Bitcoin and equities have closed out the third quarter of 2024 with sturdy performances, defying forecasts and avoiding the standard September downturns. The S&P 500 has climbed 5.1% for the quarter, its finest efficiency since 1997.

Bitcoin has surged over 7% this month, considered one of its strongest September performances ever. This indicators stable sentiment, whilst issues linger within the broader market.

Goldman Sachs stories that hedge funds are actively inserting 3 times extra bets on growing IT shares than quick positions.

Crypto Market Outlook: Can Bitcoin Maintain Momentum?

Market analysts count on the fairness rally to face challenges as Q3 earnings stories start in mid-October. Excessive values in each equities and Bitcoin could also be examined.

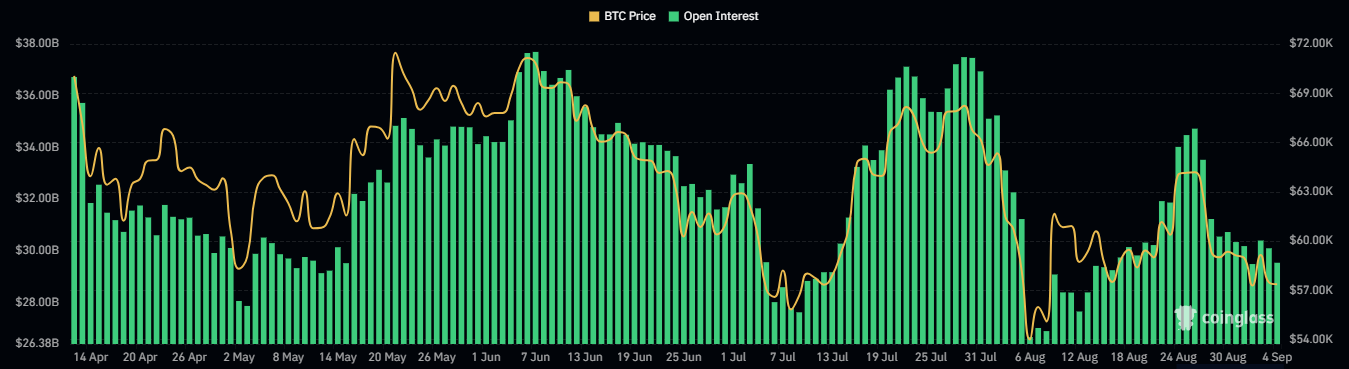

Nevertheless, Bitcoin may benefit from any dip in equities as a consequence of its nature as a risk-on asset, significantly within the total monetary easing. Moreover, within the medium time period, many market observers stay optimistic. A breakout above $70,000 might create additional bullish momentum, positioning Bitcoin for extra positive aspects within the months forward.

Present Market Situations and Technical Evaluation

As of press time, Bitcoin was buying and selling at $63,826.43, recording a decline of two.91% within the final 24 hours, furthermore, it mirrored a slight pullback after a current uptrend that peaked round $67,500.

From a technical evaluation, the MACD indicator exhibits a bearish crossover, with the sign line falling under the orange line, suggesting a weakening in bullish momentum. The MACD histogram can also be declining, indicating a bearish sentiment.

Supply: TradingView

Furthermore, the RSI stands at 62.26, exhibiting a bullish situation however signaling a possible overbought state of affairs.

Disclaimer: The knowledge offered on this article is for informational and academic functions solely. The article doesn’t represent monetary recommendation or recommendation of any form. Coin Version isn’t accountable for any losses incurred because of the utilization of content material, merchandise, or providers talked about. Readers are suggested to train warning earlier than taking any motion associated to the corporate.