Bitcoin’s $BTC$77,317.26 value crash has shifted the market vibe, with bets on it sliding additional now simply as scorching as moonshot performs over $100,000.

The main cryptocurrency by market worth has dropped practically 10% this week, reaching nine-month lows beneath $78,000, CoinDesk knowledge. The worth swoon has merchants scrambling for put choices, these spinoff contracts that protect towards potential decline in bitcoin, identical to medical insurance coverage covers you in case you get sick.

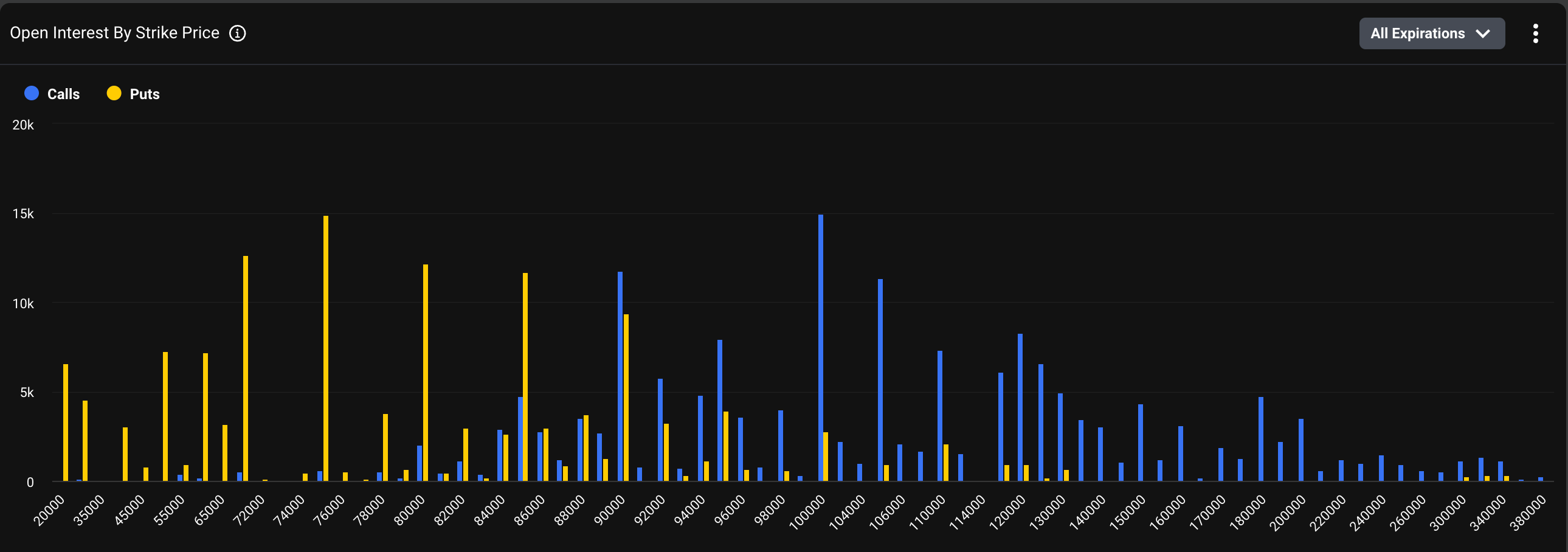

The end result: the greenback worth of the variety of lively bitcoin put choices contracts on the $75,000 degree listed on Deribit, now stands at $1.159 billion, nearly matching the so-called notional open curiosity of $1.168 billion locked within the $100,000 name choice. Deribit is the world’s largest crypto choices change by quantity and open curiosity, with one contract representing 1 $BTC.

In different phrases, the $75,000 put, which represents a guess that bitcoin’s spot value will fall beneath that degree, is simply as in style because the $100,000 name, which has been a dominant play for weeks. The latter is a guess that costs will rise into six figures.

“[There has been a] large surge in put shopping for over the previous 48h (sensitivity at peak), proper as $BTC spot crashed from 88k to 75k. Choices merchants/hedgers,/funds, had these actual value ranges focused with clear playbooks in place,” pseudonymous observer GravitySucks mentioned in an X submit.

Whereas the $75,000 put is the most well-liked bearish play, vital open curiosity can also be seen in places at strikes of $70,000, $80,000, and $85,000, whereas higher-strike calls, besides the one at $100,000, lack comparable exercise.

This stands in stark distinction to the sample since President Donald Trump’s victory, the place higher-strike calls persistently drew extra curiosity than lower-strike places. The erstwhile bullish positioning probably stemmed from hopes that valuations would surge with Trump delivering on his marketing campaign guarantees of pro-crypto laws.

Whereas the Trump administration delivered on a lot of that promise, $BTC‘s value rally nonetheless fizzled out above $120,000 in early October and has been sliding ever since. Past the macro pressures, the delay within the crypto market construction invoice has probably piled on the frustration.