Bitcoin (BTC) and gold lined up because the outperforming property in 2024, on a mixture of geopolitical uncertainty and nonetheless important inflation. In former years, BTC outperformed, however gold had years of stagnant costs.

Bitcoin and gold are on monitor to outperform in 2024, standing forward of different asset courses. Previously, BTC was nearly all the time forward of the pack, aside from the deepest bear cycles. Typically, BTC was additionally buying and selling in an other way to gold, which was thought-about a stagnant asset for ‘gold bugs’.

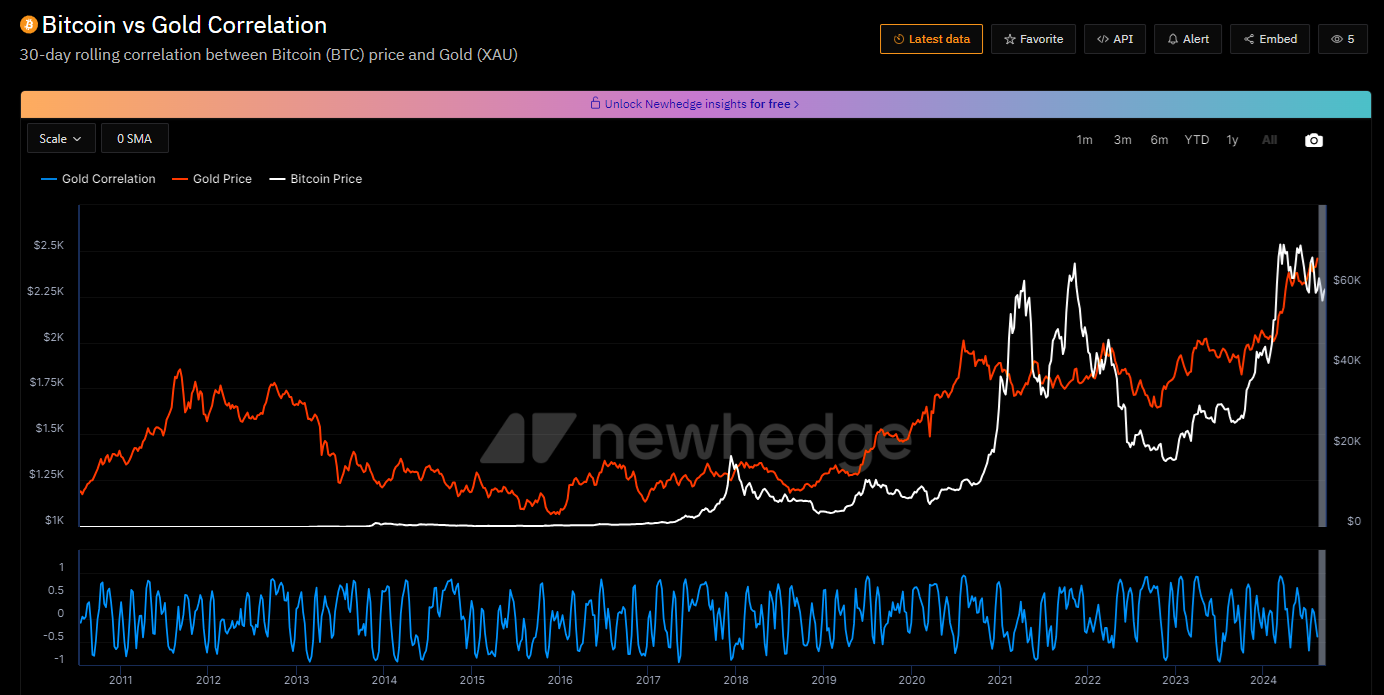

In 2024, nevertheless, a mixture of international dangers is elevating each property, as a hedge towards inflation. BTC and gold costs emerged with a a lot stronger correlation since 2023.

