Bitcoin (BTC) has confronted vital downward strain over the previous week, with its worth falling beneath $90,000 for the primary time since November 2024. It’s down 11% within the final seven days and is presently buying and selling close to a essential resistance stage of $85,985.

Technical indicators are exhibiting predominantly bearish indicators. The pink cloud is positioned above the present worth motion and widening barely, indicating rising bearish momentum. Regardless of this short-term weak spot, some analysts level to potential indicators of restoration as short-term EMA traces start to development upward.

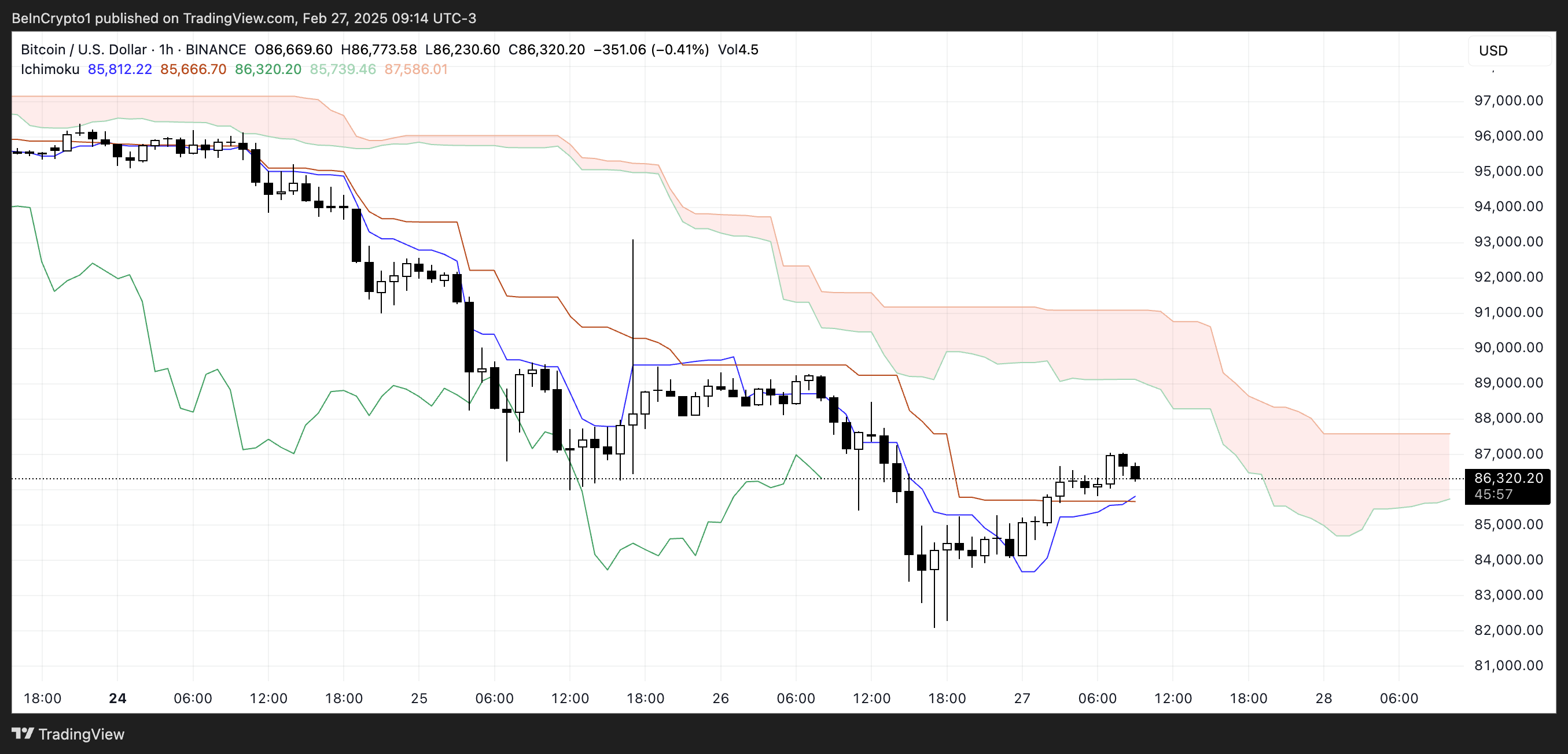

Bitcoin Ichimoku Cloud Reveals a Bearish Setup

The Ichimoku Cloud for Bitcoin reveals a predominantly bearish sentiment. The pink cloud (Kumo) is positioned above the present worth motion, signaling a resistance zone that BTC would wish to interrupt via to reverse the development. The cloud can be widening barely, indicating rising bearish momentum.

