After weeks of heavy draw back, Ethereum crypto is displaying early indicators of vendor fatigue even because the broader construction stays clearly bearish.

Market Thesis: Macro Nonetheless Down, However Stress Is Easing

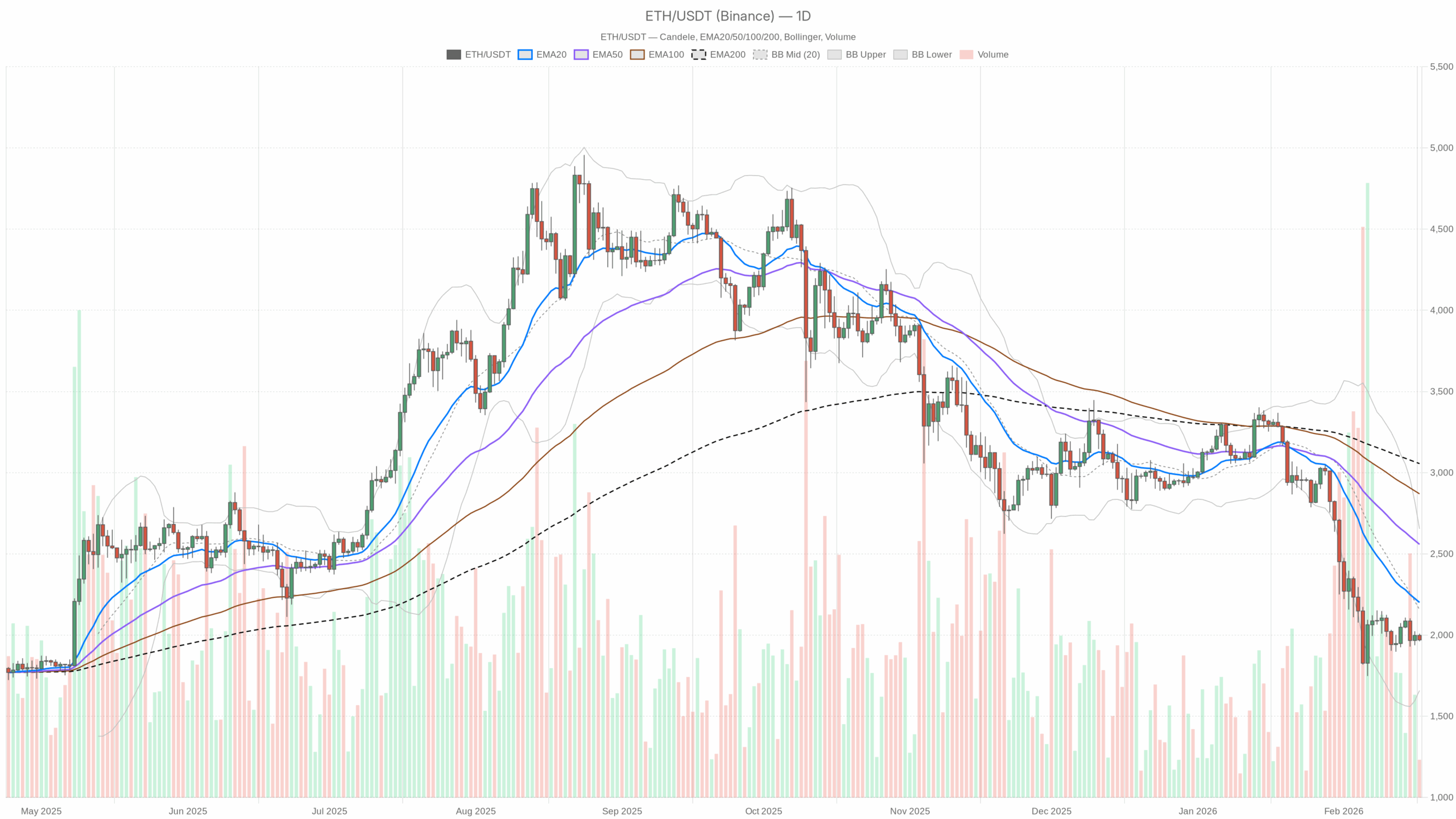

Ethereum crypto (ETHUSDT) is buying and selling round $1,970, firmly under all key each day shifting averages and effectively below the midline of its Bollinger Bands. The upper timeframe construction is clearly bearish: it is a market that has been offered onerous and remains to be caught in a downtrend.

