Main coin Bitcoin has had a turbulent previous few weeks, with its worth troubles prompting many short-term buyers—also known as “paper arms”—to exit the market.

Nevertheless, amidst the value volatility, the coin’s long-term holders (LTHs) stay resolute and present no indicators of backing down as they try to push BTC again above $85,000. How quickly can they notice this?

Bitcoin Lengthy-Time period Holders Shift From Promoting to Stacking

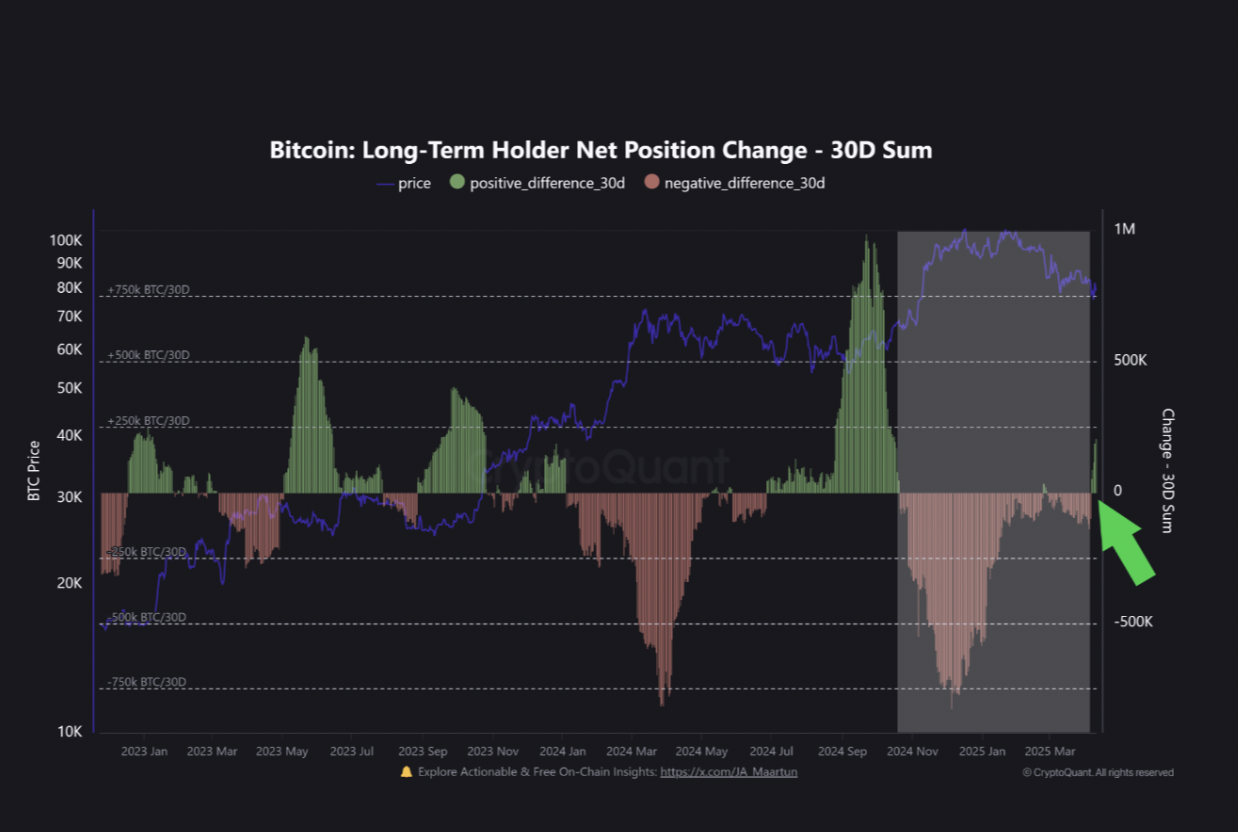

In a latest report, CryptoQuant analyst Burak Kesmeci assessed BTC’s Lengthy-Time period Holder Internet Place Change (30d sum) and located that since April 6, the metric has turned constructive, exhibiting clear upward momentum. Consequently, Kesmeci wrote, BTC has risen by roughly 12%.

Bitcoin Lengthy-Time period Holder Internet Place Change. Supply: CryptoQuant

BTC’s Lengthy-Time period Holder Internet Place Change tracks the shopping for and promoting conduct of LTHs (those that have held their property for at the very least 155 days) to measure the shift within the variety of cash held by these buyers over a particular interval.

