$BTC’s latest restoration could also be hiding a harmful sign. The Bitcoin worth bounced almost 9% between February 12 and February 15, giving the impression that the worst of the correction was over.

However the rebound is already weakening. Now, leverage knowledge, momentum alerts, and on-chain revenue traits recommend the bounce might have elevated crash danger as an alternative of ending it.

Bitcoin’s 9% Bounce Drew Almost $2 Billion in Lengthy Bets

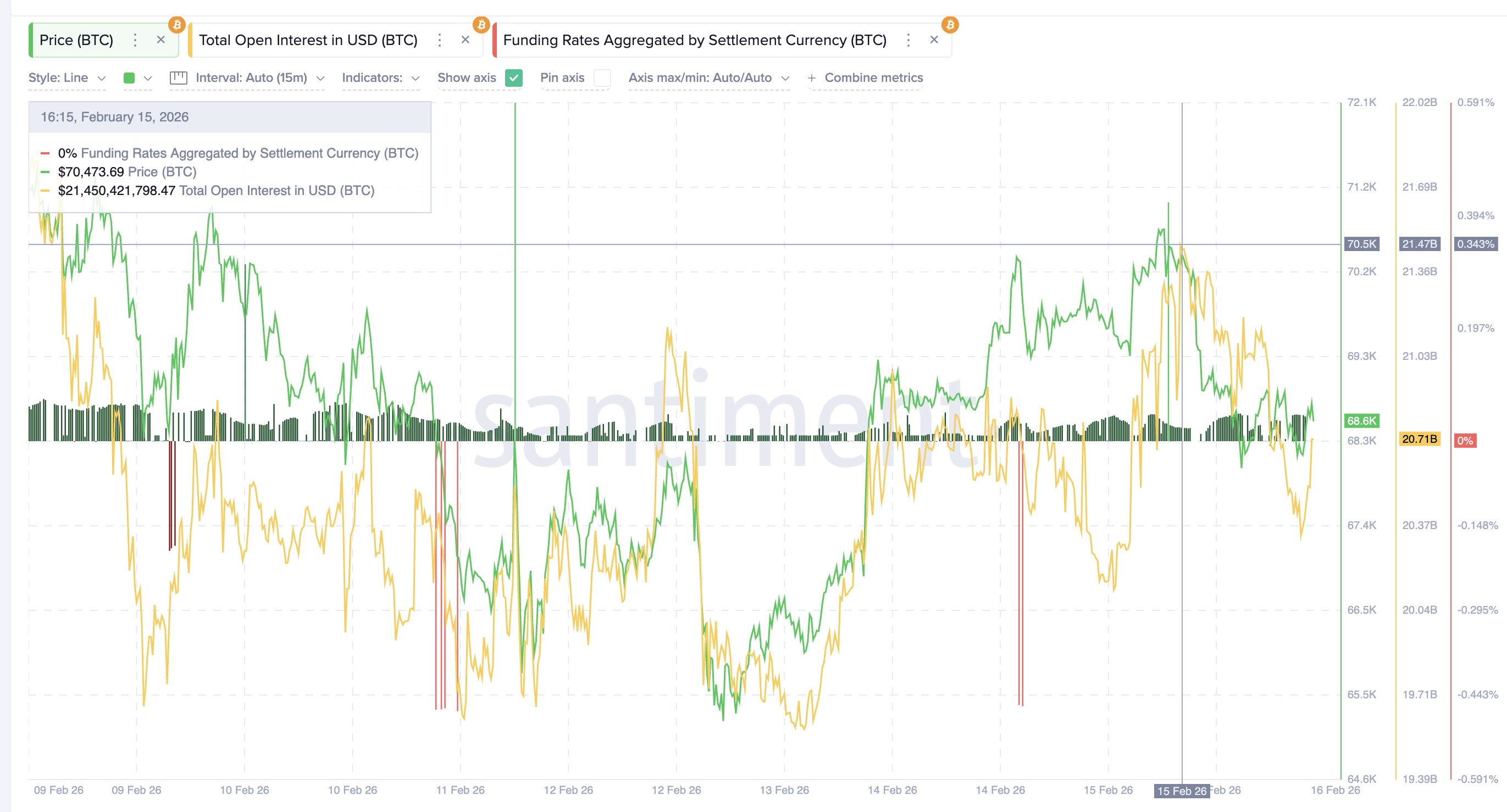

Between February 12 and February 15, Bitcoin climbed roughly 9%. On the similar time, futures merchants aggressively positioned for additional upside. Whole open curiosity, which tracks the overall worth of energetic futures contracts, rose from $19.59 billion to $21.47 billion. This was a rise of about $1.88 billion, or roughly 9.6%, between February 13 and February 15.