However this isn’t contemporary, impulsive draw back anymore. Each day RSI has sunk into the low 30s, MACD is deeply unfavorable however beginning to curl, and the value is hovering across the each day pivot after a broad market pullback with Bitcoin dominance up at ~56% and the general crypto market in Excessive Concern. The dominant power proper now could be defensive positioning: capital hiding in BTC and stablecoins, whereas ETH behaves like a threat asset in a risk-off atmosphere. The important thing query for merchants is whether or not that is the final leg of a medium-term downtrend or the early staging space for a bigger base.

Each day Chart (D1) – Macro Bias: Bearish

Development Construction: EMAs

Values

Worth: $1,969.99

EMA 20: $2,201.06

EMA 50: $2,558.76

EMA 200: $3,055.96

What it means

ETH is buying and selling effectively under its 20, 50, and 200-day EMAs. The shorter EMAs are stacked below the longer one, and the hole between worth and the EMA cluster is vast. It is a textbook downtrend regime, with the 20-day appearing as the primary main dynamic resistance. Any bounce in the direction of $2,200–$2,250 is, by default, a rally into resistance, not a confirmed pattern reversal.

Momentum: RSI (14)

Worth

RSI 14 (D1): 33.89

What it means

RSI is sitting in a bearish however not totally oversold zone. Sellers are clearly in management, however the market is just not in full capitulation territory but. That is the sort of studying the place:

- The draw back pattern is unbroken.

- Every new low has barely much less momentum behind it.

- Bounces can seem abruptly if shorts get crowded.

Put merely, the trail of least resistance remains to be down, however the threat of a pointy counter-trend spike is rising.

Momentum & Development High quality: MACD

Values

MACD line: -224.56

Sign line: -242.03

Histogram: +17.47

What it means

MACD is deeply unfavorable, confirming extended bearish momentum. Nevertheless, the road is now crossing up towards the sign, with the histogram turning optimistic. That’s the first signal that the promoting wave is shedding power, although the pattern remains to be down.

In buying and selling phrases, the bear pattern is mature. Merchants don’t chase shorts blindly right here; new shorts want both a transparent breakdown or a weak bounce into resistance.

Volatility & Vary: Bollinger Bands

Values

Mid (foundation): $2,156.75

Higher band: $2,654.58

Decrease band: $1,658.93

Worth: $1,969.99

What it means

Worth is sitting under the midline, within the decrease half of the band construction, however not hugging the decrease band. This factors to a down-biased vary somewhat than a full volatility squeeze or panic selloff. Sellers have the higher hand, however they don’t seem to be urgent ETH to extremes every day.

So long as ETH stays trapped below the mid-band (round $2,150–2,200), rallies are suspect and extra more likely to be imply reversion towards resistance than a clear pattern reversal.

Volatility & Threat: ATR (14)

Worth

ATR 14 (D1): $154.67

What it means

Each day volatility is elevated however not explosive. A typical each day transfer of about $150 on a $1,970 asset is substantial, however not capitulation-level. That is the sort of tape the place swings are significant and threat must be sized rigorously. Entries will be proper directionally however nonetheless get shaken out by regular noise.

Brief-Time period Reference Ranges: Each day Pivot

Values

Pivot Level: $1,980.09

First Resistance (R1): $1,998.48

First Help (S1): $1,951.61

What it means

ETH is buying and selling simply under the each day pivot, in a slim band between S1 and the pivot. That’s traditional indecision territory after a selloff: bears have the structural edge, however intraday pricing is balanced sufficient that both a push again to R1 or a slip towards S1 can occur rapidly.

For intraday merchants, shedding S1 with momentum would affirm that the each day downtrend is reasserting itself. Regaining and holding above the pivot opens the door for a squeeze towards $2,000–2,050, nonetheless inside a bearish context.

1-Hour Chart (H1) – Brief-Time period Nonetheless Heavy, However Not Collapsing

Development Construction: EMAs

Values

Worth: $1,970.04

EMA 20: $1,981.02

EMA 50: $1,990.59

EMA 200: $2,015.26

What it means

On the 1-hour chart, ETH is buying and selling below all key EMAs, however the hole between worth and the 20 and 50 EMAs is comparatively small. The regime remains to be bent downward, but the market is nearer to a short-term equilibrium than to a waterfall.

In apply, this implies rallies again into $1,985–2,000 are nonetheless promote zones for short-term merchants until worth can reclaim and maintain above the 200 EMA close to $2,015.

Momentum: RSI (14)

Worth

RSI 14 (H1): 44.03

What it means

Hourly RSI is in a impartial to mildly bearish space. Promoting strain has cooled off from any excessive. There’s room in each instructions intraday. ETH can simply push up towards the hourly EMAs earlier than the following resolution level, or roll over from right here with none sign of exhaustion.

