An nameless cryptocurrency dealer turned a $368 preliminary buy into $2 million of unrealized features in simply three days. Commentators on X speculate on a doable insider buying and selling exercise, though nothing is confirmed.

Specifically, the commerce occurred with the meme coin HIPPO on the Sui community in opposition to its native token, SUI. Based on a Lookonchain report on October 2, the “man” made roughly $2 million in three days.

First, on September 28, the nameless dealer spent $368 price of 198 SUI to purchase 253.5 million of HIPPO. The “man” then bought 119.6 million HIPPO for $325,000 price of 175,000 SUI, partially realizing his features.

By the point of the unique submit, the meme coin was buying and selling at $0.012, with 133.9 million HIPPO behind, price roughly $1.7 million. Nevertheless, the HIPPO/SUI pair on Cetus’s decentralized change is already up, touching the value resistance at practically $0.014.

Issues about Sui’s tokenomics

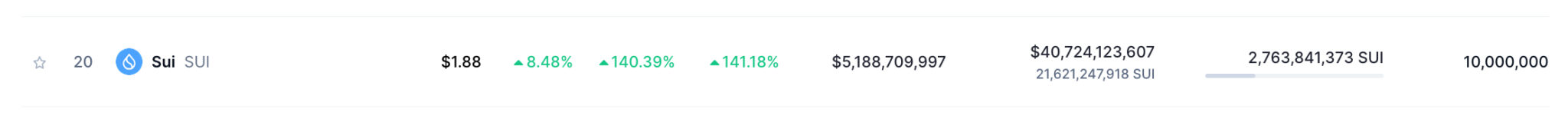

Sui has not too long ago grown to the twentieth place by way of market cap with a $5 billion capitalization. But, its totally diluted worth (FDV) is way increased than that, contemplating solely 27.6% of all SUI’s provide is circulating.

Thus, the cryptocurrency has an impending 72.4% inflation that can inevitably attain the market, creating vital promoting strain.

Curiously, most of those yet-to-circulate tokens are locked in vesting contracts within the management of Mysten Labs or non-public buyers. In October, SUI unlocked over $100 million, as Finbold reported, elevating issues and criticisms.

Justin Bons labeled SUI’s tokenomics as the results of “sheer greed,” as we printed in Might.

“SUI has an amazing design, apart from its token economics: SUI claims to have a capped provide of 10B, with 52% being “unallocated” until 2030. The issue is that over 8B SUI is being staked proper now! Over 84% of the staked provide is held by founders. To say that is gross is an understatement The sheer greed of SUI’s distribution is mindblowing”

– Justin Bons

Some market members identified that the upcoming unlock defined why influencers and the crypto media immediately began “pushing” SUI.

That is eye opening. Now I perceive why $SUI has been pushed exhausting since 2 weeks by KOLs and many media.

Each single time. https://t.co/Eqa7kkebUI

— Connoisseur (@cardano_gourmet) September 29, 2024

Furthermore, cryptocurrency dealer and investor Wazz warned of Sui’s mannequin the place these whales with locked tokens can nonetheless stake, and revenue from the yet-not-circulating tokens pledged to them.

In the event you’re holding any coin that permits for staking of locked tokens, you are getting scammed.

You suppose you are being good shopping for earlier than the unlocks vest, however in actuality seed buyers are dumping staking rewards non cease at 100x valuationshttps://t.co/hR9eegJZCZ

— Wazz (@WazzCrypto) October 2, 2024

Meme coin merchants and the ‘Higher Idiot Idea’

Cryptocurrencies are inherently risky and current appreciable dangers for merchants, buyers, and customers, even with strong and usable tasks. Nevertheless, buying and selling meme cash provides one other layer of dangers, particularly liquidity-related.

Moreover, this asset class has traits that resemble monetary bubbles, which can lead to liquidity demise spirals. The “Higher Idiot Idea” explains the dynamics seen on meme cash. They’re speculative tokens moved primarily by social hype and buzz with none natural demand.

Merchants purchase the token with the expectation {that a} “larger idiot” can pay a better value sooner or later. However, the scheme fades away as soon as there are not any “larger fools” to proceed fueling the value up, usually dealing with liquidity points and demise spirals.