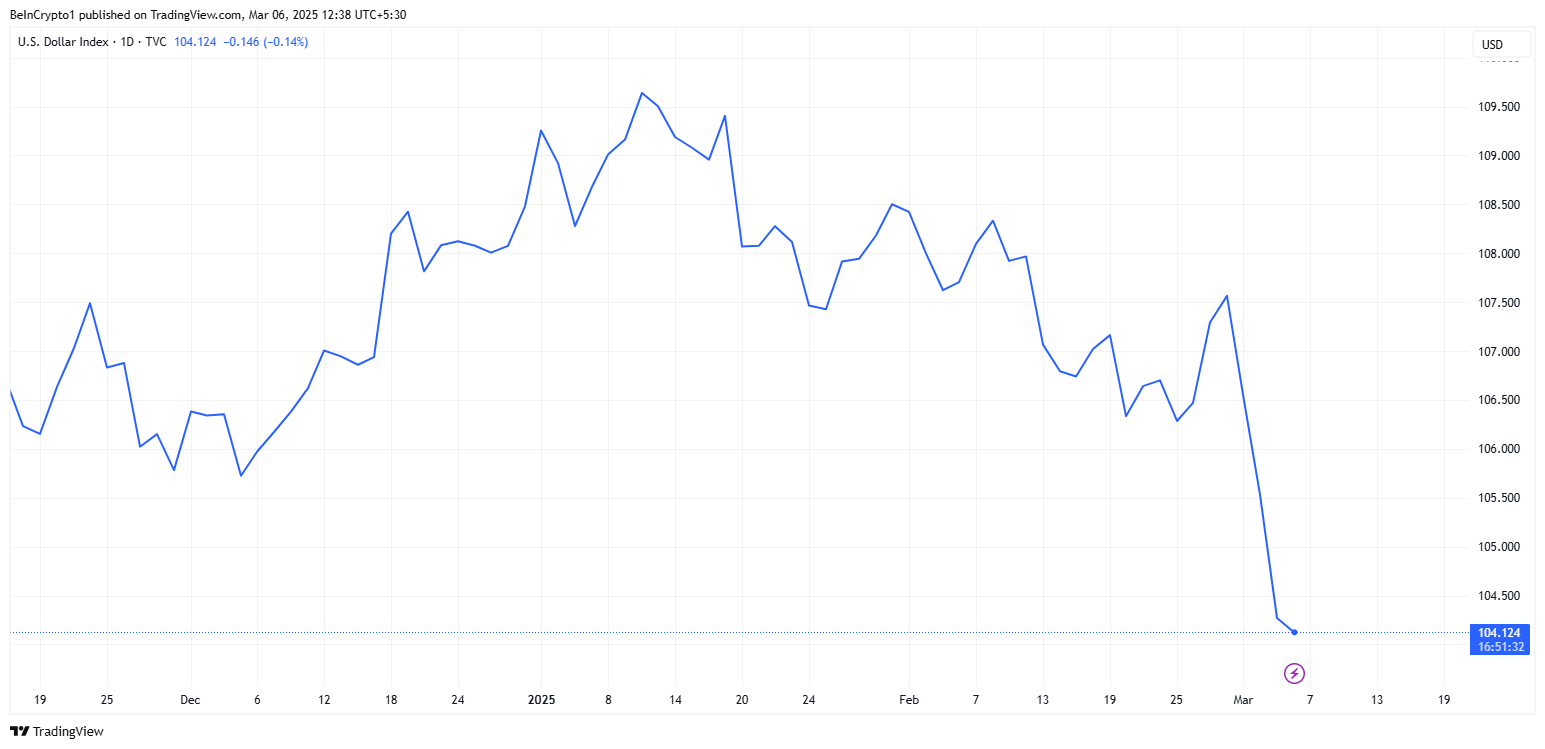

Tomas additionally highlighted the impression of central financial institution insurance policies, stating that whereas main banks are chopping charges, the energy of the US greenback might be a limiting issue. If the greenback index (DXY) drops to round 100 or decrease, it might create circumstances much like earlier Bitcoin bull runs.

DXY Efficiency. Supply: TradingView

The Federal Reserve’s Function

Macro researcher Yimin Xu believes that the Federal Reserve would possibly halt its Quantitative Tightening (QT) insurance policies within the latter half of the yr. Such a transfer, Yimin says, might probably shift towards Quantitative Easing (QE) if financial circumstances demand it. This shift might inject further liquidity into the markets, fueling Bitcoin’s upward trajectory.

“I believe reserves might get too skinny for the Fed’s liking within the second half of the yr. I predict they’ll terminate QT in late Q3 or This autumn, with potential QE to return after,” Xu commented.

Tomas agreed, stating that the Federal Reserve’s present plan is to extend its stability sheet slowly, which is according to GDP development. He additionally articulates {that a} main monetary occasion might set off a full-scale return to QE.

These views counsel that uncertainties stay, together with the energy of the US greenback and potential financial shocks. Nonetheless, the broader consensus amongst analysts factors towards an impending bullish section for Bitcoin.

Buyers should conduct their very own analysis as they proceed to look at macroeconomic indicators within the coming months, anticipating whether or not the expected rally will materialize.