Momentum & Development High quality: MACD

Values

MACD line: -3.45

Sign line: -1.76

Histogram: -1.69

What it means

On H1, MACD is barely unfavorable with a unfavorable histogram, so bearish momentum persists however it isn’t aggressive. This helps the thought of a grinding, corrective tape somewhat than a contemporary impulse down. Brief sellers are in management, however they don’t seem to be steamrolling the market proper now.

Volatility & Vary: Bollinger Bands

Values

Mid (foundation): $1,983.67

Higher band: $2,004.67

Decrease band: $1,962.67

What it means

Worth is buying and selling just below the mid-band, within the decrease half of a pretty tight hourly vary. That’s per short-term consolidation inside a downtrend. Breaks exterior this band, notably an in depth under round $1,960 or above about $2,005, would possible convey a pickup in momentum in that route.

Volatility & Threat: ATR (14)

Worth

ATR 14 (H1): $16

What it means

Typical hourly swings of about $16 present that intraday volatility is manageable however non-trivial. Merchants can not depend on ultra-tight stops until they’re keen to be shaken out by routine fluctuations.

Brief-Time period Reference Ranges: Hourly Pivot

Values

Pivot Level: $1,968.94

First Resistance (R1): $1,973.60

First Help (S1): $1,965.38

What it means

ETH is buying and selling nearly precisely on high of the hourly pivot. That alerts a very short-term stability after prior weak spot. Management is up for grabs intraday. A transfer and maintain above R1 favors a push into the $1,980–1,990 resistance belt, whereas a drop under S1 places the $1,955–1,950 space in play.

15-Minute Chart (M15) – Execution Context Solely

Development Construction: EMAs

Values

Worth: $1,970.04

EMA 20: $1,974.49

EMA 50: $1,979.88

EMA 200: $1,994.79

What it means

On M15, ETH is slightly below the quick EMAs, that are in flip under the 200 EMA. The microstructure remains to be bearish, however very near short-term imply ranges. For execution, which means:

- A rejection from the 15-minute 20 and 50 EMAs (round $1,975–1,980) aligns with the broader downtrend and favors brief entries.

- A clear reclaim of the 200 EMA (close to $1,995) can be the primary signal of a extra severe intraday squeeze.

Momentum: RSI (14)

Worth

RSI 14 (M15): 41.87

What it means

Decrease-timeframe RSI is modestly bearish, with loads of room to maneuver both method. It confirms that short-term promoting is current however not excessive, which is an efficient setup for tactical trades contained in the bigger pattern.

Momentum & Development High quality: MACD

Values

MACD line: -4.30

Sign line: -4.14

Histogram: -0.16

What it means

M15 MACD is unfavorable however practically flat. Micro momentum is fading, which regularly precedes both a minor aid bounce or a volatility contraction earlier than the following transfer. It doesn’t give a powerful directional edge by itself; context from the upper timeframes issues extra.

Volatility & Vary: Bollinger Bands

Values

Mid (foundation): $1,975.31

Higher band: $1,988.04

Decrease band: $1,962.58

What it means

ETH is sitting barely under the mid-band on a fairly tight 15-minute vary. That’s traditional short-term consolidation. Breaks above $1,985 or under $1,963 on this timeframe will possible set the tone for the following few hours however is not going to, on their very own, change the larger each day image.

Volatility & Threat: ATR (14)

Worth

ATR 14 (M15): $6.33

What it means

Common 15-minute candles are shifting about $6–7. That is sufficient to punish overleveraged, ultra-tight trades, particularly round intraday pivots and EMAs.

Brief-Time period Reference Ranges: 15-Minute Pivot

Values

Pivot Level: $1,970.51

First Resistance (R1): $1,971.14

First Help (S1): $1,969.41

What it means

Worth is successfully glued to the 15-minute pivot, with R1 and S1 lower than $2 away. That is micro-congestion, the sort of noise band the place breakout makes an attempt can rapidly pretend out. For entries, it’s often higher to attend for a transfer away from this tight cluster.

Market & Sentiment Backdrop

Bitcoin dominance up at ~56.4%, whole crypto market cap down about 0.8% in 24 hours, and a Concern & Greed Index at 10 (Excessive Concern) inform the identical story: capital is defensive, and altcoins like ETH will not be being favored. ETF flows into BTC and ETH have cooled, and volumes are down roughly 12% throughout the market. This atmosphere tends to cap aggressive upside makes an attempt in ETH until there’s a clear shift again into risk-on habits.

