Bitcoin value historical past: 2026 as a turning level

2025 was a pivotal yr for the crypto market. The early surge in threat urge for food steadily gave strategy to a way more fragile sentiment.

Bitcoin reached an all-time excessive of $126,210.50 on October 6, 2025. Since then, the market has been dominated by doomscrolling, denial, suspicion, demanding liquidations, and bouts of unreasonable optimism.

After a number of so-called “crypto bloodbaths” in only a few months, merchants at the moment are approaching 2026 with delicate warning.

Whether or not one other bull run emerges in early 2026 will largely depend upon broader macroeconomic circumstances and total monetary market sentiment.

S&P 500 bubble: Will BTC save crypto market?

This query typically comes up when valuing the most important U.S. tech firms. A comparability with the 2000 dot-com bubble is helpful. Again then, the Nasdaq fell about 75% over two years.

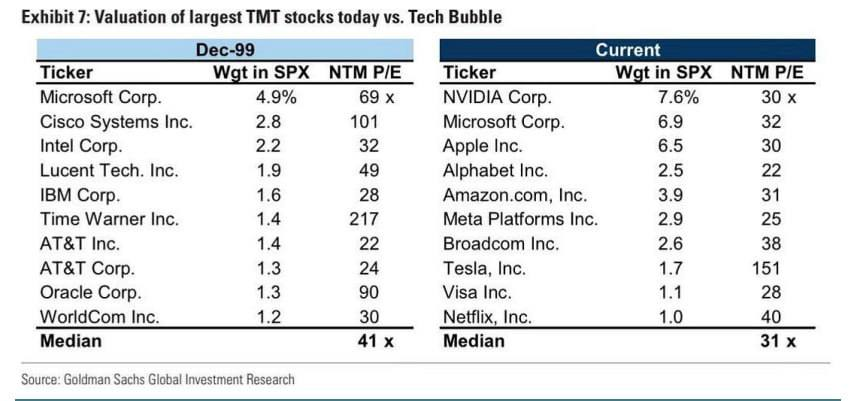

A desk from Goldman Sachs compares at the moment’s P/E ratios of the ten largest firms within the S&P 500 with their ranges on the 1999 peak, earlier than the bear market started. It additionally highlights focus: the highest three firms made up 10% of the index then, versus 20% at the moment.

Extra importantly, on the 1999 peak, the typical P/E of the highest 10 firms was 41; at the moment it’s about 31. There have been outliers then (Cisco, Time Warner) and now (Tesla), however on common valuations are nonetheless roughly 30% decrease than 25 years in the past.

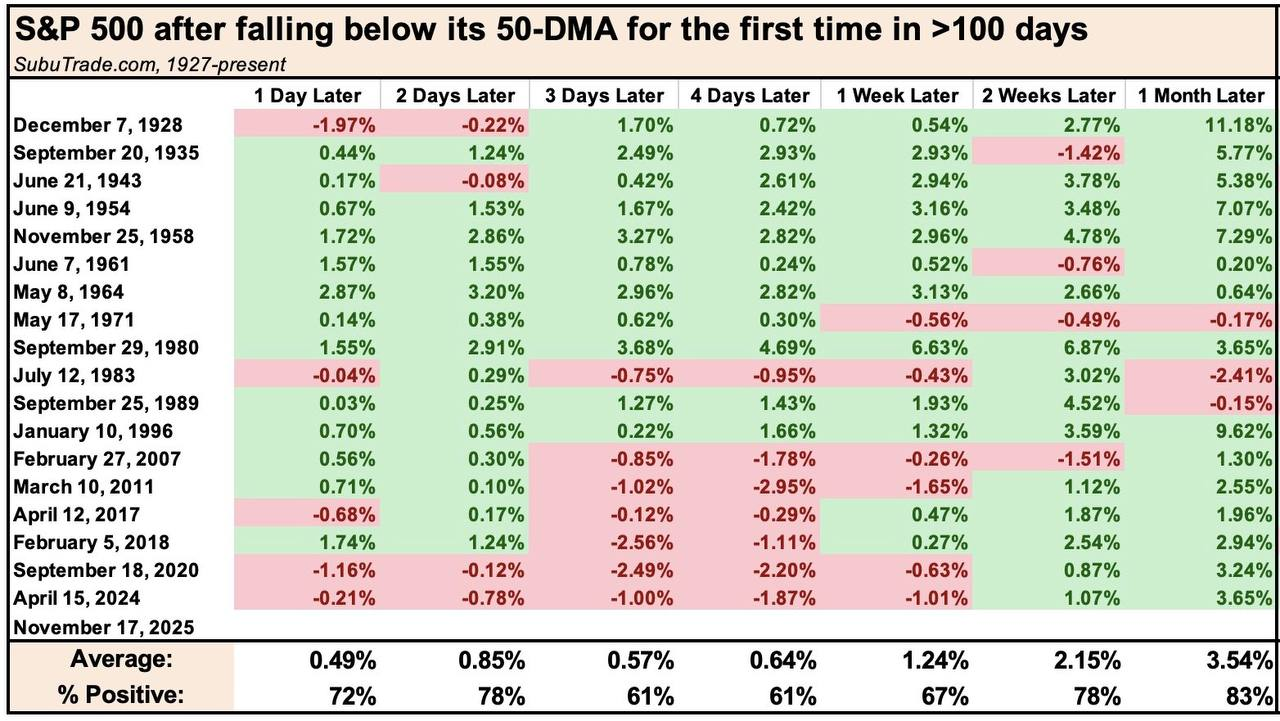

The S&P 500 lately ended a streak of 138 consecutive days closing above its 50-day transferring common.

