Bitcoin (BTC) is turning into harder to mine after rising competitors prior to now ten days. The subsequent problem adjustment might make the community much more aggressive.

The Bitcoin (BTC) problem index is close to an all-time excessive, after a small readjustment on the finish of January. The subsequent problem readjustment factors to a rise of 4.71%, additional pressuring miners to allocate extra sources or shut down their operations to await extra favorable problem situations. The habits of miners and their readiness to supply cash below all situations might sighal whether or not the worth of BTC will proceed its upward trek, or face extra promoting strain.

Up to now few days, the mining revenue/loss sustainability metric shifted to ‘underpaid’, based mostly on Cryptoquant information. Since 2022, miners had intervals of underpaid mining, which didn’t cease them from constructing extra information facilities. Nevertheless, this additionally meant miners have been strategic about their promoting, attempting to make the perfect of native market tops.

The Bitcoin mining capitulation principle has been examined over 4 halvings already. In all of Bitcoin’s historical past, miners haven’t deserted the community, or led to dam manufacturing stalling. Nevertheless, past a sure level, miners might speed up their promoting and put extra strain on the worth of BTC.

The impact of mining capitulation might filter inefficient miners, resulting in the substitute of apparatus and a brand new equilibrium of bills and block rewards. The value per problem is presently in a transition zone, the place miners might proceed stretching their efforts for some time, however might quickly shift to promoting.

Bitcoin mining stays aggressive for larger operations

Simply earlier than the issue readjustment, mining charges jumped once more to over 992 EH/s. Large swimming pools and mining operations confirmed no indicators of diminishing their makes an attempt to unravel blocks. Nevertheless, some miners proceed to compete even because the potential earnings margins are small.

The upcoming problem adjustment might result in a interval of slower mining, in a bid to create extra favorable situations. Nevertheless, some mining operations may attempt to inflate the hashrate and make the much less aggressive mining services capitulate.

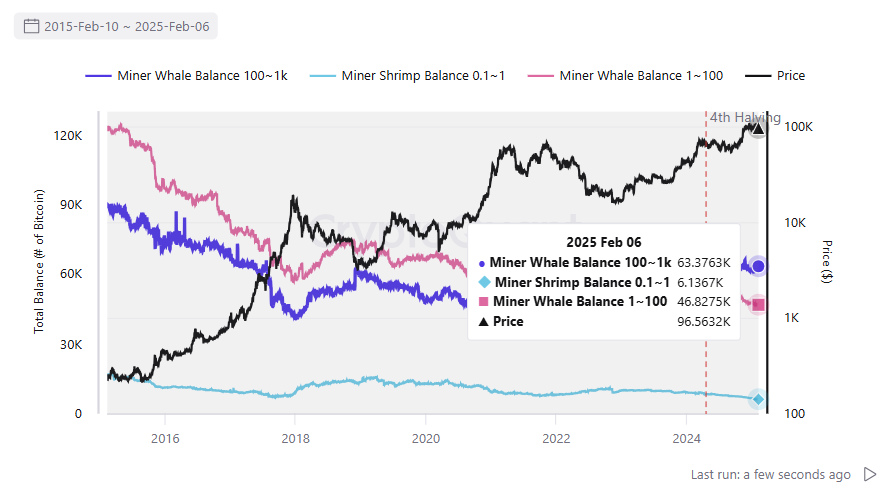

Bitcoin common mining prices are at $86,000, whereas BTC traded above $97,000. The impact of mining problem shall be completely different for varied swimming pools and solo mining information facilities. Even now, whale miners can afford to retain extra of their cash, whereas small-scale operations are promoting sooner.

Small-scale miners are promoting sooner, whereas whale operations can afford to carry BTC. | Supply: Cryptoquant

The development of shrimp and small-scale miners promoting accelerated within the final days of 2024, when BTC made its trek above $100,000.

Will miner capitulation trigger a worth backside?

Miners retain as much as 1.91M cash, with every day fluctuations from promoting and new manufacturing. The choice to promote throughout a capitulation occasion will deplete reserves accrued throughout earlier halving intervals.

A miner capitulation occasion, even when not dramatic, can sign the top of a market drawdown. The present indicators of miners slowing down their exercise and promoting might translate right into a BTC purchase sign within the coming weeks.

BTC already went by one small capitulation occasion in the summertime of 2024, adopted by an analogous historic purchase sign. Miner behaviors are seen as comparatively predictable, and a method to gauge the way in which ahead for spot coin shopping for.

In early 2025, BTC nonetheless had a comparatively profitable efficiency in January. For some miners, the bills for mining one further BTC have been nonetheless decrease than the market worth, whereas additionally providing future worth in case of an ongoing bull market in 2025.

Regardless of the combination of difficult mining situations, BTC remains to be not flashing a Hash Ribbon indicator. The looks of a hash ribbon alerts the energetic part of miner capitulation, the place situations actually spark a spherical of promoting.

For the final time, a brief capitulation sign appeared in October 2024, instantly offset by the year-end rally. The looks of a hash ribbon additionally coincides with intervals of extra dramatic market drawdowns. The interval of miner capitulation, nonetheless, can be an indicator that the drawdown is over and a neighborhood low has been discovered. After that, each merchants and miners return to equilibrium and should begin a brand new bullish cycle.