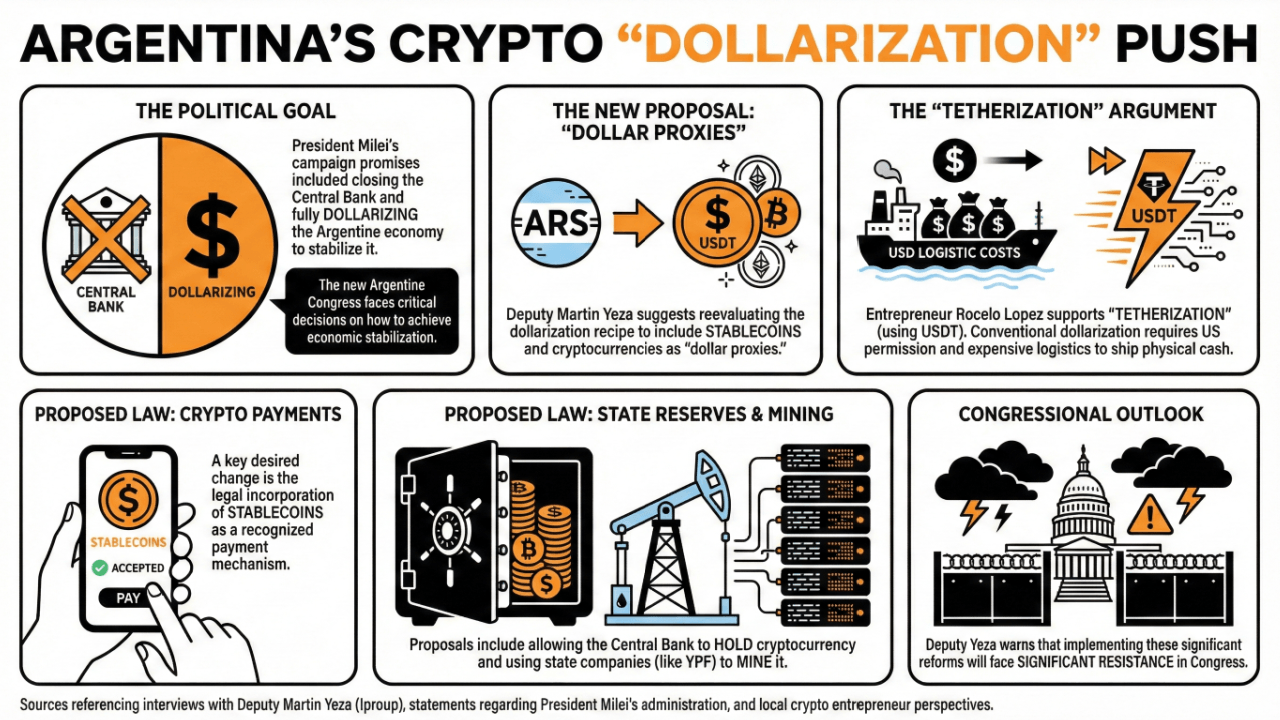

Martin Yeza, deputy of the brand new Congress, said that stablecoins would possibly fulfill a brand new pivotal function within the nation’s fee construction. He considers that permitting the central financial institution to carry cryptocurrency and state firms to mine crypto can be optimistic. Native analysts additionally supported a so-called financial “tetherization.”

Argentina’s New Congress May Give Crypto A New Push In 2026

The brand new Argentine Congress must cope with a number of crucial cryptocurrency and stablecoin-related points this new yr.

In keeping with Deputy Martin Yeza, the federal government will reevaluate the recipe for dollarization to stabilize the economic system this yr, with the inclusion of stablecoins and cryptocurrencies as greenback proxies.

Speaking with Iproup, he said:

If a collection of reforms are applied, we’ll face vital resistance, and people sorts of periods will definitely not be well-received in Congress.

Nonetheless, one of many adjustments he wish to see is the incorporation of stablecoins as a fee mechanism. He additionally considers that permitting the central financial institution to carry cryptocurrency and mine it via state firms, equivalent to YPF, even when the federal government doesn’t make the most of these prospects instantly.

One of many key marketing campaign guarantees of President Milei was to shut the central financial institution and dollarize the economic system to deliver inflation numbers down.

Rocelo Lopez, a neighborhood crypto entrepreneur, supported a “tetherization” of the Argentine economic system, referring to Tether, the issuer of USDT, the most important stablecoin by market capitalization.

For a traditional dollarization of the Argentine economic system, the uswould must greenlight it, and related delivery and logistics prices for bringing U.S. money to Argentina must be thought-about.

A “tetherization” would provide advantages in comparison with an everyday dollarization course of with out involving the U.S. authorities. Operations can be traceable and with low-cost transactions, Lopez burdened.

Latest stories reveal that Argentine banks are ready to supply crypto providers to their clients, and that the central financial institution is drafting a particular measure to open the cryptocurrency market to personal banks.

Learn extra: Central Financial institution of Argentina Mulls Permitting Banks to Supply Crypto Providers

FAQ

-

What key points will the brand new Argentine Congress deal with concerning cryptocurrency?

The Congress will reevaluate the usage of stablecoins and cryptocurrencies as greenback proxies to assist stabilize the economic system in 2026. -

What reforms does Deputy Martin Yeza advocate for cryptocurrency adoption?

Yeza helps incorporating stablecoins as a fee mechanism and permitting the central financial institution to carry and mine cryptocurrency via state firms. -

How does Rocelo Lopez view the thought of “tetherization” for Argentina?

Lopez advocates for “tetherization” as a versatile various to conventional dollarization, offering advantages like traceability and low-cost transactions without having U.S. permission. -

What developments are taking place with Argentine banks concerning cryptocurrencies?

Stories point out that Argentine banks are getting ready to supply crypto providers and that the central financial institution is engaged on measures to open the crypto market to personal banks.