The Main Span A (inexperienced line) is beneath the Main Span B (pink line), additional confirming the bearish outlook. Moreover, the value is buying and selling beneath each the blue Tenkan-sen (conversion line) and the pink Kijun-sen (baseline), suggesting that the short-term development remains to be underneath downward strain.

BTC Ichimoku Cloud. Supply: TradingView.

The Tenkan-sen has began to flatten out, which usually signifies a pause or consolidation within the downtrend. Nonetheless, it stays beneath the Kijun-sen, reinforcing the bearish bias.

The inexperienced Chikou Span (lagging line) is beneath the value motion and the cloud, supporting the continuation of the bearish development. General, except BTC can push via the cloud resistance and the Tenkan-sen crosses above the Kijun-sen, the bearish momentum is more likely to persist.

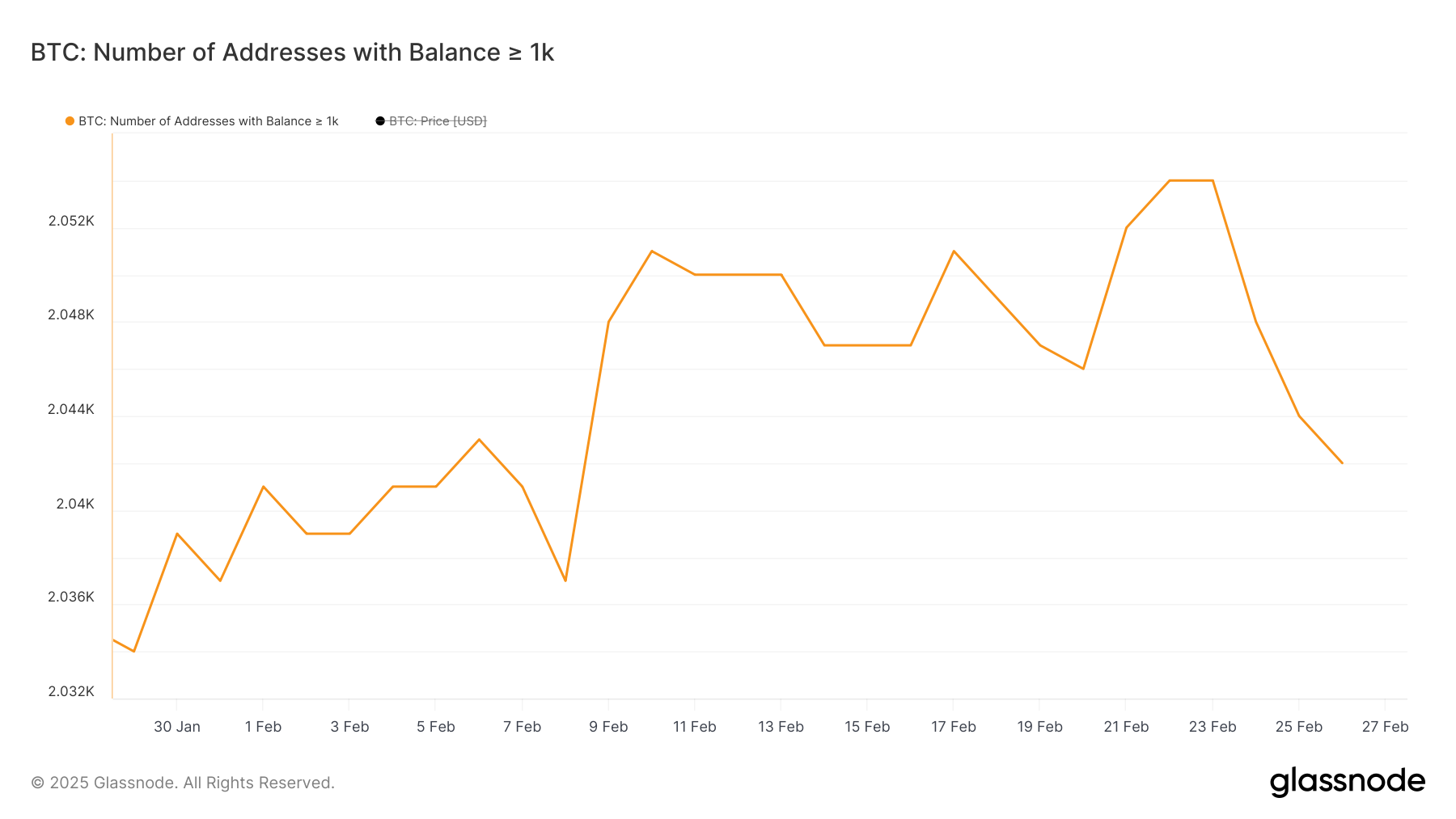

BTC Whales Are Going Down Within the Final 5 Days

The variety of Bitcoin whales, outlined as addresses holding at the very least 1,000 BTC, demonstrated regular development till reaching a peak of two,054 on February 22.

Since that prime level, nonetheless, the metric has begun to say no, with the present rely standing at 2,042 whale addresses.

Monitoring these massive holders is essential for market contributors, as whales possess vital market-moving energy. Their accumulation or distribution patterns typically precede main worth actions, and their focus ranges present perception into Bitcoin’s wealth distribution and total community well being.

Variety of addresses holding at the very least 1,000 BTC. Supply: Glassnode.

The current decline in whale addresses might sign short-term promoting strain, as these massive holders could also be taking income or redistributing their holdings throughout a number of wallets for safety functions, doubtlessly contributing to cost volatility or downward strain within the close to time period.

Regardless of this current lower, it’s essential to notice that the present whale rely of two,042 stays traditionally elevated in comparison with earlier years, suggesting continued robust institutional and high-net-worth particular person curiosity in Bitcoin as a long-term retailer of worth. In accordance with Tracy Jin, COO of MEXC:

“The long-term development stays unchanged: institutional demand and the event of Bitcoin infrastructure, together with ETFs and new funding merchandise, proceed to strengthen its place. Nonetheless, the short-term outlook stays underneath strain: the market goes via a section of liquidation of extra leverage and a lower in threat urge for food.The market goes via a section of liquidation of extra leverage and a lower in threat urge for food, however that is helpful for BTC’s long-term wholesome growth,” Jin informed BeInCrypto.

Will Bitcoin Recuperate Ranges Above $90,000?