This improve didn’t occur in isolation. Funding charges additionally turned strongly optimistic, rising towards +0.34%. The funding fee is the payment paid between lengthy and quick merchants. When it’s optimistic, lengthy merchants pay quick merchants. This reveals that the majority $BTC merchants have been betting on costs rising.

Rising BTCLeverage: Santiment

Need extra token insights like this? Join Editor Harsh Notariya’s Each day Crypto Publication right here.

Collectively, rising open curiosity and optimistic funding charges confirmed that the market was positioning for a bigger restoration. However the bigger chart construction reveals a vital drawback.

This whole rebound occurred inside a bear flag sample. A bear flag kinds when the value rises slowly after a pointy drop however stays inside a downward continuation construction. It typically acts as a pause earlier than one other decline.

$BTC Bounce Inside A Bearish Sample”>

$BTC Bounce Inside A Bearish Sample”>

$BTC Bounce Inside A Bearish Sample: TradingView

The latest rejection close to the native peak and the continuing pullback now present that Bitcoin remains to be buying and selling inside this bearish sample. Value is already drifting towards the decrease boundary of the flag. If this decrease help breaks, the following leg of the weakening Bitcoin worth prediction might start.

Hidden Bearish Divergence and 90% Revenue Surge Present Sellers Are Returning

Momentum indicators are actually beginning to affirm this rising weak point. On the 12-hour chart, Bitcoin shaped a hidden bearish divergence between February 6 and February 15.

Throughout this era, the value shaped a decrease excessive, that means the restoration was weaker than the earlier peak. However the Relative Power Index, or RSI, shaped a better excessive. RSI measures the energy of shopping for and promoting momentum.

Hidden RSI Divergence: TradingView

This mixture known as hidden bearish divergence. It often seems when shopping for momentum rises briefly, however the general development stays weak. It alerts that sellers are quietly regaining management. Shortly after this sign appeared, Bitcoin’s pullback started.

