Bitcoin (BTC USD) has typically traded in tandem with the US inventory market indices, the Nasdaq Composite and S&P 500.

Nevertheless, onchain information analytics supplier CryptoQuant has revealed a destructive correlation between Bitcoin and Nasdaq.

The worth of Bitcoin has elevated by over 10% over the previous week, whereas the Nasdaq plummeted drastically, throughout the similar interval.

Perception on the Chart Decoupling

CryptoQuant shared a screenshot of the BTC and S&P 500 Index correlation in an X put up.

The chart exhibits that the historic correlation between BTC USD and the inventory market has damaged. The inventory market and BTC at the moment are transferring in fairly the other way.

CryptoQuant analyst oinonen_t famous that the Bitcoin correlation with Nasdaq, which stood at 0.91 in January, has diminished to 0.83.

Picture Supply: CryptoQuant on X

Likewise, the correlation with the S&P 500 has dropped to 0.77 from 0.88 in late 2024.

Bitcoin’s worth has remained comparatively steady since US President Donald Trump declared a pause on international tariffs.

The flagship coin is up 10.3% up to now week. The weekly spike comes as Bitcoin continued recouping its losses from ‘Liberation Day,’ rising 3.3% to $90,750.

In the meantime, conventional belongings shuddered. The Nasdaq and S&P 500 indexes have declined by 4.6% and 5.2%, respectively, up to now month.

Bitcoin’s decoupling from conventional “risk-on” belongings marks the start of a major shift.

It signifies Bitcoin’s distinctive worth proposition as a scarce, decentralized, and globally accessible asset is more and more resonating with buyers.

As extra buyers undertake Bitcoin amid ongoing geopolitical tensions, BTC’s worth is predicted to hit a brand new all-time excessive.

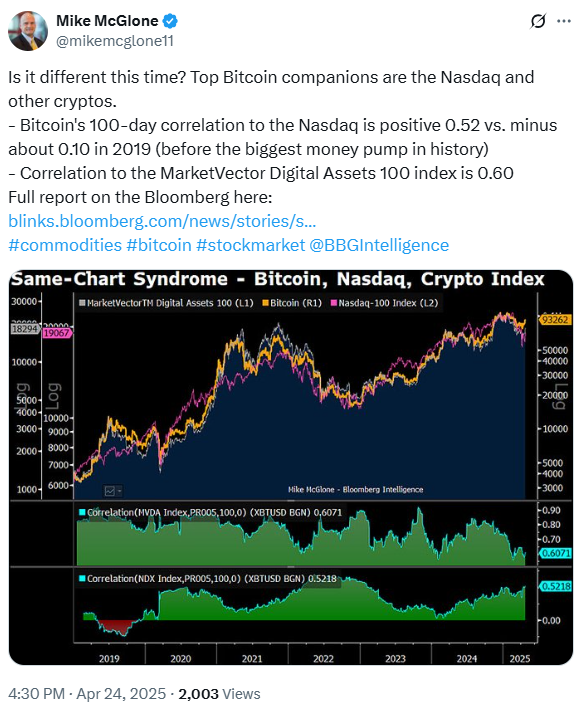

BTC USD Correlation to Nasdaq Turns Optimistic

Mike McGlone, a Senior Group Strategist at Bloomberg Intelligence, has drawn consideration to Bitcoin’s 100-day correlation to the Nasdaq. He famous that the correlation has turned favorable to 0.52.

Picture Supply: Mike McGlone on X

This worth marks an enormous transfer from the destructive worth recorded in 2019 (earlier than the most important cash pump in historical past).

Throughout this era, the correlation fell to -0.10. You will need to notice that the 100-day correlations typically flip destructive throughout or following substantial Bitcoin drawdowns.

Merely put, a “optimistic” correlation signifies that Bitcoin and Nasdaq are transferring in the identical path.

Alternatively, a destructive correlation exhibits the belongings are transferring in the other way.

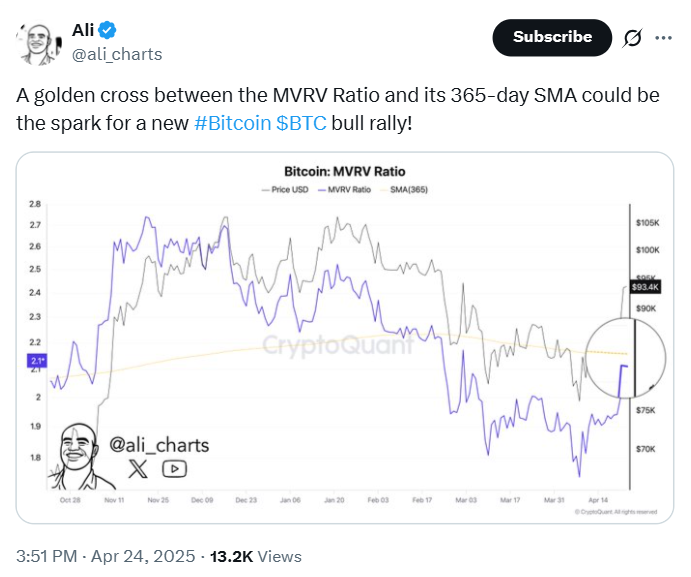

Market Analyst Highlight Bullish Sign

BTC USD worth was buying and selling at $93,529 at press time, up 0.13% over the previous 24 hours. Whereas Bitcoin has moved previous key essential ranges, market analysts declare extra rallies lie forward.

Standard onchain analyst Ali Martinez has spotlighted a key bullish sign for the main cryptocurrency.

Picture Supply: Ali Charts on X

The analyst famous {that a} golden cross sample has fashioned between the MVRV Ratio and its 365-day SMA. Ali claims this sample may point out the continuation of an ongoing Bitcoin bull run.

Notably, a golden cross occurs when a short-term transferring common crosses above a long-term transferring common, signaling potential sustained upward momentum.

Market analysts level to the $92,000 degree as important assist on the BTC Chart.

With Bitcoin at the moment holding above this key assist, the golden cross of the MVRV and 365-day SMA may reinforce bullish sentiment.

Bitcoin may simply cross the $100,000 psychological degree within the subsequent few days.