One other intently watched Hyperliquid whale suffered losses from its lengthy place. The whale, acknowledged as one of the crucial skilled merchants within the crypto house, switched to a brief place with 20X leverage.

One other Hyperliquid whale was pushed out of its lengthy place following the downturn of BTC costs. The whale, acknowledged as @aguilatrades, is likely one of the oldest recognized individuals within the BTC market. In contrast to Wynn, this dealer hardly publicizes its choices and trades, and isn’t looking for reputation. The brand new pockets was recognized simply days in the past and tagged by on-chain investigators.

AguilaTrades(@AguilaTrades) has closed his $BTC lengthy place with over $12.4M in losses — and flipped brief.

Will he maintain racking up losses, or is that this brief his shot at redemption?https://t.co/dSItG8OY3n pic.twitter.com/L04a0FyNtE

— Lookonchain (@lookonchain) June 13, 2025

Hyperliquid whales have suffered latest liquidations

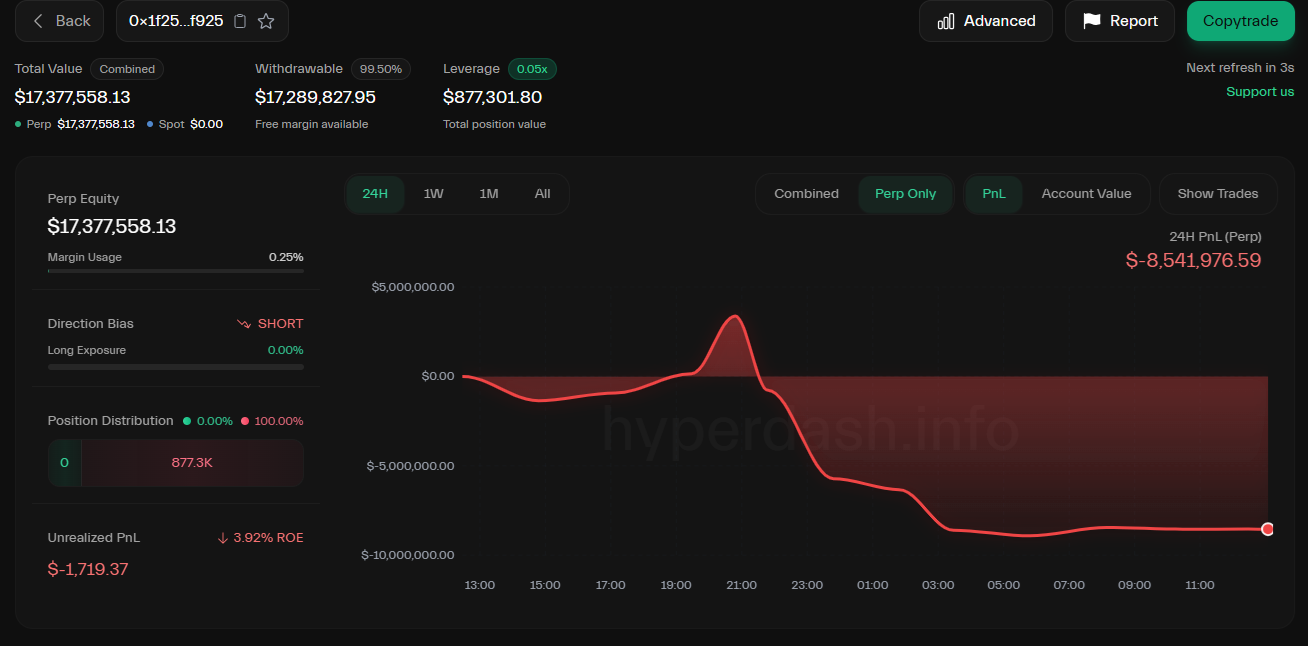

On-chain information confirmed the dealer closed a 40X leveraged lengthy on BTC, absorbing $12.4M in losses. Quickly after that, the whale opened a 20X leveraged brief place valued at over $878K.

At one level, AguilaTrades took a place reverse the dangerous dealer James Wynn. The influx of whale merchants additionally attracted none apart from Andrew Tate, who was shortly liquidated within the high-risk market.

Not too long ago, Wynn additionally obtained liquidated on a number of positions, additionally involving meme tokens like PEPE. Counter-trading Wynn was nonetheless a profitable technique, as within the case of 1 whale making $8M from shorting BTC simply in time for its downturn.

The Hyperliquid whale was intently watched for a shift in sentiment, as lengthy positions had been attacked once more. | Supply: Hyperliquid

The collection of liquidations affected a number of whales that voted confidence in BTC or went lengthy on ETH. BTC traded at $104,763, whereas ETH slid to the $2,500 vary, breaking its try to regain $2,800. The market momentum turned, as greed buying and selling shifted to a extra impartial angle.

The liquidations for lengthy whales coincided with the market-wide downturn and liquidation of lengthy positions. Round $1B was liquidated from the crypto markets previously 24 hours, with over $451M in liquidations for BTC pairs.

Hyperliquid exercise stays close to peak ranges

Regardless of this, Hyperliquid’s exercise remained close to peak ranges, aiming to retain its exercise from April and Could. Hyperliquid often grew to become extra lively throughout instances of clear route for prime cash, with whales taking high-profile positions.

Following the latest peak exercise, HYPE slid right down to $40 after peaking at $43.76. The token sees further shopping for stress from whales, which can carry the worth again towards $45. Whales are additionally utilizing Hyperliquid to construct positions on the native token, in addition to presently sizzling meme tokens. Hyperliquid stays a high-risk venue, which has nonetheless produced whales with important earnings, primarily based on the DEX leaderboard.

The high-profile trades partially disguised the efficiency of whales that also managed to win within the present market. Hyperliquid nonetheless displays the overall exuberance of the market. Nonetheless, there are skeptics that see the change as a venue for money-laundering, utilizing liquidations to sway the asset value, whereas holding the reverse place on one other change.

Moreover, Hyperliquid customers are nonetheless anticipating a possible second airdrop, maintaining exercise within the hopes of receiving a better payout.

Hyperliquid stays the ninth-largest ecosystem by worth locked, largely because of the weight of the native HYPE token, but in addition for a small assortment of memes. The ecosystem locks in $1.6B in worth, with near-record inflows of USDC previously days. The DEX nonetheless comprises over $3.1B in USDC, breaking to a brand new excessive previously week.