The U.S. central financial institution lower its goal for the federal funds fee by 25 foundation factors on Wednesday for the primary time this 12 months.

BTC Hits $117K Following Fed Curiosity Fee Resolution

Many have been left puzzled when bitcoin ( BTC) dipped to $115K nearly instantly after the U.S. Federal Reserve lastly lower rates of interest by 25 foundation factors on Wednesday. However by Thursday morning, the cryptocurrency had climbed all the way in which again to $117K, very similar to shares which additionally appeared to have a delayed response and at the moment are on tempo for an additional report shut.

Maybe there was an expectation of a 50-basis-point lower, though the CME Group’s Fedwatch Software confirmed an unlikely 4% likelihood of such an final result. It might even have been the market taking its time to digest the Fed’s extra detailed evaluation of the U.S. economic system in its Abstract of Financial Projections (SEP).

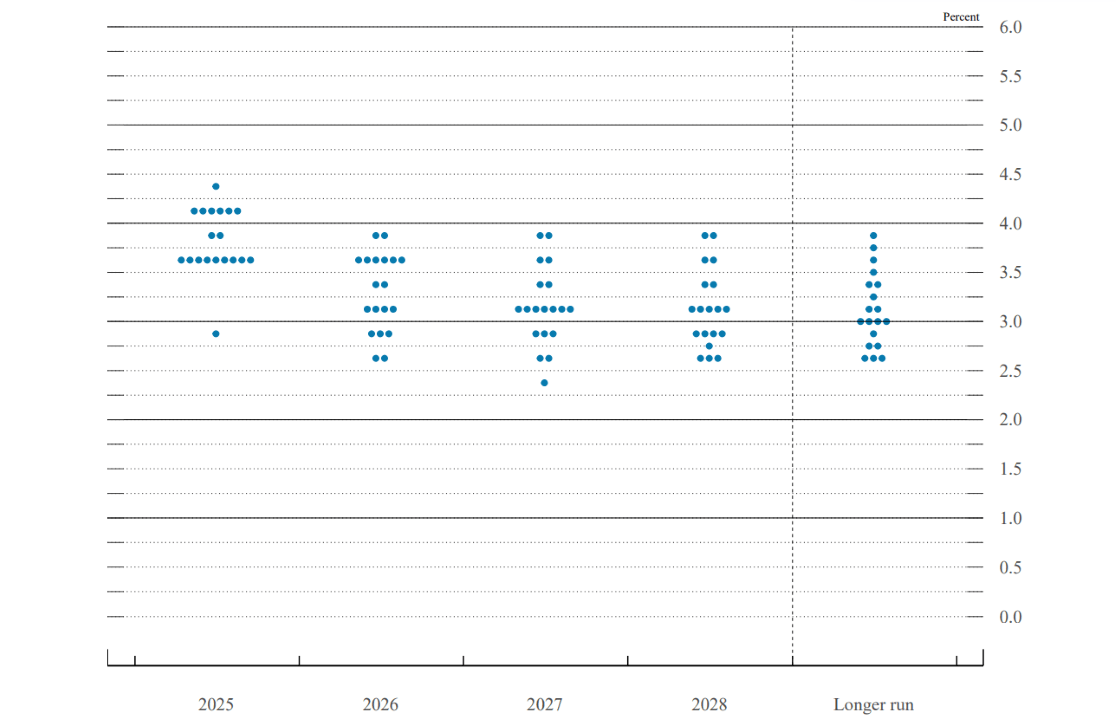

(The so-called “dot plot” reveals a set of nameless dots every representing fee projections by a member of the Federal Open Market Committee (FOMC) and every of the 12 presidents of the Federal Reserve Banks. / federalreserve.gov)

The so-called “dot plot,” a quarterly chart within the SEP with anonymized blue circles that symbolize particular person rate of interest projections by every member of the Federal Open Market Committee (FOMC) and all Federal Reserve Financial institution presidents, was additionally printed yesterday and strongly suggests curiosity cuts all the way in which into 2027, at which level charges might backside out at 3.1%. Possibly bitcoin buyers took their time to mull over the dot plot’s dovish outlook earlier than waking up barely extra bullish at the moment.

