Binance noticed an uptick in exercise previously month, with the largest enhance coming from the futures market. The clear bullish pattern expanded demand for lively buying and selling with leverage, to make the most effective of the market’s route.

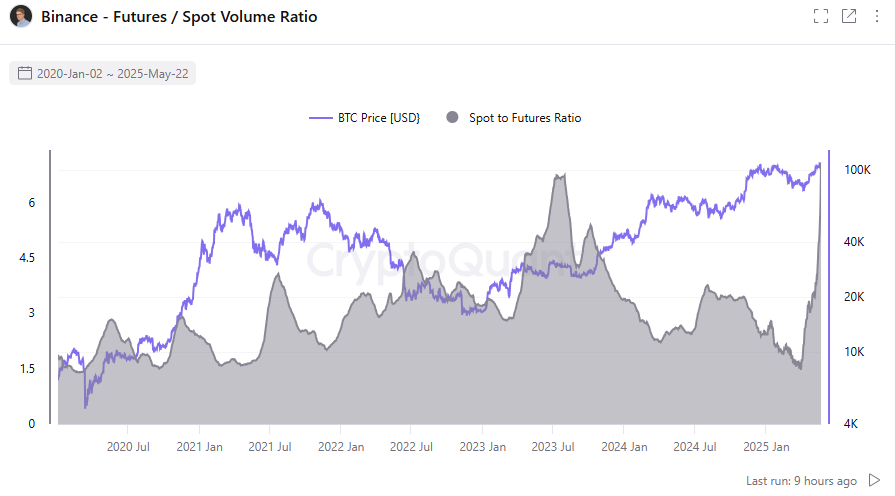

Binance is as soon as once more predominantly a futures market, growing the ratio of futures to identify buying and selling. The dominance of futures buying and selling is close to a 1.5-year excessive, reflecting the elevated open curiosity for BTC and different lively property. The ratio elevated vertically previously month, reflecting the shift in sentiment and risk-taking.

Binance carries $12.8B of the overall BTC open curiosity, remaining essentially the most lively market with a slight value premium on the futures markets.

The spot to futures ratio elevated quickly, returning to the very best ranges in 1.5 years. | Supply: Cryptoquant

Futures volumes focused on Binance in 2025 because the undisputed chief. Nonetheless, OKX futures markets confirmed a progress pattern within the yr to this point. In Might, Binance futures markets carried a complete of $1.25T in buying and selling volumes, on monitor to surpass the degrees from April. A lot of the crypto futures volumes are additionally focused on Bybit and Bitget.

Futures buying and selling factors to speculative pattern

Rising futures buying and selling suggests the crypto market is again in risk-on mode. Leveraged futures buying and selling gives the largest short-term return, particularly throughout instances of usually optimistic sentiment.

On Binance, futures merchants are 4.9 instances extra lively in comparison with spot merchants. Whereas accumulation continues for BTC and ETH, particularly by establishments and whale wallets, short-term features are nonetheless thought-about for altcoins or sizzling property.

The expansion in futures buying and selling translated into the next Concern and Greed Index. Prior to now week, the index moved up from 70 factors to 78 factors, crossing over into excessive greed territory. Even the worry of liquidations doesn’t cease merchants from betting on the BTC reversal of route.

At present, a lot of the bets on BTC are within the vary of $110,000 to $112,000, the 2 value ranges with the largest liquidity in futures positions.

Prior to now day, quick positions on BTC additionally expanded to over 53% on most main exchanges, towards 46% for lengthy positions. The dangerous dealer habits could translate into one other quick squeeze. Lengthy merchants are displaying bullish sentiment, however stay cautious towards liquidations.

Stablecoins stream out of spot exchanges

The principle supply of elevated futures and spinoff exercise is the provision of stablecoins. Binance is the principle goal for USDT inflows, nonetheless carrying over $24B in accessible tokens. Binance elevated its affect, at the moment holding over 22% of all trade reserves.

Spot exchanges barely carry a reserve of $90M in ERC-20 USDT stablecoins. Regardless of the all-time low of BTC and ETH reserves, spot shopping for from open markets stays a lot slower. Demand from whales, ETFs and company patrons additionally depends on OTC desks and personal offers.

The opposite supply of futures and spinoff exercise comes from the worldwide market exercise on Binance. The trade has blocked most of Europe from buying and selling derivatives since 2022. Kraken has tried to fill that area of interest, providing absolutely regulated crypto derivatives for the European market.