The latest Amazon Net Providers (AWS) outage that knocked out main crypto and fintech platforms, together with Coinbase, Robinhood, MetaMask and Venmo, has reignited debate over how decentralized Web3 actually is.

Whereas blockchains continued producing blocks uninterrupted, hundreds of thousands of customers had been unable to entry wallets, exchanges and decentralized functions (DApps) as a result of their interfaces and software programming interfaces (APIs) had been hosted on centralized servers.

“Decentralization has succeeded on the ledger layer however not but on the infrastructure layer,” Jamie Elkaleh, chief advertising and marketing officer at Bitget Pockets, advised Cointelegraph. “Actual resilience is determined by diversifying past hyperscalers into community-driven and distributed networks.”

Elkaleh added that full decentralization “isn’t but possible at scale” as a result of most groups depend on hyperscalers like AWS, Google Cloud and Azure for compliance, velocity and uptime. The sensible aim, he mentioned, ought to be “credible multi-home” infrastructure, distributing workloads throughout each cloud and decentralized networks to keep away from single factors of failure.

Elkaleh argued that cloud suppliers supply scalability and safety, however at the price of focus threat. “If one area or supplier goes down, a whole bunch of apps are affected,” he mentioned. Hybrid programs, mixing cloud with decentralized storage and community-run nodes, are the following logical step.

Associated: Amazon AWS Outage Hits Coinbase Cell App, Robinhood

Customers had been locked out of working blockchains

Anthurine Xiang, co-founder of EthStorage and QuarkChain, mentioned the outage proved that “even in Web3, many providers nonetheless rely closely on centralized infrastructure.”

She defined that true decentralization requires redesigning each layer, from storage to entry, in order that no single supplier can take programs offline. “It’s like the home is okay, however the door is jammed,” Xiang mentioned, describing how customers had been locked out of working blockchains.

The outage started on Monday and lasted for roughly 15 hours. The outage prompted Coinbase’s app and Base community to crash, stopping customers from logging in or making transactions, whereas Robinhood merchants reported delays and API failures.

The outage additionally affected MetaMask, with customers reporting that they noticed zero balances of their wallets. “Their belongings had been protected, however the service accountable for retrieving stability information had gone offline,” Xiang defined, noting it wasn’t a technical failure of the blockchain itself.

In the meantime, Jawad Ashraf, CEO of Vanar Blockchain, criticized the crypto business for all “working on the identical servers.” He claimed that roughly 70% of Ethereum nodes are hosted by AWS, Google, or Microsoft. “We’re simply paying three totally different landlords as an alternative of 1,” he mentioned.

Constructing absolutely decentralized programs is feasible, he added, however “most groups gained’t do it anytime quickly” as a result of it’s slower and extra complicated than spinning up on AWS.

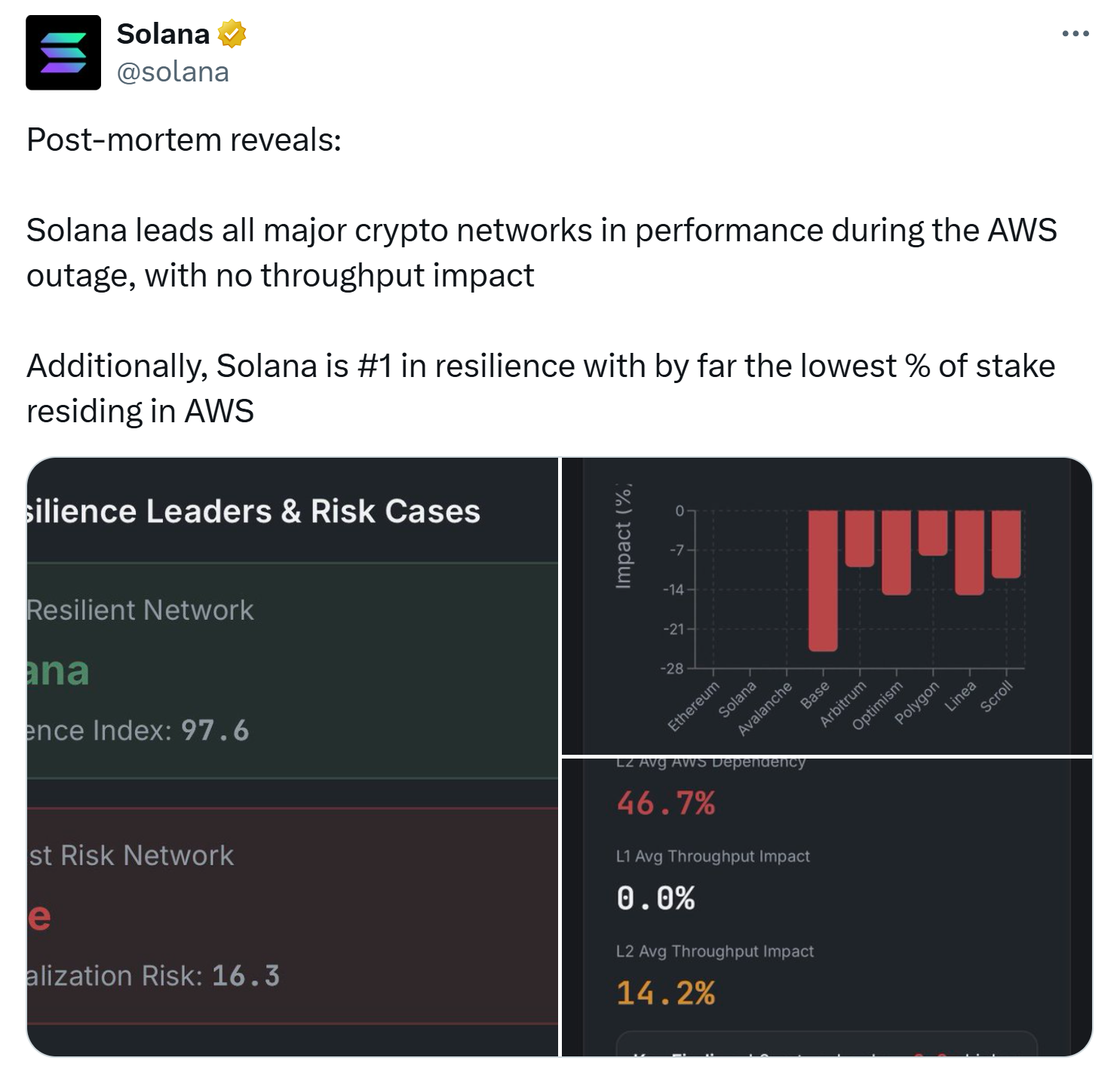

Solana claims no throughput affect from the outage. Supply: Solana

A wake-up name

Elkaleh mentioned the outage ought to speed up funding in decentralized cloud, storage and compute networks similar to Akash, Filecoin, Arweave and others. He known as for Web3 builders to embrace hybrid fashions that blend conventional reliability with distributed redundancy.

“Each main outage is a wake-up name,” he mentioned. “The way forward for Web3 gained’t be outlined by how decentralized the tokens are, however by how distributed the infrastructure really turns into.”

Journal: Again to Ethereum — How Synthetix, Ronin and Celo noticed the sunshine