Bitcoin’s (BTC) current value surge, which has seen the cryptocurrency enhance by 10% over the previous seven days, has positioned 95% of its holders in worthwhile positions. This upward momentum means that Bitcoin could possibly be on the verge of hitting a brand new all-time excessive.

Presently, the value is near retesting the $70,000 mark. This on-chain evaluation explains how the coin might climb past this stage and what it might imply for buyers.

Bitcoin’s Uptober Will get Again on Observe

Bitcoin’s value motion in October initially raised considerations, because it dropped from $63,000 to under $59,000. This led to doubts in regards to the potential of the historically bullish “Uptober.” Nonetheless, since mid-October, Bitcoin has rebounded, and the constructive momentum suggests the opportunity of a robust finish to the month.

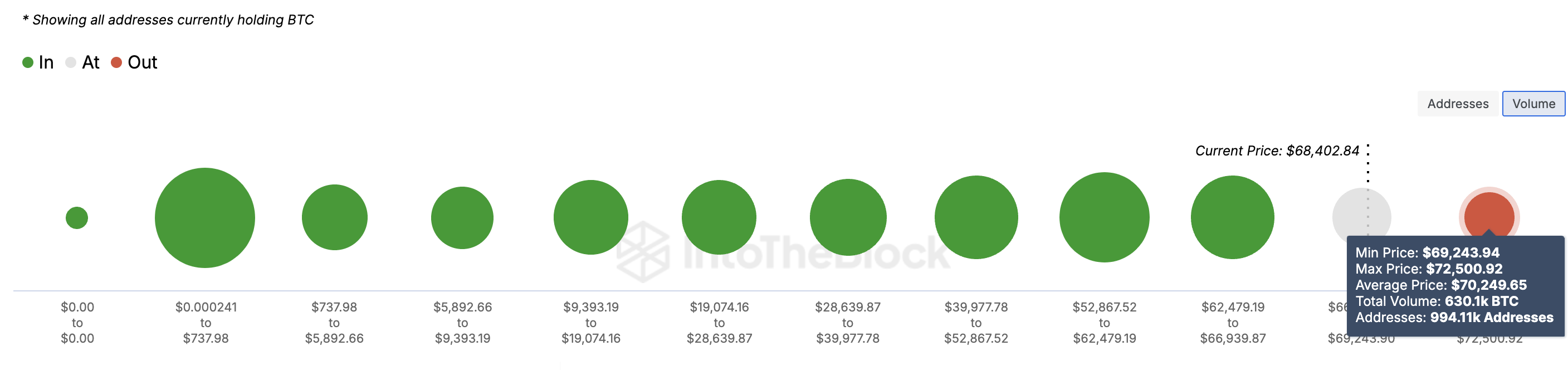

Based mostly on the World In/Out of Cash (GIOM) knowledge, BTC is in a robust place to make additional positive aspects. The GIOM identifies the typical value at which cash have been bought and compares it with the present value. If the weighted on-chain price foundation is larger than the present value, then addresses are at a loss.

Conversely, if the present value is larger than the acquisition value, then addresses are in earnings. From a value perspective, the upper the cluster of addresses or quantity, the stronger the help or resistance.

Learn extra: 5 Greatest Platforms To Purchase Bitcoin Mining Shares After 2024 Halving

Bitcoin GIOM. Supply: IntoTheBlock

Presently, solely 994,100 addresses (holding roughly 630,000 BTC) are in unrealized losses, which is considerably decrease than the variety of worthwhile addresses.

Traditionally, when the vast majority of holders are in revenue, it typically correlates with bullish traits. Subsequently, it’s seemingly that the coin would possibly break past the typical buy value of $72,500, which is a weak provide wall.