When its worth is constructive, it signifies that LTHs are usually not promoting, and stay optimistic about BTC’s future worth efficiency. Conversely, when it turns unfavorable, it means that these holders are promoting or distributing their cash, typically in response to market pressures, which is a bearish sign.

In response to Kesmeci, BTC’s Lengthy-Time period Holder Internet Place Change (30d sum) flipping constructive is notable. This metric had remained beneath zero since October final week, signaling that LTHs had been constantly promoting their BTCs.

The sellofs reached their lowest level on December 5, prompting a 32% dip in BTC’s worth and marking the height of a 6-month interval of distribution by LTHs.

Nevertheless, this pattern has modified since April 6. The metric now sits above zero and is in an uptrend. Talking on what this implies, Kemesci added:

“Whereas it’s too early to say definitively, the rising constructive momentum on this metric could possibly be an indication that long-term conviction is returning to the market.”

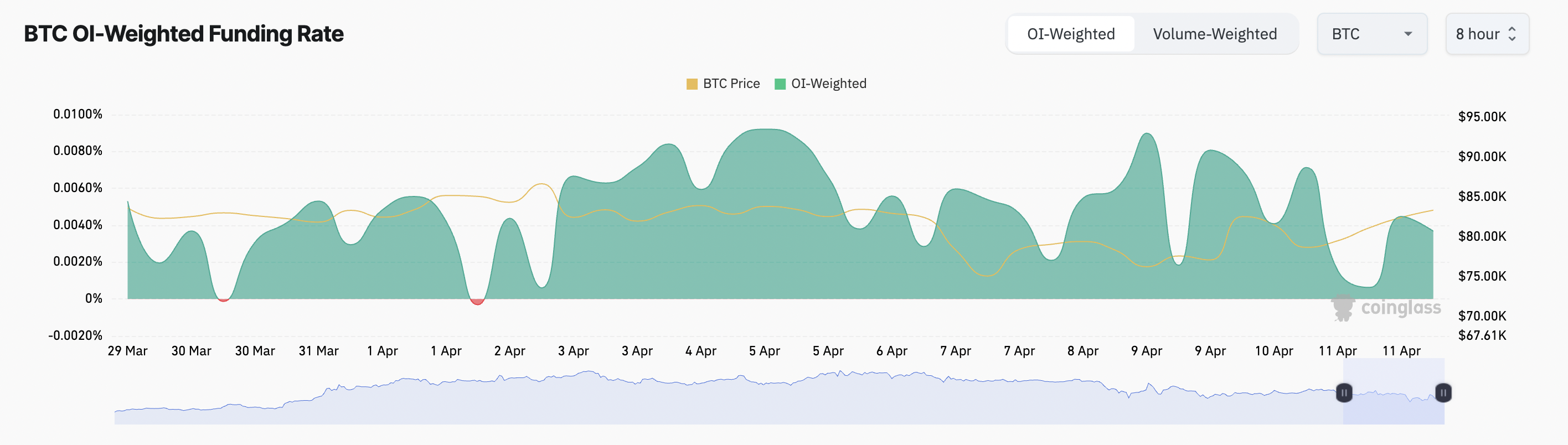

Furthermore, BTC’s funding charge has remained constructive amid its worth troubles, confirming the bullish outlook above. At press time, that is at 0.0037%.

BTC Funding Fee. Supply: Coinglass

The funding charge is the periodic cost exchanged between lengthy and brief merchants in perpetual futures markets. It’s designed to maintain the futures worth near the underlying asset’s spot worth.

When it’s constructive like this, lengthy merchants are paying brief merchants. This means a bullish market sentiment, as extra merchants are betting on BTC’s worth to climb.

Lengthy-Time period Holders Set the Stage for $87,000 Run

The surge in accumulation from BTC LTHs has pushed the coin’s worth above the important thing resistance at $81,863. At press time, the king coin trades at $83,665.

Because the market responds to those sustained shopping for pressures from LTHs, the coin’s worth could also be primed for a big rally within the close to future.

If retail merchants observe go well with and improve their coin demand, BTC may break above $85,000 to $87,730.

BTC Value Evaluation. Supply: TradingView

Nevertheless, if the buildup pattern ends and these LTHs start to promote for beneficial properties, BTC may resume its decline, fall beneath $81,863, and drop towards $74,389.