As Bitcoin (BTC) edges nearer to the psychologically important $100,000 milestone, a number of technical and on-chain indicators recommend {that a} main breakout may very well be on the horizon. One such metric – Bitcoin’s Obvious Demand – has proven a powerful rebound, signalling renewed curiosity and sustained accumulation available in the market.

Bitcoin Sees Sharp Rebound In Obvious Demand

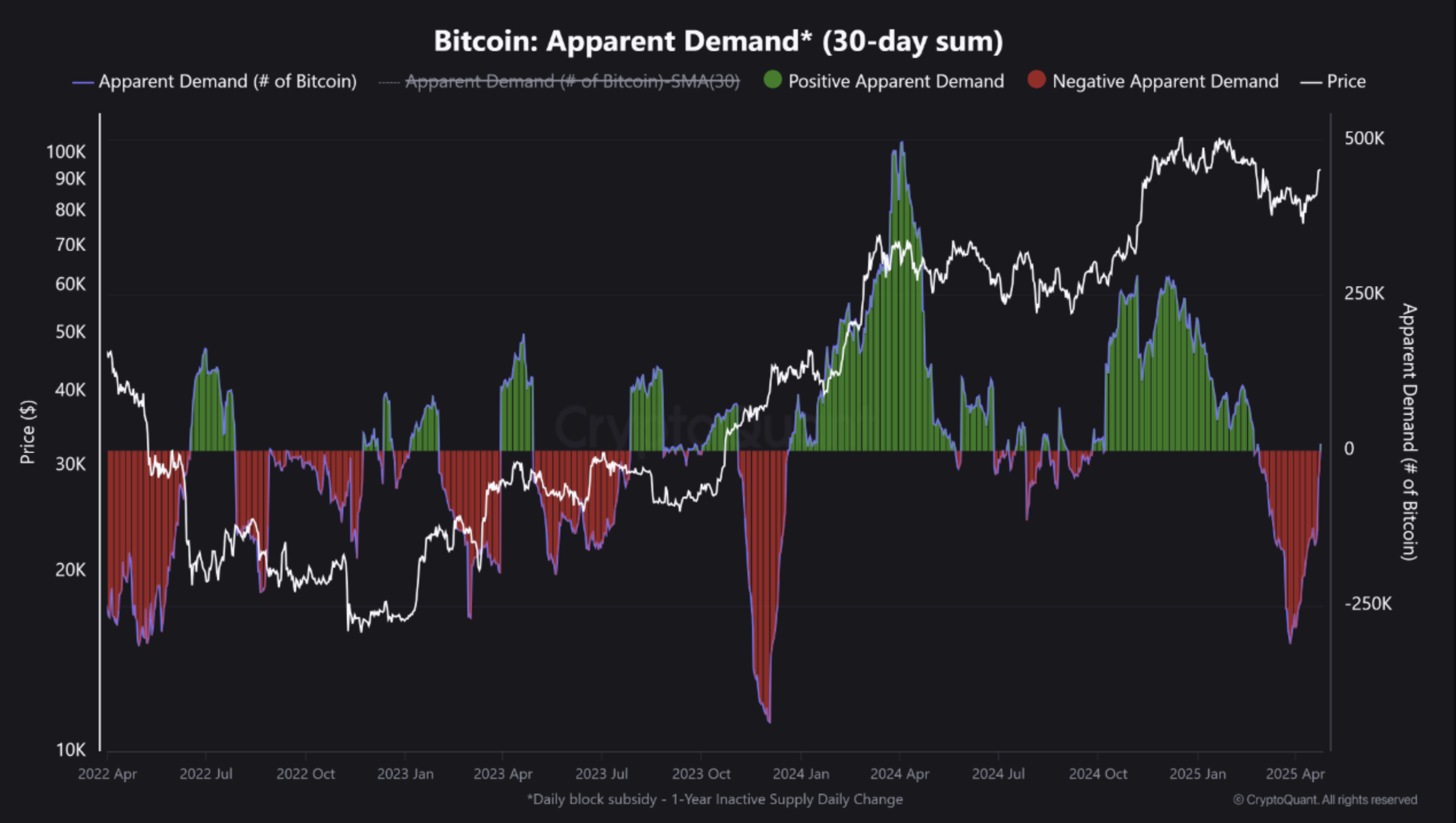

In keeping with a current CryptoQuant Quicktake put up, contributor IT Tech pointed to a major rise in BTC’s Obvious Demand. Most notably, this key indicator has returned to constructive territory after spending a number of consecutive weeks within the crimson.

For the uninitiated, Bitcoin’s Obvious Demand (30-day sum) measures the cumulative web demand for BTC over the previous 30 days by monitoring pockets accumulation and alternate outflows. A pointy enhance on this metric suggests sturdy, sustained shopping for stress, which may point out bullish sentiment and potential for a worth rally.

The next chart illustrates this rebound in BTC’s Obvious Demand, which primarily displays web modifications in one-year inactive provide adjusted by day by day block rewards – a metric designed to raised symbolize natural demand development.

Beforehand, this metric had fallen deeply into unfavourable territory – dipping beneath -200,000 (highlighted in crimson) – suggesting waning demand. Nonetheless, its current reversal into constructive territory alerts that long-dormant capital is flowing again into the market. As famous within the put up:

The demand pivot is carefully aligned with the current worth rebound above $87K, implying this restoration is underpinned by actual on-chain conduct somewhat than purely speculative flows.

This marks the primary constructive Obvious Demand studying since February and aligns with rising inflows into spot Bitcoin exchange-traded funds (ETFs), in addition to rising accumulation by long-term holders.

Knowledge from SoSoValue exhibits that US-based spot BTC ETFs have recorded 5 consecutive days of web constructive inflows, totalling greater than $2.5 billion. The cumulative web influx into spot BTC ETFs now stands at a powerful $38.05 billion.

Is A BTC Rally In Sight?

IT Tech famous that previous reversals in Obvious Demand have traditionally preceded both important rallies or intervals of sturdy worth help. If the present development continues, BTC might have the momentum wanted to problem the $90,000 degree within the close to time period.

Nonetheless, analysts warning that Bitcoin should maintain its present help round $91,500 to keep up upward momentum. This degree is especially essential as a result of it’s near the realized worth of short-term BTC holders, in accordance to CryptoQuant contributor Crazzyblockk.

Additional including to this outlook, outstanding crypto analyst Rekt Capital emphasised that Bitcoin must safe a weekly shut above $93,500 and reclaim it as help in an effort to set up a transparent path to $100,000. At press time, BTC trades at $94,492, up 2% within the final 24 hours.

Featured picture from Unsplash, charts from CryptoQuant and Tradingview.com