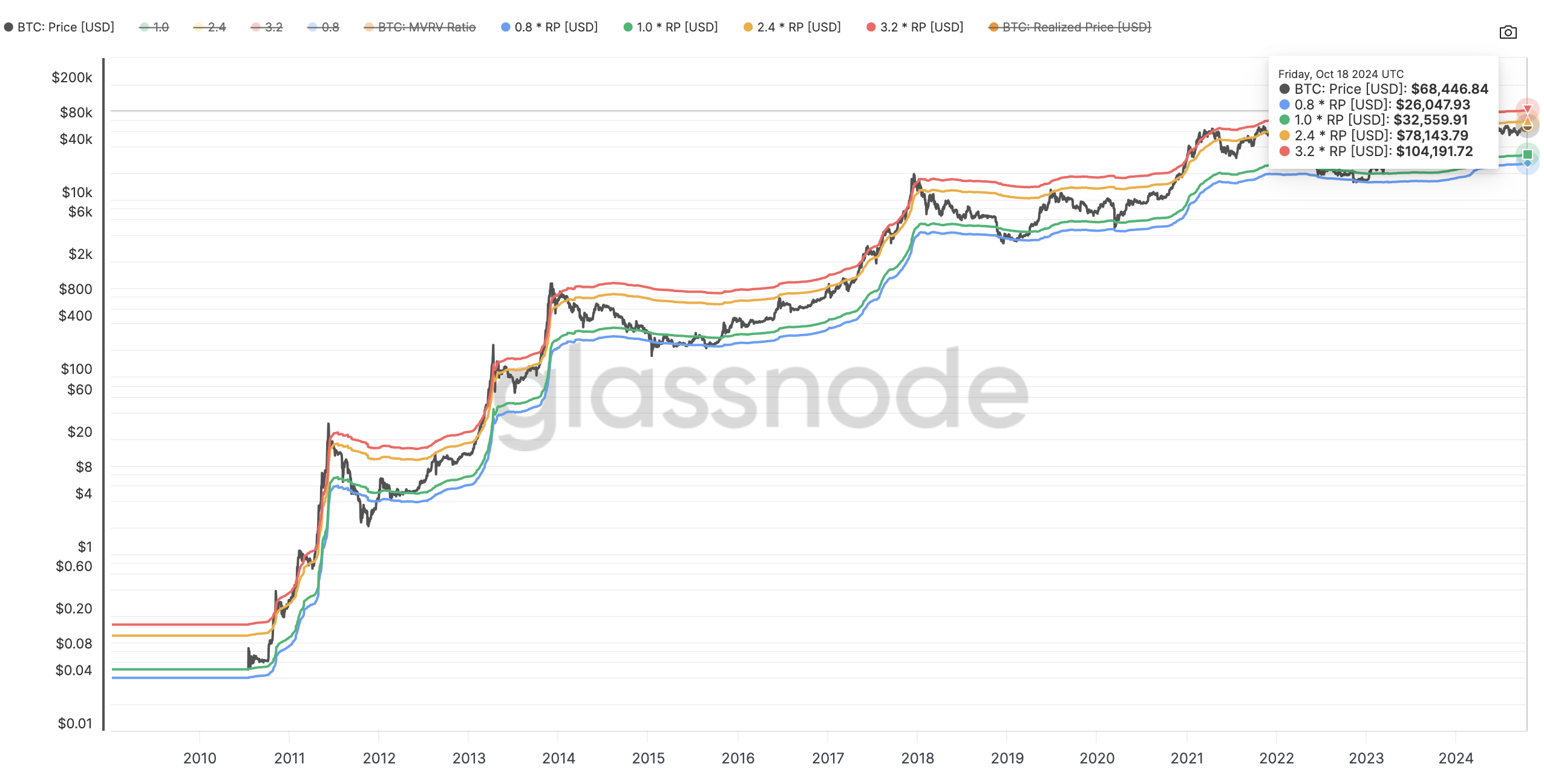

Moreover this, the Market Worth to Realized Worth (MVRV) pricing band, which estimates value ranges that cryptos can attain, means that Bitcoin value might hit $78,143 before anticipated.

Bitcoin MVRV Pricing Bands. Supply: Glassnode

BTC Value Prediction: Rally to Proceed

Bitcoin has damaged out of the descending channel it has been buying and selling in since March, in keeping with the each day chart.

The Superior Oscillator (AO), a device used to substantiate traits by evaluating historic and up to date value actions, exhibits a rise. When the AO’s studying is constructive, it alerts rising momentum, whereas a decline signifies bearish motion.

Presently, the rising AO means that Bitcoin’s bullish momentum stays sturdy.

Learn extra: The place to Commerce Bitcoin Futures: A Complete Information

Bitcoin Day by day Value Evaluation. Supply: TradingView

If this momentum holds, Bitcoin’s value might rally by 14.25%, doubtlessly reaching $78,000. Nonetheless, if promoting stress arises within the quick time period, the coin’s worth could retreat to $62,555.