Whereas Bitcoin is commonly thought of a hedge in opposition to inflation, it does have a optimistic inflation charge of 0.83%. Bitcoin’s inflation is extraordinarily low in comparison with the greenback’s peak of 9.1% in 2022. Nevertheless, after we examine the cumulative inflation charge for each Bitcoin and the US greenback, we see the true energy of Bitcoin’s position in preserving wealth.

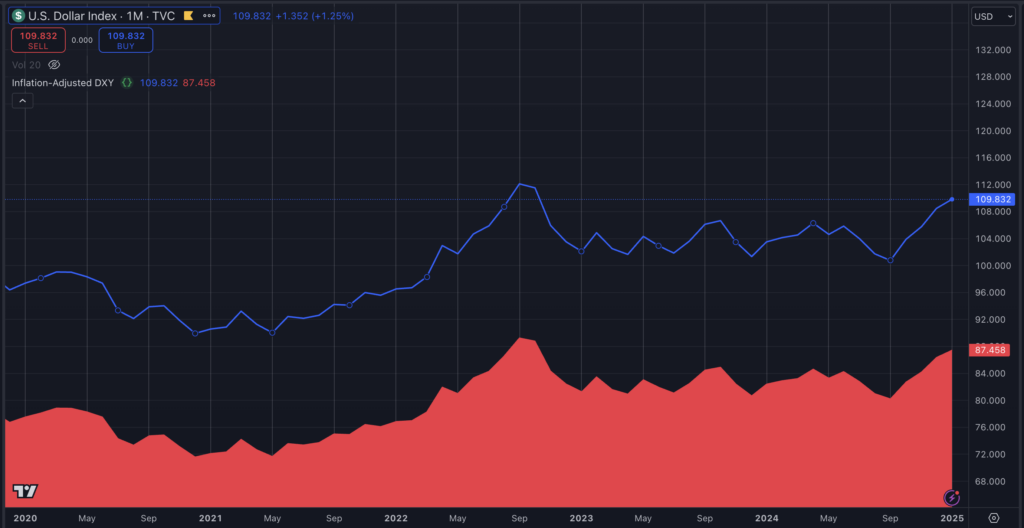

From 2020 to 2025, Bitcoin rose roughly 960%, whereas the US Greenback Index (DXY), which measures the US greenback in opposition to a basket of different currencies, rose simply 12% in nominal phrases.

Bitcoin’s inflation-adjusted value and the DXY, normalized for inflation, present important insights into the true worth dynamics of each property. Whereas the nominal DXY displays relative foreign money energy, its inflation-adjusted worth highlights the continued erosion of buying energy.

The nominal DXY presently stands at 109.8, reflecting international demand for the greenback amid macroeconomic uncertainty. Nevertheless, when adjusted for cumulative US inflation since 2020—averaging over 2% yearly and peaking above 8% in 2022—the true worth of the DXY drops to 87.5. This represents a 22.3-point distinction, or roughly 20.3% of the nominal worth, illustrating the greenback’s substantial lack of buying energy over time regardless of its relative energy in opposition to different currencies.

Bitcoin’s nominal value, in the meantime, is round $91,000. Adjusted for its low provide inflation—1.74% yearly from 2020–2024 and 0.83% in 2025—its inflation-adjusted value stands at roughly $84,365. The $6,635 distinction represents solely 7.3% of its nominal worth, stressing Bitcoin’s relative stability and skill to protect buying energy over time in comparison with fiat currencies. This smaller adjustment highlights Bitcoin’s programmed shortage and low inflation as key elements in its resilience.

The divergence between the inflation-adjusted metrics for the DXY and Bitcoin emphasizes a broader narrative. Whereas fiat currencies just like the greenback face important devaluation as a result of inflation, Bitcoin’s managed provide forces place it as a hedge in opposition to foreign money debasement. The extra pronounced inflationary influence on the DXY emphasizes the problem of sustaining buying energy in a fiat system, significantly in periods of excessive inflation.

The distinction between nominal and inflation-adjusted metrics is significant for evaluating the long-term worth of property. The DXY’s nominal energy masks the elemental erosion of the greenback’s buying energy, whereas Bitcoin’s inflation-adjusted value displays its capacity to keep up worth over time. These insights reinforce the significance of inflation-adjusted analyses in creating efficient methods for navigating the macroeconomic panorama.

Additional, the inflation of comparability currencies used to ascertain the DXY must also be thought of to determine the exact divergence. Nevertheless, the above figures give a ballpark evaluation of Bitcoin’s elevated energy in opposition to the greenback past nominal phrases.

Merely put, should you invested $100 in Bitcoin in 2020 and $100 in DXY in the present day, your BTC would have a shopping for energy of $927, whereas your DXY can be equal to $91 in actual phrases.