Spot Bitcoin and Ether exchange-traded funds (ETFs) continued to bleed capital on Tuesday, with each belongings seeing their fifth straight day of outflows. In distinction, Solana funds prolonged their influx streak to 6 days.

In line with information from Farside Traders, spot Bitcoin (BTC) ETFs noticed $578 million in web outflows on Tuesday, the steepest single-day decline since mid-October. BlackRock’s iShares Bitcoin Belief (IBIT) and Constancy’s FBTC led withdrawals.

Spot Ether (ETH) ETFs confronted comparable promoting stress, registering $219 million in web redemptions. Constancy’s FETH and BlackRock’s ETHA merchandise bore the brunt, extending a five-day pattern that has wiped practically $1 billion in capital from Ether-linked ETFs since late October.

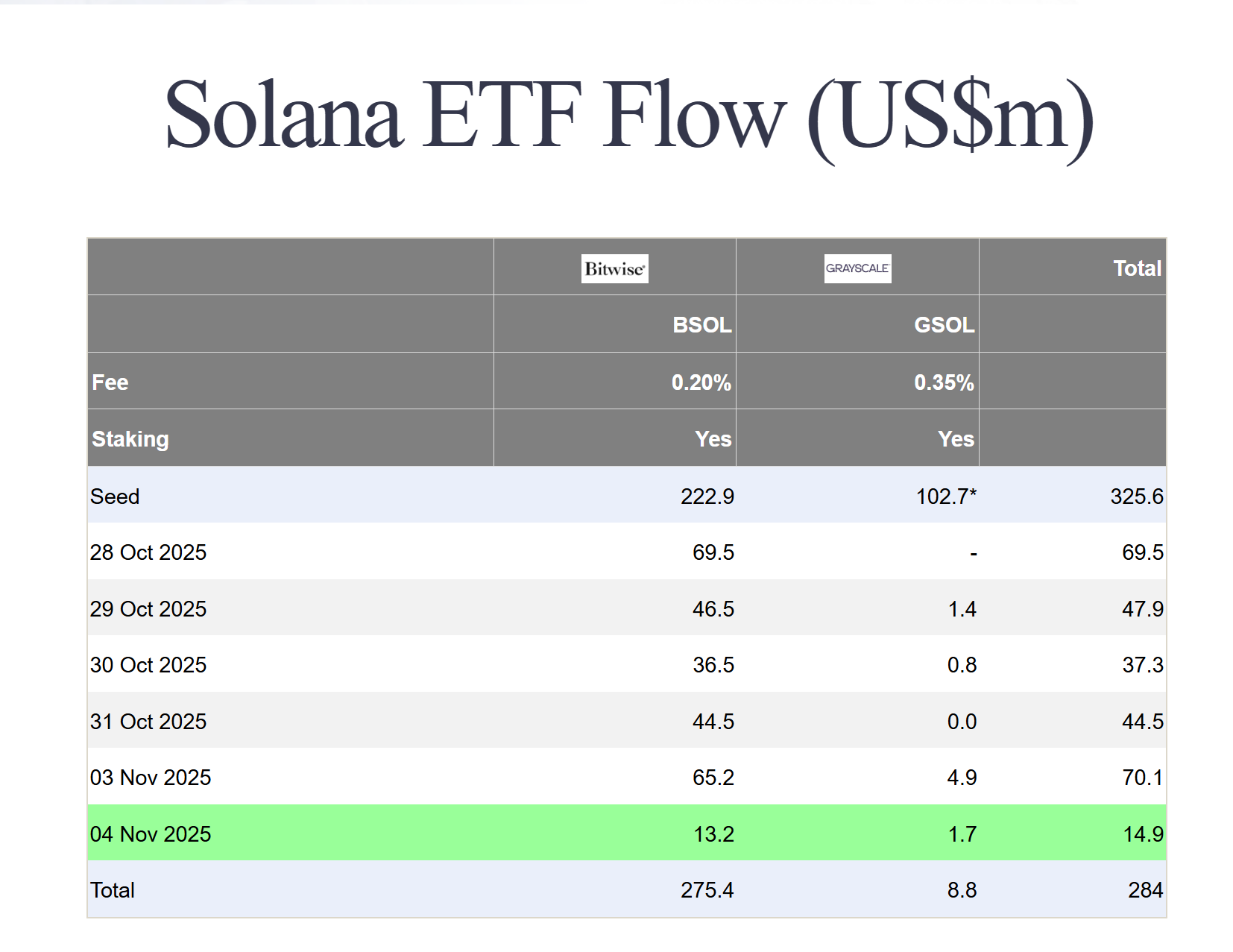

Spot Solana (SOL) ETFs defied the market gloom, posting $14.83 million in web inflows, their sixth consecutive day of beneficial properties. Bitwise’s BSOL and Grayscale’s GSOL every added to the optimistic move, as institutional merchants proceed rotating capital into the newer, yield-bearing product.

Solana ETFs see inflows for sixth consecutive day. Supply: Farside

Associated: ETFs will usher establishments into altcoins, identical to Bitcoin

Establishments trim threat as macro jitters rise

Vincent Liu, chief funding officer at Kronos Analysis, advised Cointelegraph that the sample displays rising macro unease slightly than waning confidence in digital belongings.

“Straight days of redemptions present establishments are trimming threat as leverage unwinds and macro jitters rise,” Liu mentioned. “Till liquidity situations stabilize, capital rotation will hold the ETF bleed alive.”

He added that the outflows stem from a broader risk-off surroundings pushed by a strengthening US greenback and tightening liquidity, not from fading conviction in crypto.

Associated: Bitcoin whales shift billions into ETFs like BlackRock’s IBIT

Solana’s rise is recent move, recent story: Liu

Liu additionally claimed that Solana’s energy is “partly recent move meets recent story, a brand new ETF with yield enchantment pulling in curious capital.” He famous that whereas others bleed amid macro chaos, Solana’s “velocity, staking, and story hold momentum tilted upward.”

Liu cautioned that Solana’s ETF progress stays area of interest for now. “It’s a narrative-driven transfer by early adopters chasing yield and progress. The broader market continues to be in risk-off mode,” he warned.

Journal: Bitcoin OG Kyle Chassé is one strike away from a YouTube permaban