Primary State of affairs Based mostly on D1: Bearish Bias With Late-Stage Downtrend Dynamics

Placing all of it collectively, the major situation is bearish on the each day timeframe:

- Worth is much under the 20, 50, and 200 EMAs.

- RSI is weak however not in full capitulation.

- MACD is deeply unfavorable but beginning to enhance.

- Worth trades within the decrease half of the Bollinger Bands, with average however not excessive volatility.

- Market-wide sentiment is deeply fearful and skewed towards BTC dominance.

This mixture sometimes characterizes a mature downtrend. Sellers nonetheless have the structural benefit, however the threat of countertrend rallies is non-trivial, particularly if shorts turn into overconfident or macro information improves.

Eventualities

Bullish State of affairs – Brief Squeeze & Imply Reversion

For the bullish path, suppose when it comes to imply reversion inside a bearish regime, not an prompt full reversal.

What bulls must do

- Defend the $1,950–1,930 zone (round D1 S1 and simply above the decrease Bollinger Band trajectory). Holding this space alerts that sellers are operating out of gas on every dip.

- Reclaim and maintain above the each day pivot at round $1,980, then push by means of $2,000–2,020, the place H1 resistance and the 1-hour 200 EMA sit.

- Set off a follow-through transfer towards the each day mid-Bollinger and EMA20 zone, roughly $2,150–2,250. That’s the key mean-reversion goal.

Indicator backdrop supporting a bullish bounce

- Each day RSI within the low 30s with room to maneuver increased if promoting pauses.

- Each day MACD histogram turning optimistic, hinting at fading draw back momentum.

- Worth oscillating round intraday pivots as an alternative of collapsing by means of them.

What would invalidate the bullish situation

- A decisive each day shut under round $1,930–1,900 with increasing ATR and RSI breaking towards the 20s. That may point out contemporary promoting somewhat than exhaustion.

- Failure of any bounce to even check the EMA20 on D1, with repeated rejections under round $2,050, would sign that consumers don’t have any actual power.

Bearish State of affairs – Development Resumption & New Lows

The bottom case, given the D1 regime, remains to be that rallies are promoting alternatives till confirmed in any other case.

What bears need to see

- Failure to reclaim the EMA20 on D1. So long as ETH stays pinned below roughly $2,200, the broader downtrend is unbroken.

- Intraday bounces stalling close to $1,985–2,020, the place the 1-hour EMAs and hourly R1 zones cluster, adopted by renewed promoting.

- A clear breakdown under $1,950 (D1 S1), opening the door towards the decrease Bollinger Band area close to $1,700–1,680 if volatility expands.

Indicator backdrop for a bearish continuation

- Each day EMAs remaining steeply downward sloped with worth failing to shut above the 20-day.

- RSI staying under 40 and rolling decrease on every failed bounce.

- MACD failing to finish a bullish cross and as an alternative turning again down, with the histogram flipping unfavorable once more.

- ATR beginning to rise additional as breakdowns happen, indicating stronger directional conviction.

What would invalidate the bearish situation

- A decisive each day shut above the EMA20 (roughly $2,200+) with follow-through shopping for the following day.

- RSI reclaiming and holding above 50, signaling a regime change from persistent weak spot to balanced or bullish momentum.

- MACD crossing bullish on D1 with a sustained optimistic histogram whereas worth holds above prior resistance ranges.

Positioning, Threat, and Uncertainty

This isn’t a contemporary, clear brief entry atmosphere, neither is it a high-confidence backside. It’s a late-stage downtrend below macro strain, with indicators of vendor fatigue however no confirmed reversal but:

- Directional bias: bearish on D1, mildly bearish on H1, and uneven on M15.

- Upside strikes are presently extra more likely to be countertrend rallies somewhat than the beginning of a brand new bull leg.

- Draw back breaks can nonetheless be sharp, particularly in an Excessive Concern market that’s closely BTC-centric.

In this sort of atmosphere, merchants sometimes focus much less on calling the precise backside and extra on respecting ranges and volatility:

- Each day EMAs, particularly the 20-day round about $2,200, outline whether or not ETH is simply bouncing in a bear pattern or transitioning towards a restoration.

- Pivots and ATR on H1 and M15 outline how a lot intraday noise a place has to endure.

- Market-wide worry and BTC dominance let you know that Ethereum crypto remains to be enjoying second fiddle to Bitcoin within the present risk-off regime.

So long as ETHUSDT stays under its each day EMA20 and caught within the decrease half of its Bollinger Bands, the burden of proof is firmly on the bulls. Any shift out of this construction, with convincing quantity and a transparent reclaim of key shifting averages, would mark a brand new section within the tape and warrant a reassessment of the bias.