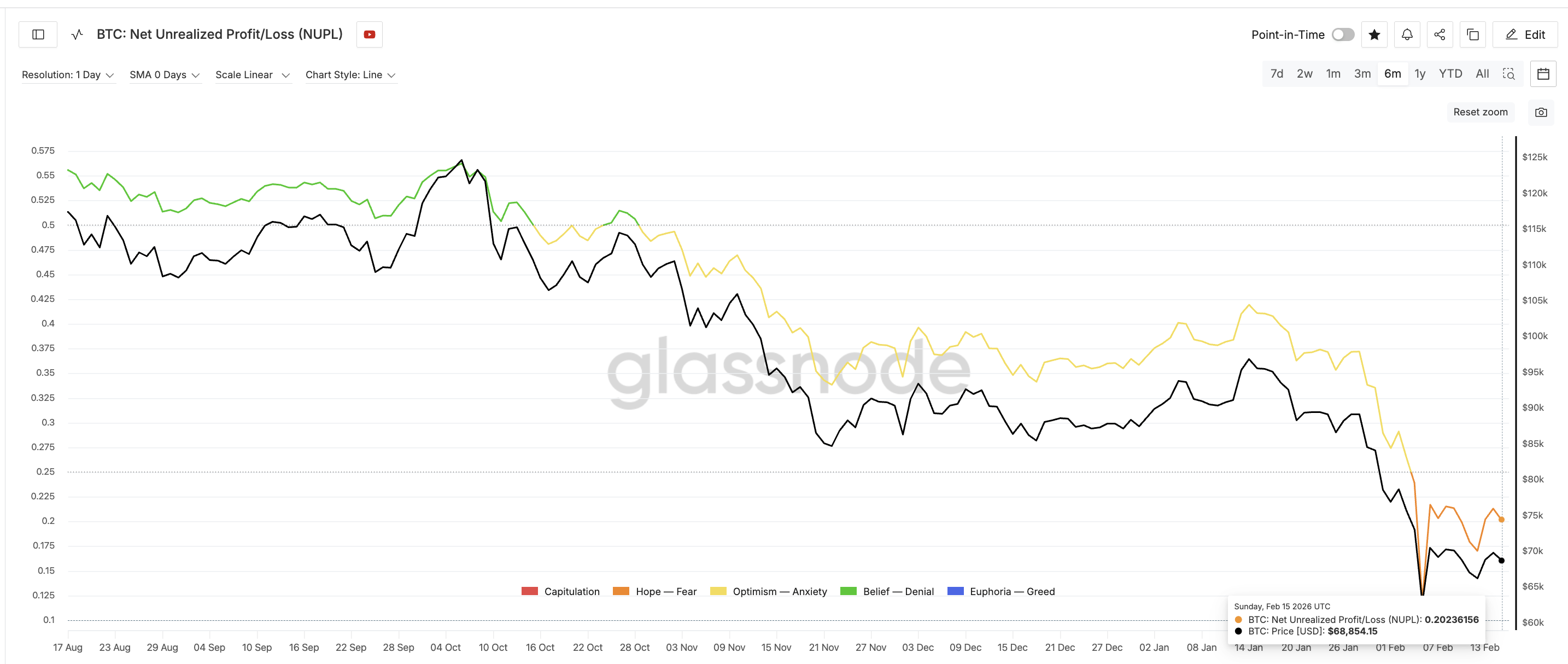

On the similar time, on-chain revenue knowledge surged sharply, creating one other warning signal. Bitcoin’s Web Unrealized Revenue/Loss, or NUPL, rose from 0.11 on February 5 to 0.21 on February 14. This was a rise of about 90%. It’s at the moment shifting close to the identical zone, at press time.

NUPL measures the typical unrealized revenue throughout all Bitcoin holders. It reveals how a lot revenue buyers are holding on paper. When NUPL rises sharply, it means many buyers are abruptly again in revenue, even when it’s a small quantity. This will increase the chance of profit-taking.

Revenue Surge: Glassnode

The final time NUPL reached related ranges was on February 4. At the moment, Bitcoin was buying and selling close to $73,000. Inside someday, the value collapsed to round $62,800. That was a drop of almost 14%. Now, the identical revenue construction has appeared once more.

This creates a scary state of affairs. Buyers holding recent earnings might promote shortly if costs begin falling. That promoting can speed up the correction. This aligns with the hidden bearish divergence already seen on the chart.

Collectively, these alerts present that the latest bounce might have strengthened sellers as an alternative of eradicating them.

Key Bitcoin Value Ranges Present Breakdown Threat Towards $58,800

Bitcoin is now approaching a very powerful help zone in its present construction. The primary vital stage is $66,270. This stage kinds close to the decrease boundary of the bear flag sample breaks.

If Bitcoin breaks under this Fib stage, the bearish continuation sample would activate. The following main draw back goal sits at $58,880 (the $58,000 zone). This stage aligns with the 0.618 Fibonacci retracement stage ( a structurally robust zone) and represents roughly a 14% decline from present costs.

Bitcoin Value Evaluation: TradingView

If promoting strain accelerates additional, Bitcoin might fall towards the $55,620 zone, which aligns with the deeper projection of the bear flag construction. On the upside, Bitcoin should reclaim $70,840 to stabilize within the quick time period.

A stronger breakout above $79,290 would absolutely invalidate the bearish construction. That may sign that patrons have regained management. Till then, the chance stays tilted to the draw back. The latest bounce improved sentiment briefly. However rising leverage, hidden bearish divergence, and a 90% surge in unrealized earnings now present that the Bitcoin worth restoration might have created the circumstances for an additional drop.

The put up Bitcoin ($BTC) Value Bounce Sparks 90% Revenue Surge as Crash Threat to $58,000 Returns appeared first on BeInCrypto.