Ethereum (ETH) continues to battle beneath the $2,000 mark, a stage it hasn’t reclaimed since March 28, as bearish momentum lingers throughout each technical and on-chain indicators. Regardless of makes an attempt to stabilize, latest knowledge reveals rising focus of ETH amongst whale wallets, alongside persistent weak point in development indicators like EMA strains.

On the identical time, retail and mid-sized holders are regularly shedding share, additional skewing possession towards giant gamers. This mixture of declining retail participation and heavy whale dominance might go away ETH more and more susceptible to sharp corrections if sentiment turns.

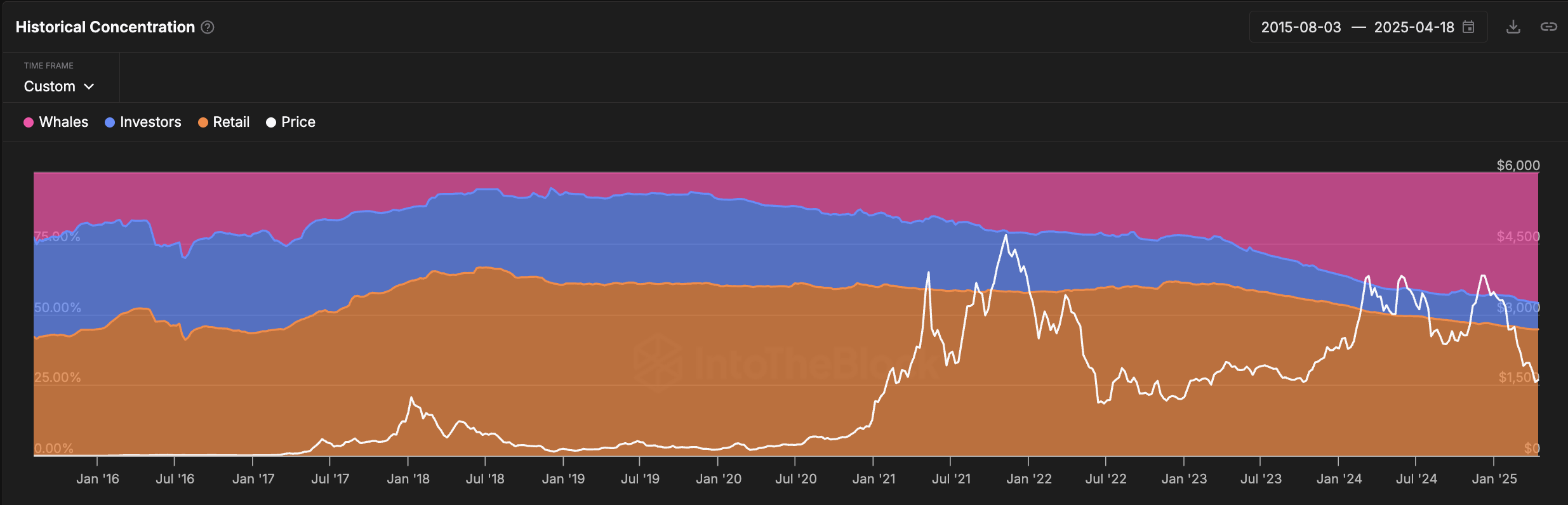

ETH Whale Holdings Hit 9-12 months Excessive, Elevating Centralization Issues

The quantity of ETH held by whale addresses—wallets controlling greater than 1% of the whole circulating provide—has reached its highest stage since 2015, sitting at 46%.

This marks a big shift in Ethereum’s possession knowledge, as whales surpassed the holdings of retail traders again on March 10 and have continued to develop their share since. As compared, investor-level addresses, which maintain between 0.1% and 1% of provide, and retail wallets, which maintain lower than 0.1%, have each seen declines of their share of ETH.

The bounce from 43% to 46% in just some months displays a pointy accumulation development among the many largest holders, suggesting a rising focus of ETH in fewer palms.

Whales usually symbolize institutional traders, funds, or early adopters, and their habits can considerably influence value because of the quantity they management. Investor-level addresses typically mirror high-net-worth people or smaller establishments, whereas retail addresses embrace on a regular basis merchants and holders.

Whereas some would possibly see the rise in whale holdings as a vote of confidence, it additionally will increase the chance of sudden volatility if giant holders start offloading.

With retail and investor participation shrinking, the market might turn into extra fragile and susceptible to sharp, sudden value actions pushed by just a few dominant gamers.

