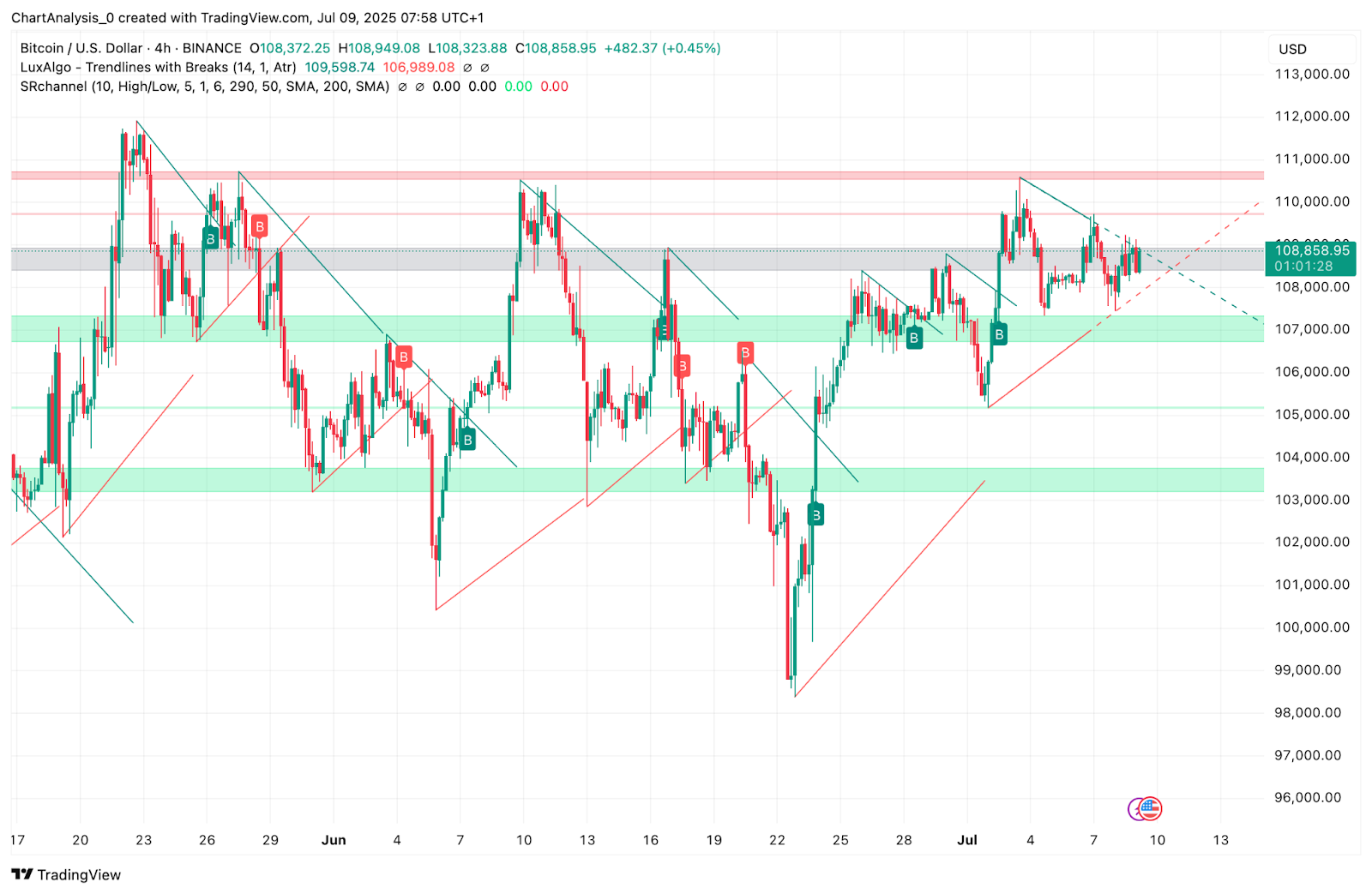

Bitcoin worth right this moment is buying and selling close to $108,865, sustaining a good vary between $108,200 and $109,200. The asset stays locked in a triangular construction as bulls try to carry above the short-term ascending trendline.

BTC worth dynamics (Supply: TradingView)

Regardless of a number of assessments of the resistance zone just under $109,600, momentum has remained capped, as mirrored by a cooling RSI and low directional motion. Nonetheless, market construction throughout every day and 4-hour charts stays bullish until $107,200 breaks decisively.

