Bitcoin (BTC) value is up over 8% within the final seven days, with a brand new all-time excessive on January 20, when it surpassed $108,000 for the primary time. This exceptional surge has fueled hypothesis about whether or not BTC’s uptrend will proceed to check new resistance ranges or face a possible pullback.

Regardless of the bullish momentum, technical indicators just like the DMI and RSI recommend that the power of the pattern could also be weakening, with sellers starting to exert extra affect.

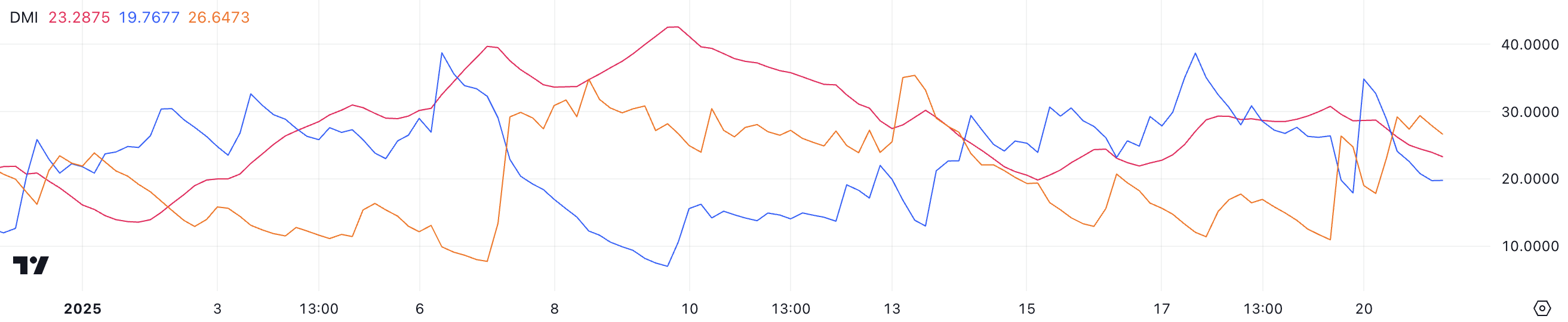

BTC DMI Reveals Sellers May Be Taking Management

The Bitcoin DMI chart reveals that the ADX has fallen to 23.2 from 30.7 over the previous two days, highlighting a weakening pattern. The ADX measures pattern power, with values above 25 signaling a robust pattern and people under 20 suggesting a scarcity of path.

The present studying under 25 signifies that BTC bullish momentum is shedding power, doubtlessly hinting at a slowdown in market exercise or a pause within the uptrend.

BTC DMI. Supply: TradingView

In the meantime, the +DI has sharply declined from 34.8 to 19.7 in a day, reflecting waning shopping for stress, whereas the -DI has elevated from 17.8 to 26.6, exhibiting rising promoting stress.

This shift means that though BTC is technically nonetheless in an uptrend, the weakening +DI and strengthening -DI level to a market shedding steam. If this pattern continues, Bitcoin value might enter a consolidation part or threat a reversal, notably if -DI overtakes +DI, signaling bearish dominance.

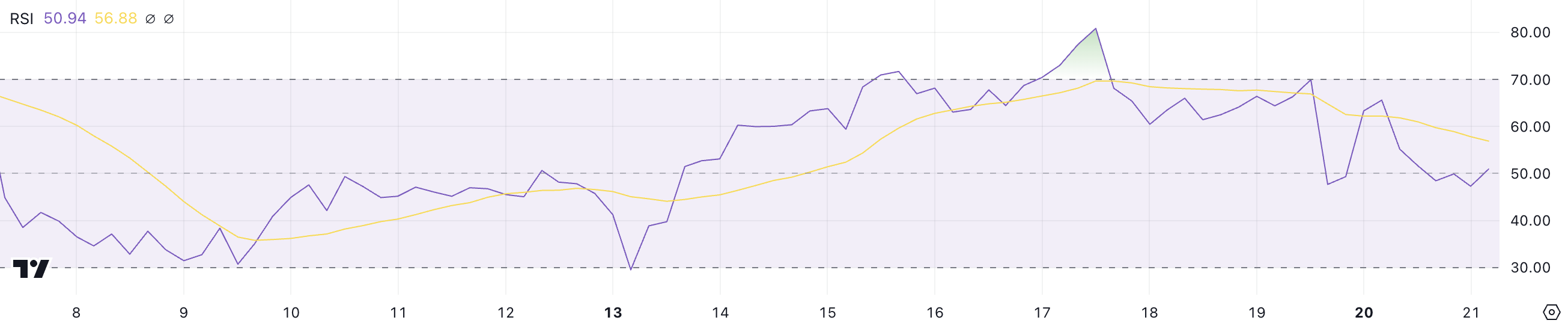

Bitcoin RSI Signifies Cooling Momentum

The BTC RSI is presently at 50.9, down from 65.5 simply at some point in the past, indicating a shift in momentum. The Relative Power Index measures the pace and magnitude of value actions on a scale of 0 to 100, with values above 70 suggesting overbought circumstances and potential value corrections.

In distinction, values under 30 point out oversold ranges and doable rebounds. A studying round 50 indicators impartial momentum, suggesting neither patrons nor sellers are in clear management.

BTC RSI. Supply: TradingView

With BTC’s RSI now at 50.9, it displays a steadiness between shopping for and promoting stress, however the latest decline from 65.5 exhibits a weakening bullish momentum.

This might point out that BTC latest upward motion is shedding steam, with value doubtlessly getting into a consolidation part. If the RSI continues to drop nearer to 40, it may recommend growing bearish momentum, whereas a rebound above 60 may reignite bullish sentiment.

BTC Worth Prediction: Can Bitcoin Attain $110,000?

BTC EMA strains point out it’s presently in an uptrend, with short-term strains positioned above long-term strains. Nonetheless, the narrowing distance between these strains means that bullish momentum could be weakening, signaling a possible slowdown within the pattern’s power.

BTC Worth Evaluation. Supply: TradingView

If the uptrend regains power, BTC value may check the resistance at $105,700, and a breakout may push the worth to $108,500. Additional bullish momentum may even drive BTC to $110,000 for the primary time.

On the draw back, if momentum cools off, BTC value may check the help at $98,800, with potential declines to $97,800 and $91,200 if that degree is misplaced. An additional breakdown may see BTC value dropping under $90,000 to check the important thing help at $89,400.