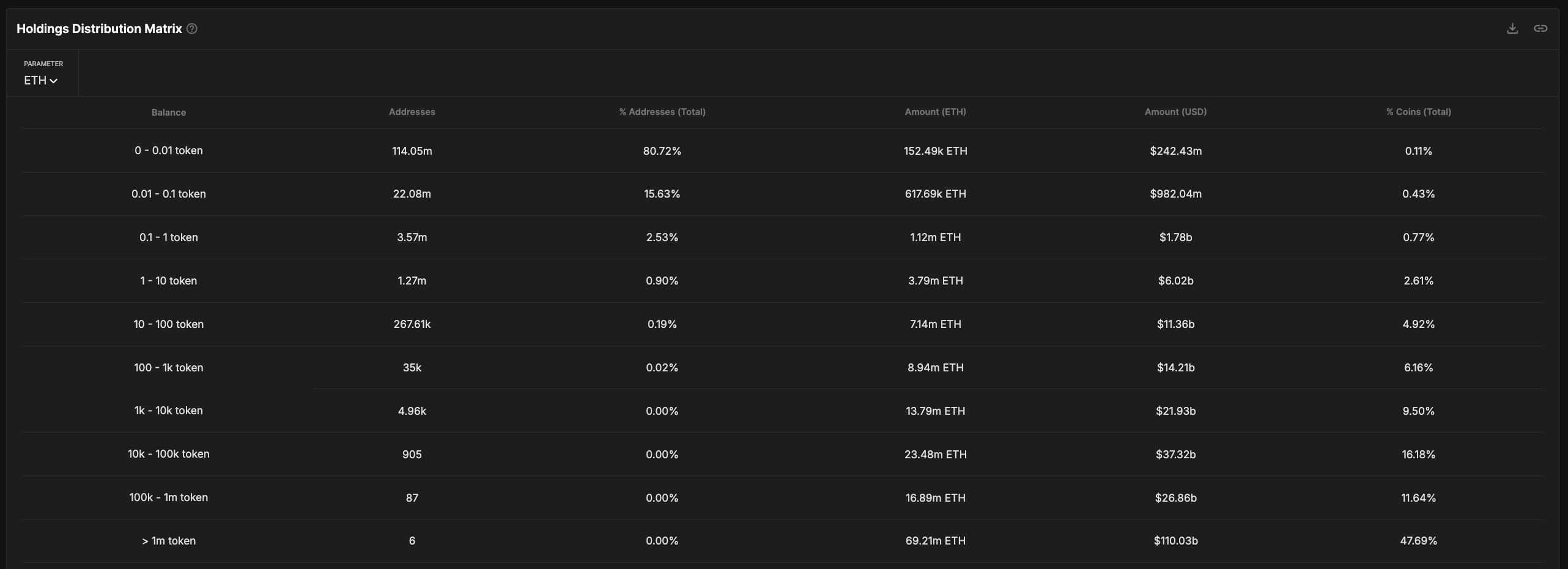

Whales Holding 1,000 to 100,000 ETH Now Management $59 Billion

Analyzing the ETH Holdings Distribution Matrix reveals regarding indicators of deepening focus.

When excluding addresses with over 100,000 ETH—usually linked to centralized exchanges—whale addresses holding between 1,000 and 100,000 ETH now management roughly $59 billion in ETH, representing round 25.5% of the circulating provide.

This group has steadily collected extra of the community’s provide, reinforcing an influence shift towards giant entities working outdoors of exchanges however nonetheless commanding immense affect over the market. Lately, Galaxy Digital moved $100 million in Ethereum, elevating questions on whether or not it was a strategic shift or a sell-off sign.

ETH Holdings Distribution Matrix. Supply: IntoTheBlock.

Whereas some would possibly interpret this development as strategic positioning by assured holders, it additionally exposes Ethereum to important draw back threat.

With over 1 / 4 of provide concentrated within the palms of those whales, any coordinated or panic-driven promoting might set off sharp value drops, particularly in an surroundings with weakening retail participation.

Somewhat than an indication of long-term stability, this stage of focus might make the ETH market more and more fragile and liable to volatility if these holders begin to rotate their capital to different property.

Bearish EMA Construction Retains ETH Underneath Stress

Ethereum’s EMA strains proceed to flash bearish indicators, with short-term averages nonetheless positioned beneath the long-term ones—indicating downward momentum stays in play.

If a brand new correction occurs, Ethereum might first check assist at $1,535. A breakdown beneath that stage opens the door to deeper declines towards $1,412 and even $1,385.

Ought to these helps additionally fail to carry, Ethereum would edge dangerously near the $1,000 mark, a stage some analysts have flagged as a possible draw back goal within the occasion of an prolonged market correction.

ETH Value Evaluation. Supply: TradingView.

Nonetheless, a bullish reversal isn’t completely out of the query. If shopping for stress returns and Ethereum reclaims short-term momentum, it might check the resistance stage at $1,669.

A breakout above that may be a big technical sign, doubtlessly pushing Ethereum value towards $1,749 and even $1,954.

Nonetheless, with EMAs nonetheless tilted to the draw back, the burden stays on bulls to show that momentum has shifted decisively of their favor.