This is what the index has completed in comparable conditions over the previous 100 years: 100 or extra days above the 50-day transferring common and the primary shut beneath it.

Trying again over the previous 100 years at comparable circumstances, the takeaway is blended: outcomes are near a coin toss on a weekly horizon, however stay constructive on a month-to-month foundation.

Given the present uncommon market circumstances, there’s an opportunity to see some FOMO from buyers and managers who did not consider within the spring/summer time rally and fell behind their benchmarks. Now they should by some means catch as much as the index.

On this state of affairs, one other small downward motion after which a rebound by the tip of the yr aren’t out of the query, even perhaps reaching new highs.

That makes discuss of a “bubble” untimely. Main bubbles normally burst amid excessive euphoria, when buyers consider “this time is completely different.”

That doesn’t describe the present temper: the CNN Cash fear-greed index was in excessive worry simply weeks in the past and has solely lately returned to impartial. After a brief pause and inner rotation, the market might proceed rising in Q1–Q2 2026.

Technique (MSTR): Bitcoin’s lengthy strategy to institutional adoption

At the moment, Bitcoin is dominated by public firms and controlled merchandise, quite than crowds combating via authorities management, as they did in earlier eras.

Technique alone controls 641,692 BTC, and Marathon holds 53,250 BTC, whereas Coinbase has 14,548 BTC. Even Tesla holds 11,509 BTC. Add the ETFs of BlackRock and others to that whole and it turns into clear {that a} main proportion of the availability is now held by entities which are topic to disclosures, board approvals and inner insurance policies quite than market intuition.

Brandt compares late 2025 to late 2021 in reverse: costs falling whereas conventional indexes just like the S&P 500 stay secure. The primary subject is that plenty of property already commerce as if charges are going to drop rapidly. Crypto adopted the identical logic, ignoring that future cuts might already be within the chart.

Brandt’s fundamental thesis is that Bitcoin’s explosive development is slowing down over time. It isn’t dying, however it’s maturing. This primarily implies that every “bull cycle” is much less highly effective than the final.

Regardless of the slowing exponential development, Peter Brandt predicted that the following main bull cycle might nonetheless carry BTC towards the $200,000 to $250,000 stage. Nevertheless, the large rally won’t occur within the close to time period, and Bitcoin would possibly must fall as little as $50,000 first to realize this goal.

The historical past of Bitcoin bull market cycles has been a historical past of exponential decay. Agree with it or not, you’ll have to cope with it. Ought to the present decline carry to $50k, the following bull market cycle ought to carry to $200k to $250K pic.twitter.com/fFdgPPKvok

— Peter Brandt (@PeterLBrandt) December 1, 2025

On a extra pessimistic facet, Bloomberg analyst Mike McGlone is forecasting a extreme downturn for Bitcoin. He argues that $50,000 won’t maintain as a flooring, viewing it as a substitute as simply an interim stage.

McGlone believes 2025 marked the cycle’s definitive peak and expects 2026 to convey a pointy “reversion to the imply,” together with his present goal close to $10,000.

Bitcoin $50,000 in 2026 On the Approach to $10,000?

2025 might have marked peak Bitcoin/cryptos. Gold has solely three main precious-metal opponents: silver, platinum and palladium. Against this, Bitcoin was the primary crypto in 2009, however now has hundreds of thousands of digital-asset opponents.… pic.twitter.com/3PSQF4zVwU— Mike McGlone (@mikemcglone11) December 28, 2025

He additionally contends that the broader crypto asset class is inflationary and successfully limitless, with fixed issuance diluting capital flows into the house.

BTC/USD: 2026 prediction

The founding father of CryptoQuant famous that giant holders, popularly generally known as whales, have offered Bitcoin value billions because the coin hit $100,000. Sometimes, whale promoting creates provide overhang, that means extra BTC hitting the market than consumers can take up, pushing costs down.

After Bitcoin hit its all-time excessive (ATH) of $126,025 on Oct. 6, the worth has corrected roughly 20-30%. That is partly because of the provide overhang and is a basic signal of distribution in market cycles.

Contemplating the whale promoting, Younger Ju had beforehand instructed that the 2024-2025 bull run had peaked and flipped bearish. Nevertheless, he identified that inflows from Technique and Bitcoin exchange-traded funds (ETFs) canceled the bear market.

Some analysts stay optimistic in regard to potential Q1 2026 bull run.

Galaxy CEO Mike Novogratz has predicted that 2026 might probably be an incredible yr for crypto. Nonetheless, he acknowledges the technical actuality that the asset is “stalled.” Novogratz claims that Bitcoin would wish to reclaim $100,000 to be able to begin gaining momentum.

In accordance with Novogratz, excessive apathy typically signifies a backside as a result of it means all of the sellers have seemingly already offered. He views this lack of hype as a bullish setup for 2026 as a result of the market is not overheated.

In a latest report, Coinbase factors to an earlier liquidity enhance, with reserve development anticipated to proceed via April 2026. The Federal Reserve’s shift from stability sheet runoff to web injections might, in response to Coinbase, assist crypto markets.

Hunter Horsley, CEO of Bitwise, has additionally argued that the four-year cycle principle is successfully over. He expects a serious bull run subsequent yr, saying, “All the things is lining up for an enormous 2026. It’s gorgeous.”

Customary Chartered lately echoed this view, stating that Bitcoin’s conventional four-year halving cycles are now not a dependable information for value motion. To verify this shift, Bitcoin would wish to interrupt its earlier all-time excessive of $126,000, which, in response to Customary Chartered, might happen in early 2026.