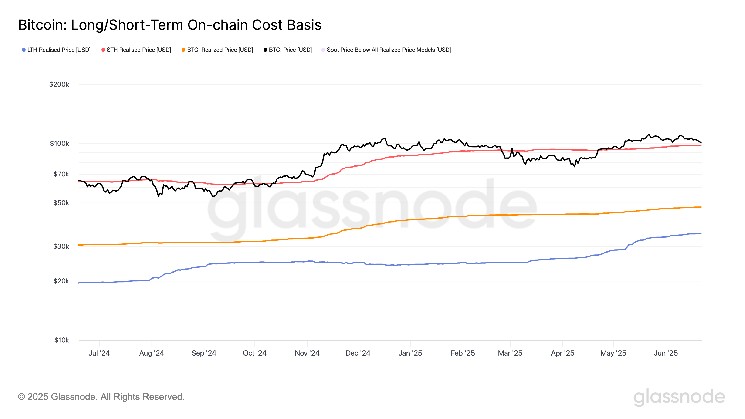

The short-term holder realized value (STH RP) for bitcoin

BTC$101,647.92

at the moment sits at $98,200, representing the typical on-chain acquisition value for bitcoin {BTC} held outdoors of trade reserves and moved throughout the final 155 days.

This metric, derived utilizing on-chain heuristics, helps distinguish between quick and long-term holders and gives perception into market sentiment, in accordance with Glassnode knowledge.

Realized value refers back to the common acquisition value for the complete circulating bitcoin provide, primarily based on the final time every coin moved on-chain. STH RP narrows this all the way down to extra not too long ago lively cash, that are statistically extra prone to be spent. These are sometimes probably the most delicate to market volatility.

Over the weekend, bitcoin dipped amid geopolitical tensions, pushed by escalating battle between Israel and Iran, and rising fears of escalation between U.S. and Iran. With conventional markets closed, buyers responded by promoting liquid belongings like bitcoin not essentially out of need, however necessity.

Traditionally, when bitcoin trades above the STH RP, it usually indicators a bullish pattern. Conversely, buying and selling beneath the STH RP is usually related to bearish or consolidation phases.

For instance, from June to October 2024, forward of the U.S. presidential election, bitcoin remained beneath the STH RP which was round $62,000 on the time. Equally, in February to April 2025, costs once more fell underneath this threshold which was round $92,000.

Bitcoin has rebounded strongly, climbing again above $100,000 and now buying and selling round $101,000. For bullish momentum to proceed, will probably be essential for BTC to stay above the $98,200 STH RP stage.