Bearish RSI Divergence Alerts Exhaustion

BTC worth dynamics (Supply: TradingView)

The 30-minute chart reveals a sequence of bearish RSI divergences, with worth forming greater highs whereas the RSI steadily declines. This alerts weakening upside momentum regardless of worth pushes. The RSI has rebounded modestly to 53.8, however stays beneath bullish extremes.

In the meantime, MACD strains have crossed barely destructive, with histogram bars reflecting muted bearish momentum. This lack of follow-through signifies a possible equilibrium section fairly than an impulsive drop.

Bitcoin Value: Bollinger Band Squeeze and EMA Help Maintain

BTC worth dynamics (Supply: TradingView)

On the 4-hour chart, Bollinger Bands are starting to contract once more, with the worth compressing between $108,200 and $109,000. The 20 and 50 EMA cluster round $108,200–108,550 is appearing as dynamic help, whereas the higher band at $109,400 stays a ceiling for short-term upside.

Each day construction continues to respect the uptrend, with BTC buying and selling above the 100 and 200 EMAs, and no indicators of breakdown from main trendlines but. This means patrons stay in management until the worth closes beneath $107,000 on excessive quantity.

BTC Derivatives Information: Sentiment Impartial to Barely Bullish

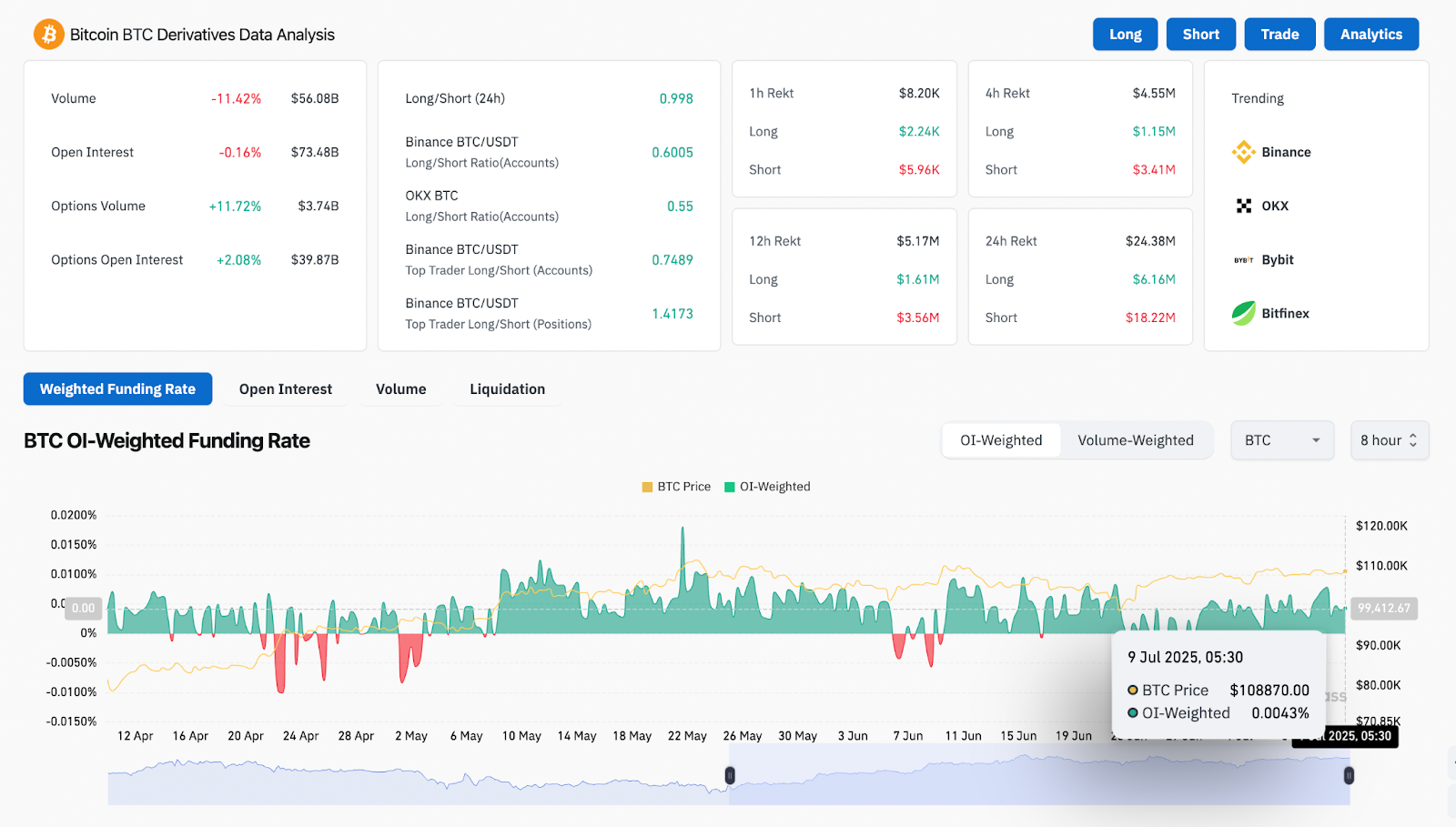

BTC Derivatives Information (Supply: Coinglass)

In accordance with the newest BTC derivatives dashboard:

- Open Curiosity is barely down by -0.16%, however Choices Quantity is up +11.72%.

