Ethereum continues to vary across the $3,000 zone, with neither bulls nor bears taking full management. The market is in a consolidation part after its failure to carry above $3,100, and merchants at the moment are intently watching key ranges on each the day by day and 4H charts. Whereas the macro construction continues to be beneath strain, short-term sentiment and positioning trace at attainable volatility forward.

Ethereum Value Evaluation: The Every day Chart

On the day by day chart, ETH stays trapped beneath each the 200-day and 100-day transferring averages, that are nonetheless appearing as dynamic resistance above the $3,500 stage. The value did not maintain above the $3,100-$3,200 resistance block and is now hovering slightly below that vary, close to $2,980. The dearth of upper highs alerts continued bearish strain.

Nonetheless, the $2,700 assist zone stays a robust demand space, having supported the worth on a number of events previously couple of months. So long as ETH stays above that zone, the draw back threat is considerably restricted. However any lack of that assist might speed up the transfer decrease, probably opening the door to the $2,300 space.

ETH/USDT 4-Hour Chart

Zooming into the 4-hour chart, the asset has been consolidating between $2,800 and $3,000 for the previous week. The Fibonacci retracement ranges drawn from the early December rally present that the 0.618-0.5 zone beneath the $3,000 zone has acted as a robust ceiling not too long ago. To date, each breakout try above that has been rejected.

In the meantime, the RSI on the 4-hour is slowly climbing again towards 60, indicating constructing momentum, however it’s not convincing but. Patrons want to interrupt and maintain above the $3,000 stage to achieve short-term management. Till then, it’s nonetheless a uneven vary with a slight bearish bias. Due to this fact, the worth motion stays reactive, not proactive.

Sentiment Evaluation

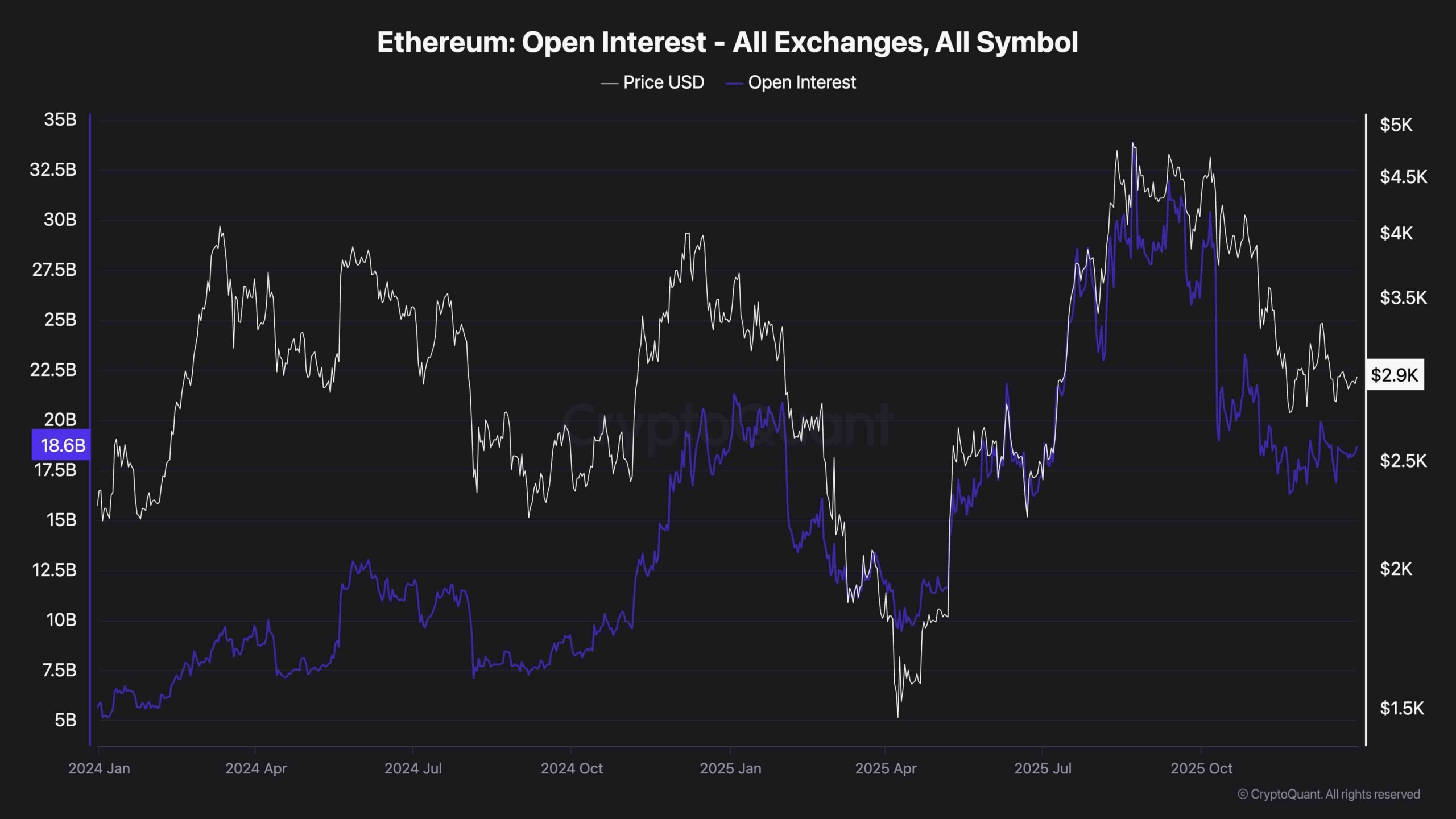

Ethereum’s open curiosity has steadily declined for the reason that mid-November peak, displaying a discount in aggressive positioning from each bulls and bears. From a excessive of round $32B, OI has now dropped beneath $20B, reflecting uncertainty and a scarcity of conviction within the present market route.

This cooling off in leverage is commonly seen forward of a serious transfer. The market is basically reset. Now, if OI begins rising once more whereas the worth stays flat, it might sign speculative curiosity returning, which might possible deliver volatility. So, merchants ought to keep alert for sudden spikes in each OI and quantity, which might verify a breakout try or a brand new leg decrease.