Overview of Market Metrics

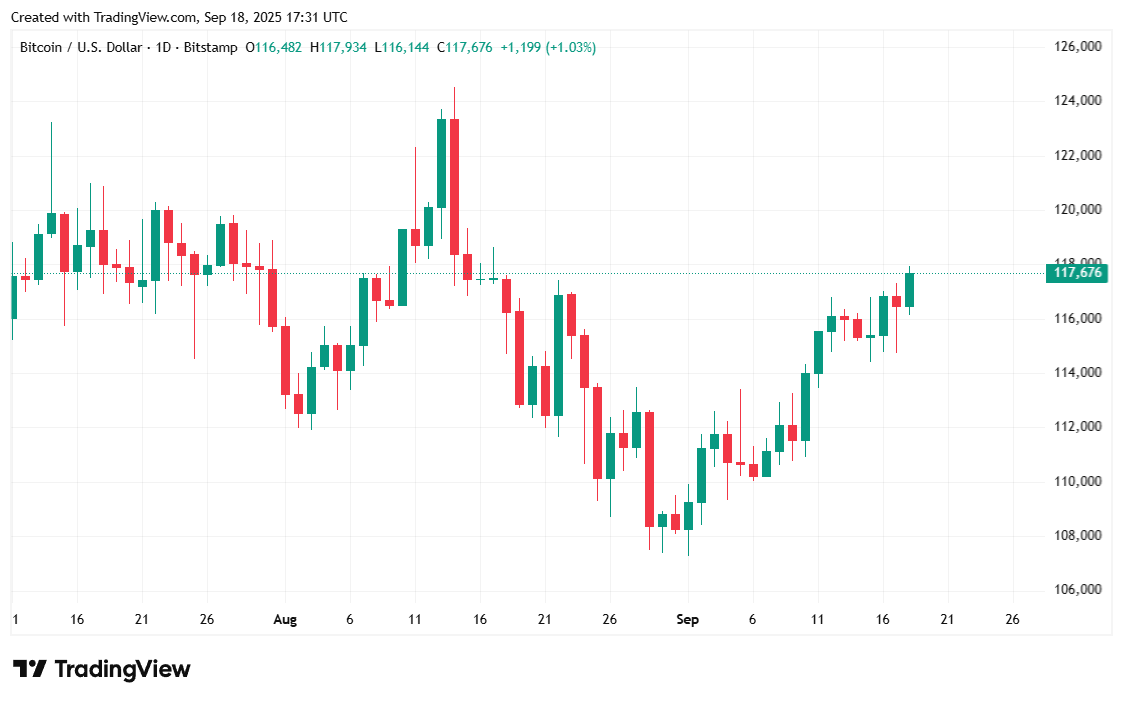

Bitcoin was buying and selling at $117,740.20 on the time of writing, up 1.77% over 24 hours and a pair of.9% over seven days. Coinmarketcap information reveals that the digital asset’s worth has fluctuated between $114,794.97 and $117,860.80 since yesterday.

( BTC worth / Buying and selling View)

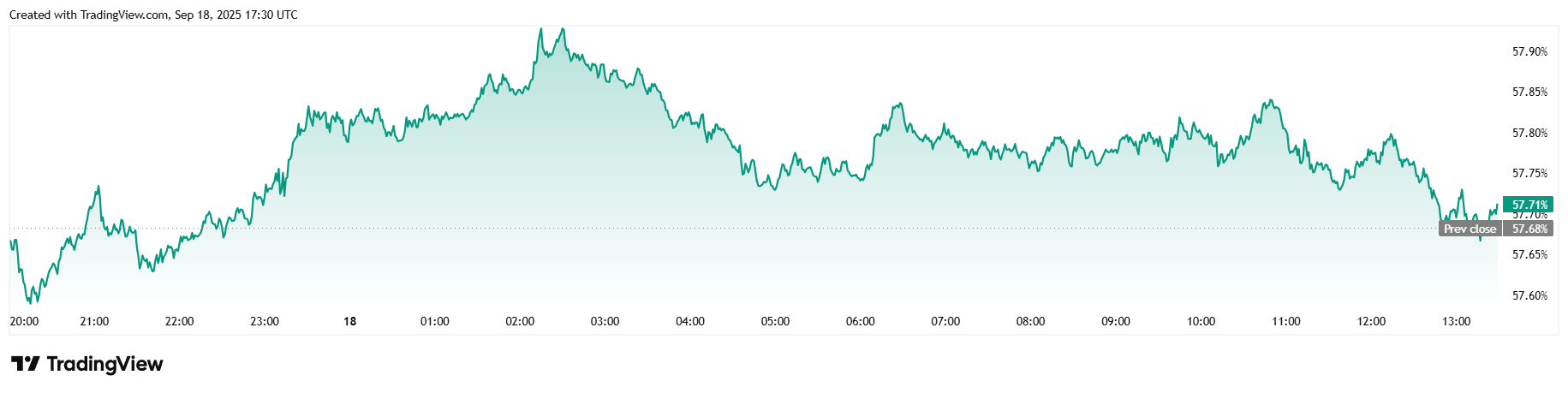

Twenty-four-hour buying and selling quantity climbed 32.73% to succeed in $64.81 billion on the time of reporting. Market capitalization grew 1.64% to $2.34 trillion and bitcoin dominance was principally flat however edged up 0.02% over 24 hours and was sitting at 57.71%.

( BTC worth / Buying and selling View)

Whole bitcoin futures open curiosity jumped 5.01% since yesterday and stood at $87.29 billion in line with information from Coinglass. Bitcoin liquidations for the previous 24 hours additionally surged to $105.42 million, principally resulting from unsuspecting brief sellers who have been caught off guard and liquidated to the tune of $79.82 million. The remaining lengthy liquidations have been a considerably smaller however not trivial $25.60 million.