- Funding charges are barely constructive at +0.0043%, indicating gentle lengthy bias with out crowding.

- The 24-hour liquidation information reveals $18.22M in brief positions liquidated, in comparison with solely $6.16M lengthy, suggesting sellers are being squeezed out at present ranges.

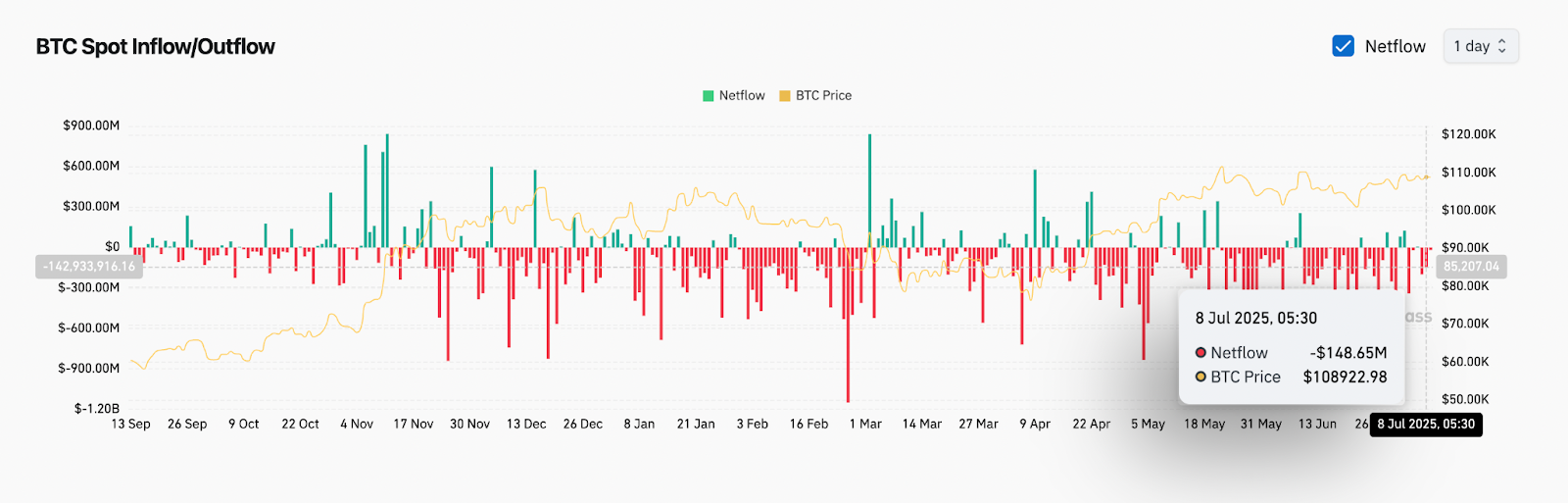

BTC Spot Inflows/Outflows (Supply: Coinglass)

Nonetheless, spot netflow stays destructive, with $148.65M in outflows as of July 8, indicating profit-taking or rotation away from exchanges regardless of worth help.

Bitcoin Value Outlook and Key Ranges to Watch

BTC worth dynamics (Supply: TradingView)

BTC continues to respect the ascending channel on the month-to-month chart, grinding close to the median line round $108,800–$109,000. Whereas upside momentum is capped for now, the broader construction favors continuation until a breakdown happens beneath $106,800.

BTC worth dynamics (Supply: TradingView)

A breakout above $109,600 might set off a brief squeeze towards $110,800–111,500, whereas failure to carry $107,200 opens draw back threat to $105,700 and $104,200.

BTC Forecast Desk

Disclaimer: The knowledge offered on this article is for informational and academic functions solely. The article doesn’t represent monetary recommendation or recommendation of any sort. Coin Version isn’t chargeable for any losses incurred because of the utilization of content material, merchandise, or companies talked about. Readers are suggested to train warning earlier than taking any motion associated to the corporate.