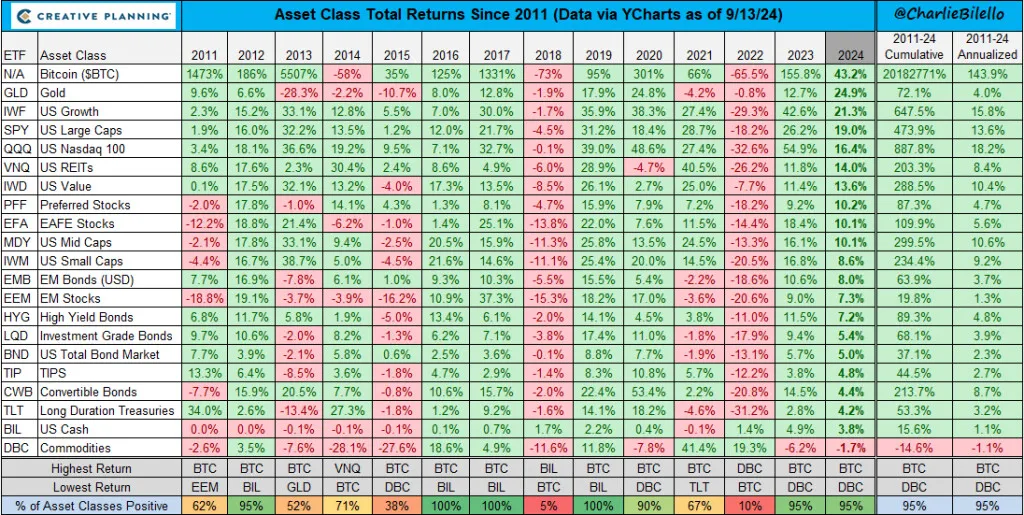

Charlie Biello of the Artistic Planning wealth administration agency labeled a choice of property, displaying BTC and gold took the #1 and #2 spots forward of the pack. In his weblog, Biello identified essentially the most energetic asset courses and their dependence on inflation and price of residing.

BTC and gold outperformed in 2024, a correlation not noticed in earlier intervals. | Supply: Charlie Biello

For the primary time since monitoring the asset courses, each BTC and gold share the highest positive factors. Nevertheless, looking for out BTC and gold as a supply of safety was additionally the narrative in 2020, sparked by the Covid-19 pandemic.

BTC had positive factors of 302% internet in 2020, whereas gold expanded by 24%, however sufficient to outpace different asset courses. Throughout bull markets, BTC usually outperforms all different courses and solely lags behind throughout its drawdown intervals.

Whereas a few of the knowledge counsel value of residing and meals inflation are decelerating, BTC and gold nonetheless maintain their enchantment. Wage development in actual phrases nonetheless has to catch up, however there may be demand for property that outperform the housing inflation.

Gold expects constructive efficiency after Fed eases rates of interest

Gold has a traditionally inverse relationship to gold costs, as a possible retailer of worth. The US Federal Reserve carried out a larger-than-expected charge lower of 50 bps, setting the rate of interest ceiling at 5%.

BTC and gold each carried out higher than different asset courses and rallied collectively. | Supply: Newhedge

That is additionally the primary rate of interest lower since 2020 when the speed was lower as little as 0.25%. From 2022 to 2024, inflation-fighting charge hikes lifted the speed to its peak of 5.50%, retained for greater than a 12 months. For the reason that 12 months 2000, gold has outperformed after every rate-cutting cycle of the Fed.

After the information of the Fed charge lower and an additional prediction of charge easing in 2026, gold briefly touched $2,600 per Troy ounce on the spot market.

On the subject of selecting BTC or gold, the argument from sound cash truly sides with BTC. Gold is consistently including new inventory from rising manufacturing. The enchantment of gold in 2024 is for its potential to rally sooner than different property. On the identical time, the BTC value denominated in gold has grown nearly consistently.

BTC dipped on promoting the information

The BTC market anticipated a charge lower however didn’t rally after the precise larger-than-expected easing. BTC dipped once more to $59,745.11, principally on account of insider components and promoting strain.

Bearish merchants pressured BTC, with promoting orders pushing the value below the $60,000 vary. It’s unsure if BTC can carry out in a way much like the 2020 rate-cut season. Nevertheless, the rally from lows below $4,000 at the moment was a lot simpler, and the speed was close to historic lows.

BTC can be pressured by expectations of a weak September shut. The main coin additionally begins its rallies at round 170 days after every halving occasion. The present sideways uneven buying and selling is occurring 151 days after the halving, setting the extra energetic bull marketplace for October.

BTC can be rising its dominance after the 2022-2024 stagnation. The dominance is now at 57.2% of the entire crypto market capitalization. Rising dominance exhibits funds are principally flowing into BTC, as essentially the most liquid and dependable asset.

BTC additionally positive factors assist from the long-term accumulation and taking cash off exchanges. Merchants stay cautious on account of makes an attempt to assault leveraged positions, however the total pattern is for holding whereas ready for an even bigger breakout. BTC nonetheless faces expectations of rallying to a brand new excessive within the final months of 2024.

Cryptopolitan reporting by Hristina Vasileva