Bitcoin (BTC) barely raised its riskiest assist zone, now resting between $90K and $95K. Beforehand, the main crypto had assist at round $87,000 based mostly on the holdings of latest patrons.

Bitcoin continued to draw patrons close to its greater worth vary. As such, the brand new delicate worth zone now lies between $90K and $95K, the place spot patrons can capitulate and promote. For now, the market has not seen true panic-selling, as most cash are additionally stored off exchanges. Nonetheless, a transfer right down to that zone might shortly result in speedy promoting and each unrealized and realized losses.

Value dips into the zone beneath $95,000 could cause realized losses of as much as $100M an hour, inflicting stress on current patrons. Beforehand, the brand new cohort of Bitcoin patrons was within the cash within the vary above $87,000. BTC moved right down to the $90,000 vary a minimum of 3 times since November, every time inflicting a number of the holders to panic-sell.

The holder capitulation ranges are nonetheless hypothetical. For now, these worth ranges don’t coincide with the spinoff buying and selling warmth map. After the latest liquidations, positions beneath $100,000 per BTC are extra scarce. Bodily holders with cash in long-term wallets could not have an effect on the market as quick as liquidations or the actions of whales searching for short-term good points.

Bitcoin remains to be within the accumulation zone, based mostly on the Rainbow chart worth arc. The continued shopping for displays the ‘excessive greed’ sentiment in the meanwhile. Throughout these intervals, BTC appears towards a possible drawdown and its secondary results on holders. BTC can be shifting towards impartial based mostly on the ratio of market worth to realized worth.

After a consolidation, Bitcoin is predicted to chart its subsequent worth transfer, drawing extra consideration to potential assist ranges and readiness to purchase dips. Even company patrons have briefly stopped updating their treasuries, awaiting extra indicators of the market’s route.

Based mostly on ‘hodl waves’, the latest patrons are additionally the quickest sellers. Holding begins to develop for wallets older than 1 week and as much as 3 months. Quick-term holders have a realized worth of $88.2K per BTC, with a acquire of round 17%. The comparatively modest cushion is carefully watched for a reversal and short-term promoting.

Alternate reserves proceed downward development

The brand new worth vary established itself as BTC moved right down to $102,000, as soon as once more sparking dialogue of potential weak fingers. For now, giant holders are nonetheless sustaining their reserve ranges, whereas trade reserves are dipping even decrease. The reassessment of holdings additionally comes a day in spite of everything BTC patrons at any time in historical past have been briefly within the inexperienced.

Centralized markets carry solely 2.34M Bitcoins accessible on the market, whereas miners have round 1.9M cash of their treasuries. After a collection of exchange-based losses, most long-term holders have determined to withdraw funds and maintain them in custody.

As BTC strikes into new wallets with the intention to carry, a number of the promoting stress could also be relieved. Whales and long-term holders are extra cautious about promoting, which additionally contains OTC offers. For now, capitulations are largely pushed by spinoff positions, the place liquidations occur at particular worth ranges.

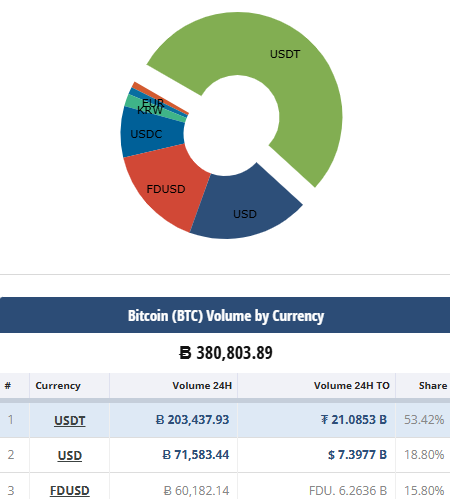

BTC nonetheless boasts a major USD market

BTC traded with a really small Coinbase premium on the spot market. On the similar time, the USD was one of many key liquidity sources. Direct USD pairings made up 18.8% of all BTC buying and selling exercise.

The share of USD buying and selling pairs stays vital, as US buying and selling hours are additionally probably the most lively. | Supply: Cryptocompare

BTC felt the impact of US merchants, the place buying and selling was additionally probably the most lively throughout US buying and selling hours. The current rally forward of Donald Trump’s second inauguration introduced BTC to a brand new all-time excessive, and the keenness for 2025 could assist costs maintain above the capitulation worth vary.

Based mostly on earlier cycles, BTC can be beneath its potential new peak, which retains some patrons as holders. BTC nonetheless guarantees worth discovery after a cycle with the smallest drawdowns in buying and selling historical past.

Land a Excessive-Paying Web3 Job in 90 Days: The Final Roadmap