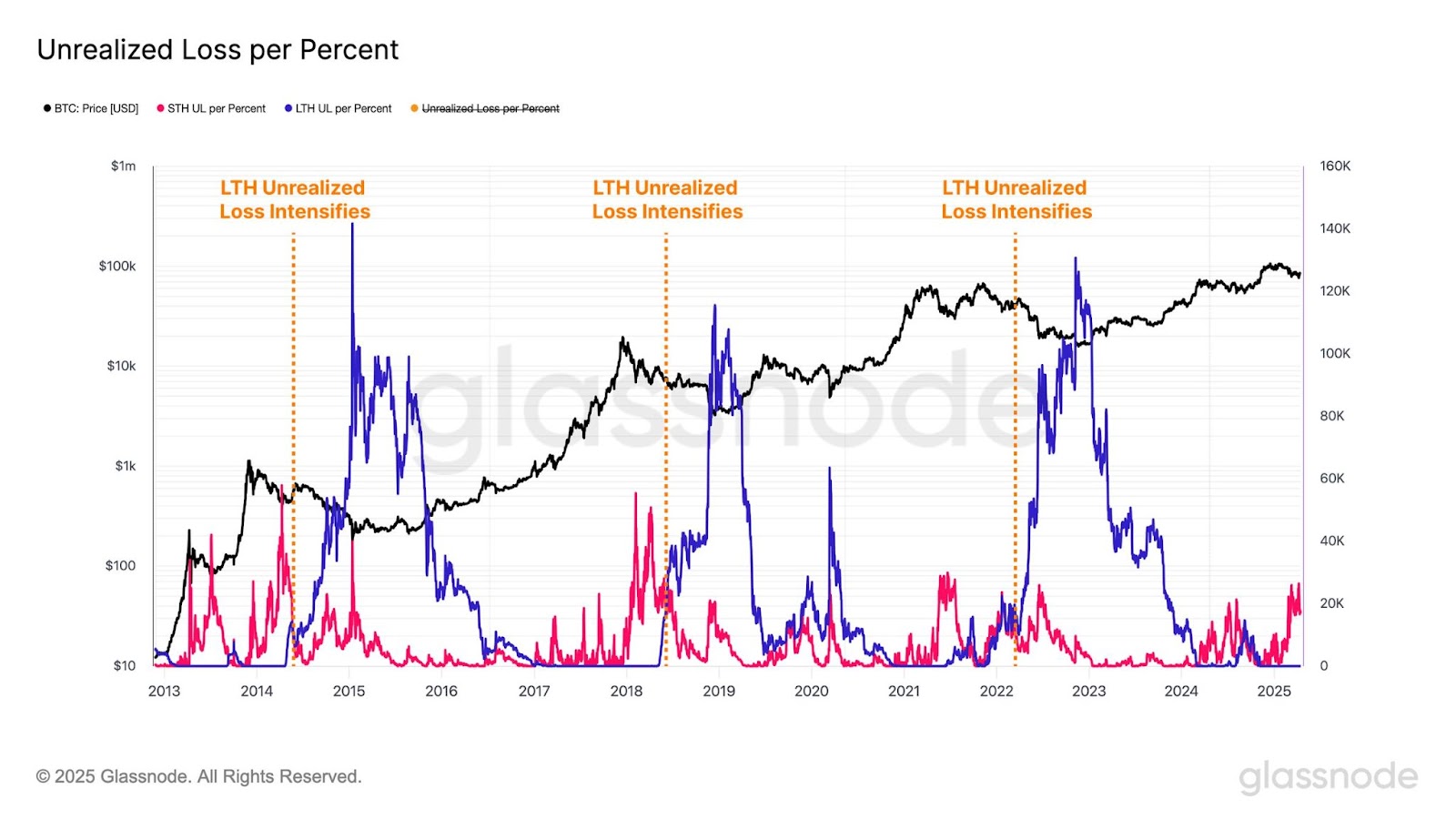

As Bitcoin continues to commerce sideways under the $85,000 mark as of April 18, the most recent knowledge from on-chain analytics agency Glassnode exhibits the asset recording important unrealized losses for short-term holders.

Whereas these short-term holders stay underwater with substantial unrealized losses, the info additionally signifies that long-term holders are nonetheless broadly in revenue. Nonetheless, mounting unrealized losses are placing even these seasoned holders vulnerable to shedding their features.

Unrealized losses signify the whole quantity of losses held throughout all Bitcoin in circulation, calculated from the distinction between the common acquisition value and the present market worth.

Bear market already?

Because the crypto market strikes with warning amid debates in regards to the sustainability of the latest bull run, the rise in unrealized loss per p.c drawdown has captured the eye of each retail and institutional buyers.

In keeping with the info, repeated value corrections throughout the broader crypto market haven’t but signaled sustainable bullish momentum. In the meantime, Bitcoin seems to be following a historic bearish sample noticed in earlier cycles.

Glassnode revealed that the unrealized losses confronted by short-term holders are a direct response to the latest market dips.

Though these corrections should not as sharp as these in earlier cycles that triggered full-blown bear markets, the resemblance in sample has sparked hypothesis {that a} bearish section might already be underway.

For long-term holders, the info painted a combined image. Whereas they continue to be largely in revenue, they’re now susceptible to absorbing losses if downward momentum persists.

Notably, the rising variety of prime Bitcoin patrons maturing into long-term holders may assist the market face up to deeper drawdowns.

Though this key metric has traditionally aligned with bear market confirmations, it alone doesn’t formally outline one. Regardless of these bearish indicators, Bitcoin whales and main funding corporations haven’t slowed down of their accumulation efforts.