Bitcoin slides below $75K amid rising world market fears, with whales shorting and key assist ranges in peril. Is a transfer to $70K subsequent?

As a ripple impact of a crash in world markets, concern within the crypto market is reaching an excessive state. The full crypto market cap has dropped to $2.34 trillion, witnessing an 11% decline over the past seven days.

Amid the rising concern, Bitcoin is right down to $74,636, buying and selling at a market worth final seen on November 9. Because the market declines, is a breakdown in the direction of $70,000 potential?

Bitcoin Falls Underneath $75K, EMAs Close to Dying Cross

Within the every day chart, Bitcoin’s worth development reveals one other failure to beat the native resistance trendline. This has resulted in a 6.19% drop in Bitcoin’s worth on Sunday, marking the bottom closing worth of $78,342 since early November.

Bitcoin Value Chart

Extending the bearish correction, Bitcoin has registered an intraday drop of two.9%, buying and selling close to the $74,000 mark. This sudden turnaround follows Donald Trump’s resolution to impose important reciprocal tariffs on a number of international locations globally.

The 50% Fibonacci degree at $75,538 coincides with the demand zone, extending from $75,600 to $75,462. This marks a vital assist zone for Bitcoin. As Bitcoin’s falling worth indicators a important assist degree breakdown, draw back potential continues to develop.

Notably, technical indicators are flashing promote indicators amid the rising bearish stress. The MACD and sign traces present a detrimental crossover and a resurgence of bearish histograms.

Moreover, the 50- and 200-day EMA traces present a downturn, suggesting a potential loss of life cross on the every day chart.

Bearish Sentiment Drives Up Brief Positions by Whales

Amid the opportunity of a steeper correction, DarkFost, a crypto on-chain analyst, highlights the rising bearish sentiment amongst crypto whales. Based on the analyst, whales are extra inclined to set quick Bitcoin positions than retail buyers.

The Whale vs. Retail Ratio is near 0.15, a comparatively low worth that signifies rising bearish sentiment amongst crypto whales.

➡️ Based on the whale vs retail ratio constructed on @Alphractal, we’re seeing that whales are extra inclined to set quick positions on BTC than retail buyers.

The ratio at present stands round 0.15, which is comparatively low and aligns with the bearish sentiment amongst whales.

