Bitcoin value confronted a powerful bullish stress as a consequence of rising shopping for domination. Because of this, BTC value surged above Fib ranges and maintained its momentum above $88K degree. Over the previous 24 hours, Bitcoin’s buying and selling quantity has surged by greater than 161%, totaling $31.2 billion.

In a broader perspective, Bitcoin fell under $100,000 on January 7 and confirmed a downward pattern. It reached a low of roughly $89,397 on January 13. On Feb 3, Bitcoin once more crashed and reached a low close to $91K. In current days, the value has been going through elevated volatility under $90K. During the last 24 hours, its complete market capitalization surged by 3.6%, settling at $1.74 trillion.

Bitcoin’s Bullish Stress Skyrockets

On Friday, Trump adjusted his place on tariffs, signaling he may present better flexibility relating to the “reciprocal tariffs” scheduled to take impact on April 2. Studies point out the Trump administration may exempt sure nations from these deliberate tariffs and is unlikely so as to add separate sector-specific tariffs on merchandise like vehicles, prescribed drugs, and semiconductors.

Nevertheless, the present suspension of tariffs on many merchandise from Canada and Mexico may also expire on April 2. Because of this even when Trump opts for a softer strategy total, tariffs on varied imported items will nonetheless enhance considerably ranging from that date.

Federal Reserve Chair Jerome Powell lately commented on the tariffs, suggesting that they might probably trigger a brief enhance in inflation this 12 months however wouldn’t result in long-term inflationary pressures. Moreover, Powell hinted at a possible rate of interest reduce of half a share level later this 12 months.

Because of this, Bitcoin value witnessed a powerful comeback in its momentum. This pushed the value above $88K in only a few hours.

Latest information from Coinglass reveals that Bitcoin noticed practically $108 million in complete liquidations over the past 24 hours, with consumers liquidating $14 million and sellers round $94 million, indicating a major enhance briefly liquidations.

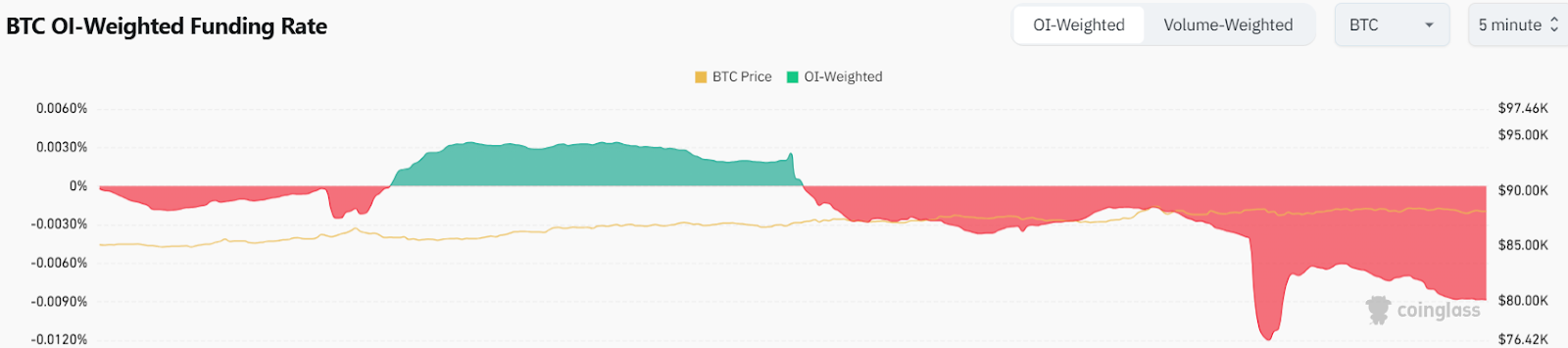

Moreover, the open curiosity for Bitcoin has surged by 9.1%, touching round $58.69 billion within the final 24 hours. Nevertheless, Bitcoin’s funding charge trades at -0.0088%, indicating that sellers may quickly achieve management. This might assist sellers to forestall the continuing shopping for momentum.

Bitcoin Value Prediction: Technical Evaluation

Bitcoin has made a powerful shopping for momentum because it broke above essential Fib ranges and surged above $88K. At present hovering at $88,520—a achieve of about 4% up to now 24 hours—the crypto king briefly examined $88.7K to validate additional good points.

Sellers proceed to press aggressively, aiming to maintain BTC pinned beneath the essential $90,000 degree. Nevertheless, consumers aren’t backing down simply, gearing up for one more try and reclaim this very important threshold.

Ought to bulls efficiently push Bitcoin again above $90K, confidence might surge, doubtlessly paving a clearer path towards the much-anticipated $95,000 milestone.

On the flip aspect, if consumers fail to rally convincingly at this pivotal zone, BTC dangers sliding additional, opening doorways to a possible pullback towards the $81,000-$85,000 area.

Bitcoin Value Prediction: What to Anticipate Subsequent?

Brief-term: In response to BlockchainReporter, BTC value may intention for $90K. If it surges above that degree, we’d see $95,000. Then again, $81K-$85K is the decrease vary.

Lengthy-term: In response to Coincodex’s present Bitcoin value prediction, Bitcoin is predicted to extend by 36.22%, reaching roughly $118,986 by April 23, 2025. Coincodex’s technical indicators at the moment replicate a impartial sentiment, although the Concern & Greed Index is at 0. Over the previous 30 days, Bitcoin skilled 13 inexperienced days out of 30 (43%), with a value volatility of 4.80%. Primarily based on these forecasts, Coincodex means that it’s presently a superb time to purchase Bitcoin.

Funding Dangers for Bitcoin

Investing in Bitcoin could be dangerous as a consequence of market volatility. Traders ought to:

- Conduct technical and on-chain evaluation.

- Assess their monetary scenario and threat tolerance.

- Seek the advice of with monetary advisors if essential.