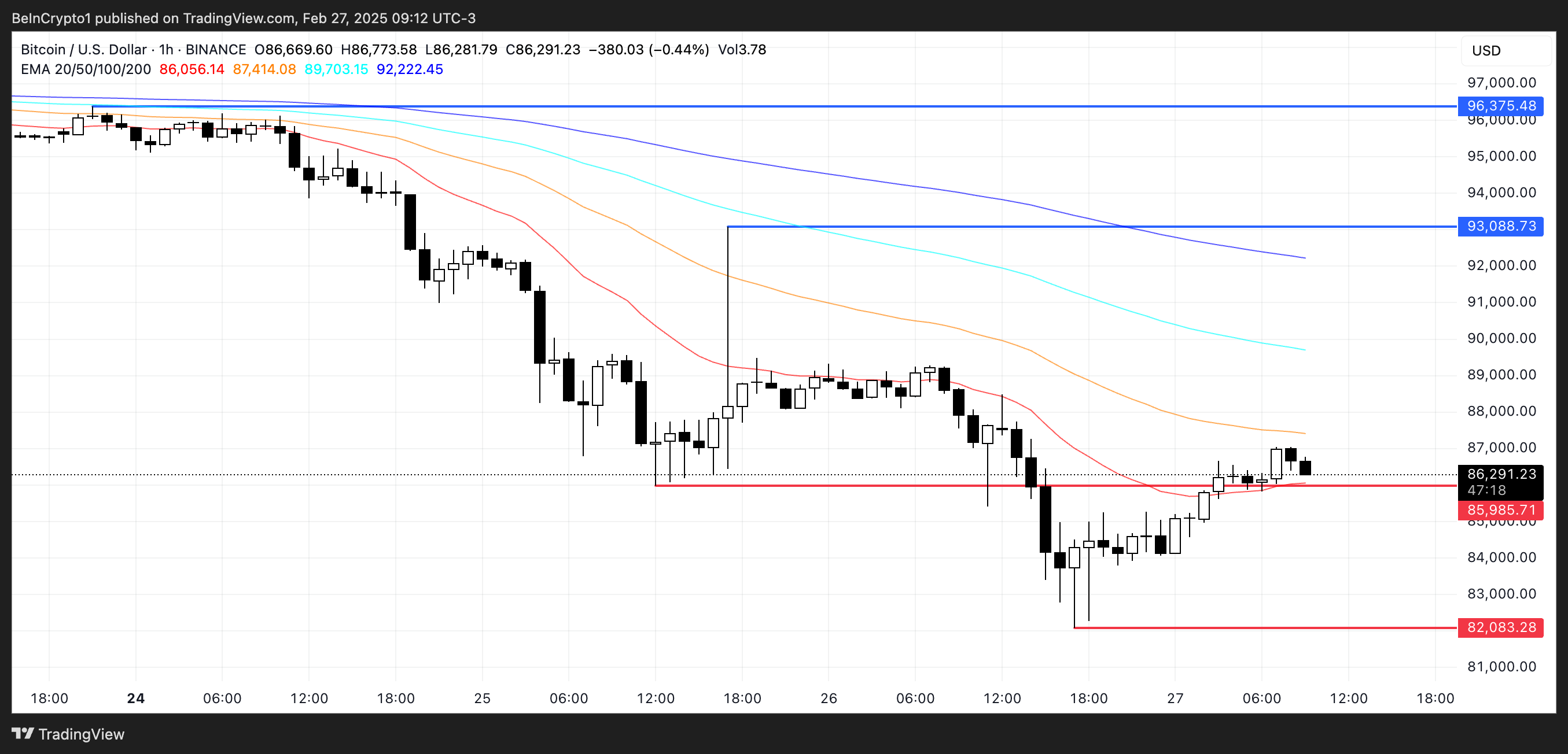

Bitcoin presently has a big resistance stage at $85,985. A failure to keep up this assist might set off a downward motion towards the $82,000 vary, persevering with the present correction.

The proximity to this resistance stage has created heightened pressure amongst merchants who’re fastidiously waiting for indicators of path on this unstable market.

BTC Worth Evaluation. Supply: TradingView.

Regardless of the present bearish configuration of Bitcoin’s Exponential Shifting Common (EMA) traces, with short-term indicators positioned beneath their long-term counterparts, there are rising indicators of potential optimism.

“Regardless of the present decline, Bitcoin’s long-term trajectory stays robust. Institutional gamers proceed to extend their positions in BTC, and the event of Bitcoin infrastructure (together with new ETFs and cost options) solely strengthens its standing as digital gold. Within the brief time period, the value must get better above $96,000-$100,000, which can affirm the market’s readiness for brand spanking new development. If the strain persists, the market might enter a section of a deeper correction.”

Maria Carola, CEO of StealthEx.

The upward trajectory of the short-term EMA traces suggests a attainable development reversal within the close to future. If this bullish crossover materializes, Bitcoin worth might acquire momentum to problem the resistance at $93,000.

A breakthrough at this stage may propel costs towards the following vital goal of $96,375, doubtlessly signaling the resumption of the broader uptrend that has characterised a lot of Bitcoin’s current efficiency.