➡️… pic.twitter.com/kTJGUkzr8Z— Darkfost (@Darkfost_Coc) April 6, 2025

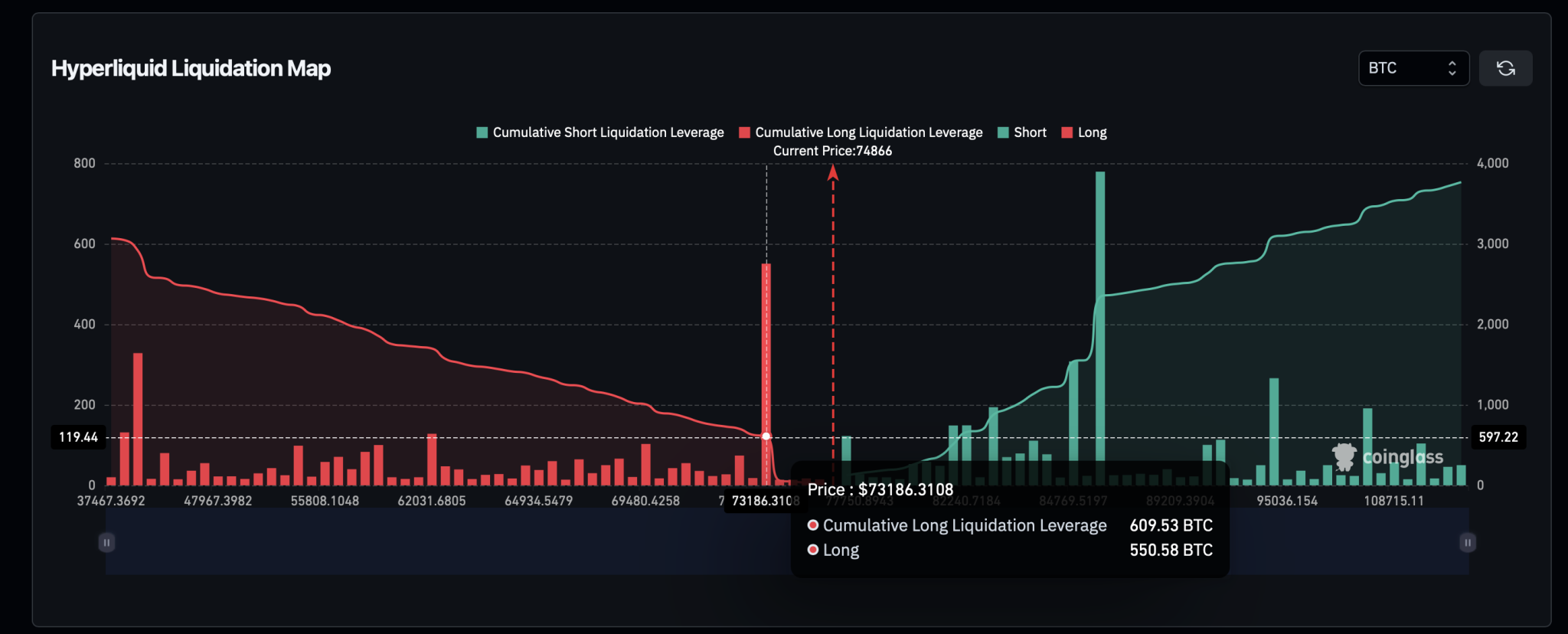

Moreover, because the market turns bearish, the Liquidation Map warns of a serious lengthy liquidation transfer. Primarily based on the HyperLiquid liquidation map, a drop to $73,187 would consequence within the liquidation of 609.53 BTC. Out of the full cumulative lengthy liquidation leverage, lengthy positions account for 550.58 BTC.

In the meantime, Bitcoin’s open curiosity stands at $52.30 billion, witnessing a minor drop of two.32%. Nevertheless, the amount has elevated by practically 138%, reaching $149.95 billion.

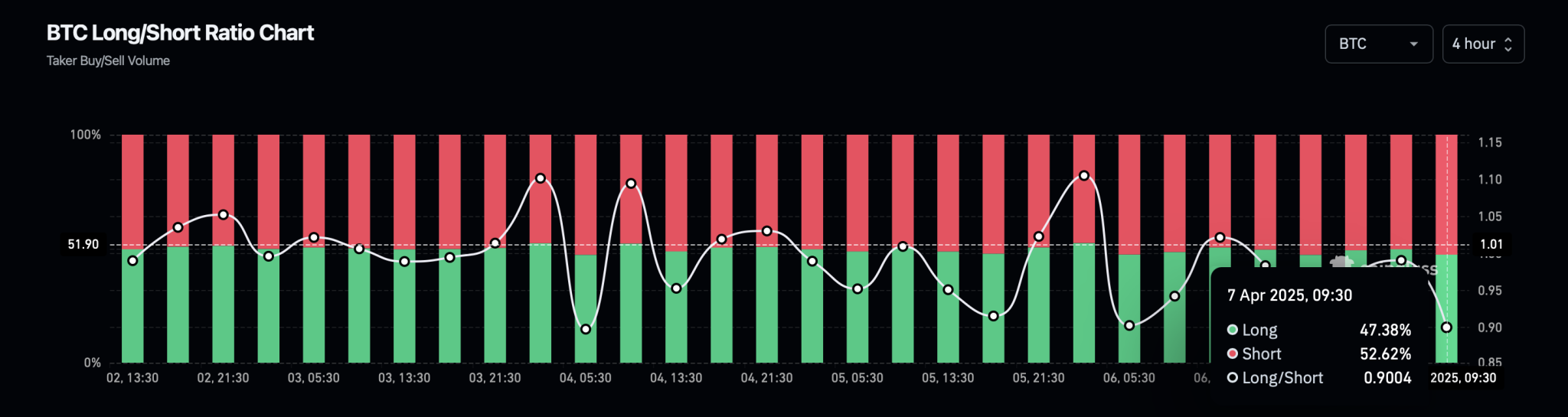

Moreover, the Bitcoin Lengthy/Brief Ratio chart reveals an rising variety of quick positions over the previous 4 hours. Brief positions account for 52.62%, dropping the Lengthy to Brief Ratio to 0.9004.

Bitcoin LongShort Ratio Chart

Will Bitcoin Drop $70K?

As Bitcoin breaks under the $75,000 mark, a decline under the 50% Fibonacci degree is probably going. This may place the rapid worth goal at $69,699, akin to the 38.20% Fibonacci degree.

Alternatively, a worth rejection and a short-term reduction rally might assist Bitcoin keep away from closing under the 50% Fibonacci degree. This may improve the opportunity of a brand new upswing to problem the overhead resistance trendline if world markets witness a bounce again.

Nevertheless, the week will doubtless witness elevated volatility as a result of a number of main occasions, together with the discharge of Industrial Sector Index information, JOLTs Job Openings information, Service Sector Index information, Non-Farm Payrolls, and the Employment Fee.