On-chain analytics agency Glassnode has defined how Bitcoin dropping $108,500 might result in a deeper correction, if the previous sample is to go by.

Bitcoin Is At Danger Of Shedding The 0.85 Quantile Stage

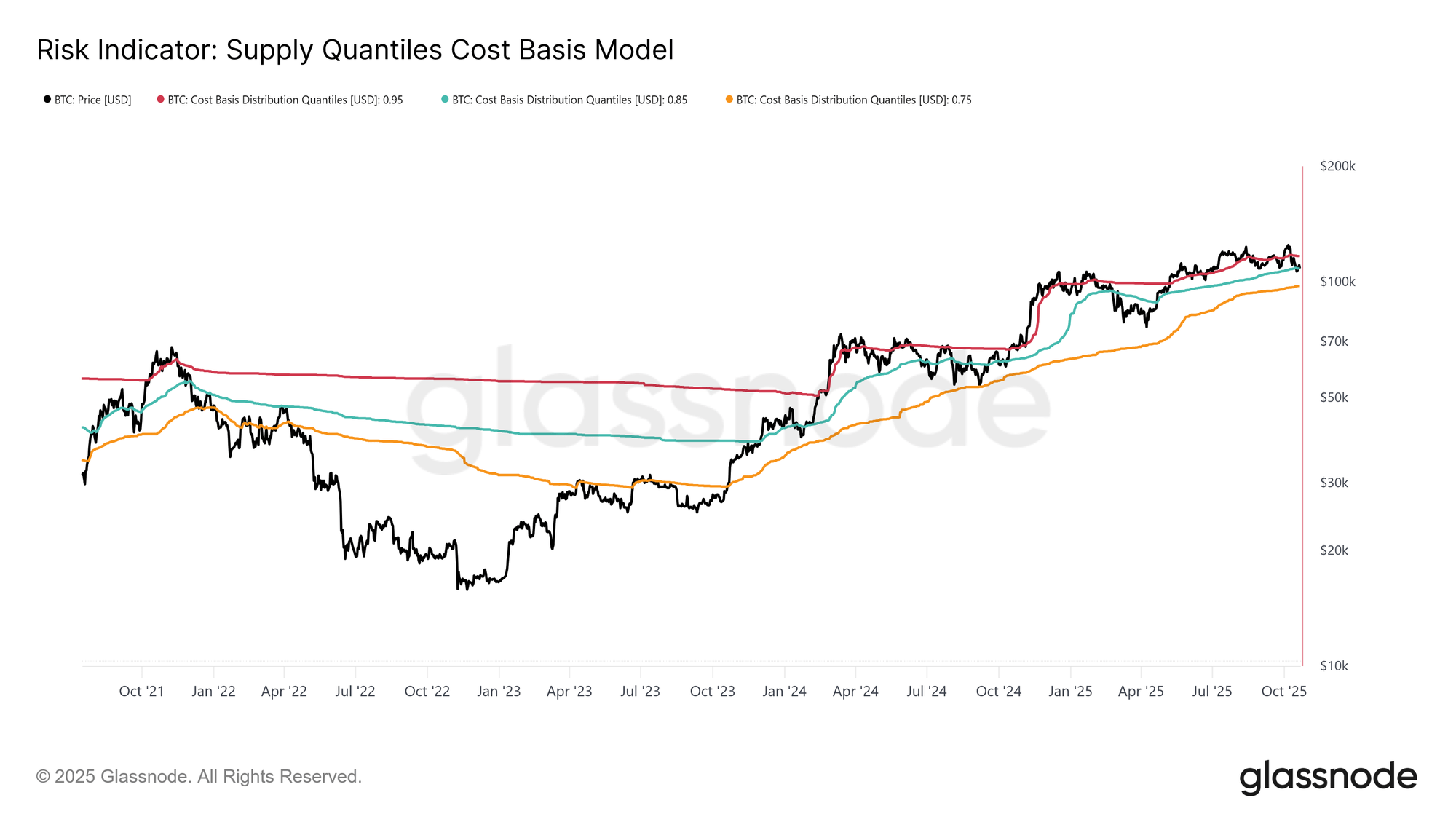

In its newest weekly report, analytics agency Glassnode has talked about how Bitcoin is presently wanting from the attitude of the Provide Quantiles Price Foundation mannequin. This mannequin maps worth ranges in line with the quantity of BTC provide that might be misplaced if the cryptocurrency have been to commerce at its present worth right this moment. There are three provide “quantiles” concerned within the indicator: 0.95, 0.85, and 0.75, similar to ranges the place 5%, 15%, and 25% of the provision can be held at a loss, respectively.

Beneath is the chart shared by Glassnode that reveals the pattern within the totally different Bitcoin provide quantiles over the previous few years.

As is seen within the graph, Bitcoin surged above the 0.95 quantile throughout its worth rally earlier within the month, as the provision in revenue approached the 100% mark throughout the brand new all-time excessive (ATH). With the current bearish motion, nevertheless, the cryptocurrency has fallen beneath the road and is now buying and selling across the 0.85 quantile located at $108,600. Thus, it will seem that about 15% of the BTC provide is within the purple in the intervening time.

Bitcoin has already confronted dips beneath this mark, so it’s attainable that the coin could also be prone to dropping the road. “Traditionally, failure to carry this threshold has signalled structural market weak point and infrequently preceded deeper corrections towards the 0.75 quantile,” defined the analytics agency.

BTC final noticed such a decline to the 0.75 quantile through the consolidation interval in mid-2024. At present, this degree is equal to $97,500. It now stays to be seen whether or not the asset can preserve above the 0.85 quantile, and if not, whether or not a retest of the 0.75 quantile will happen.

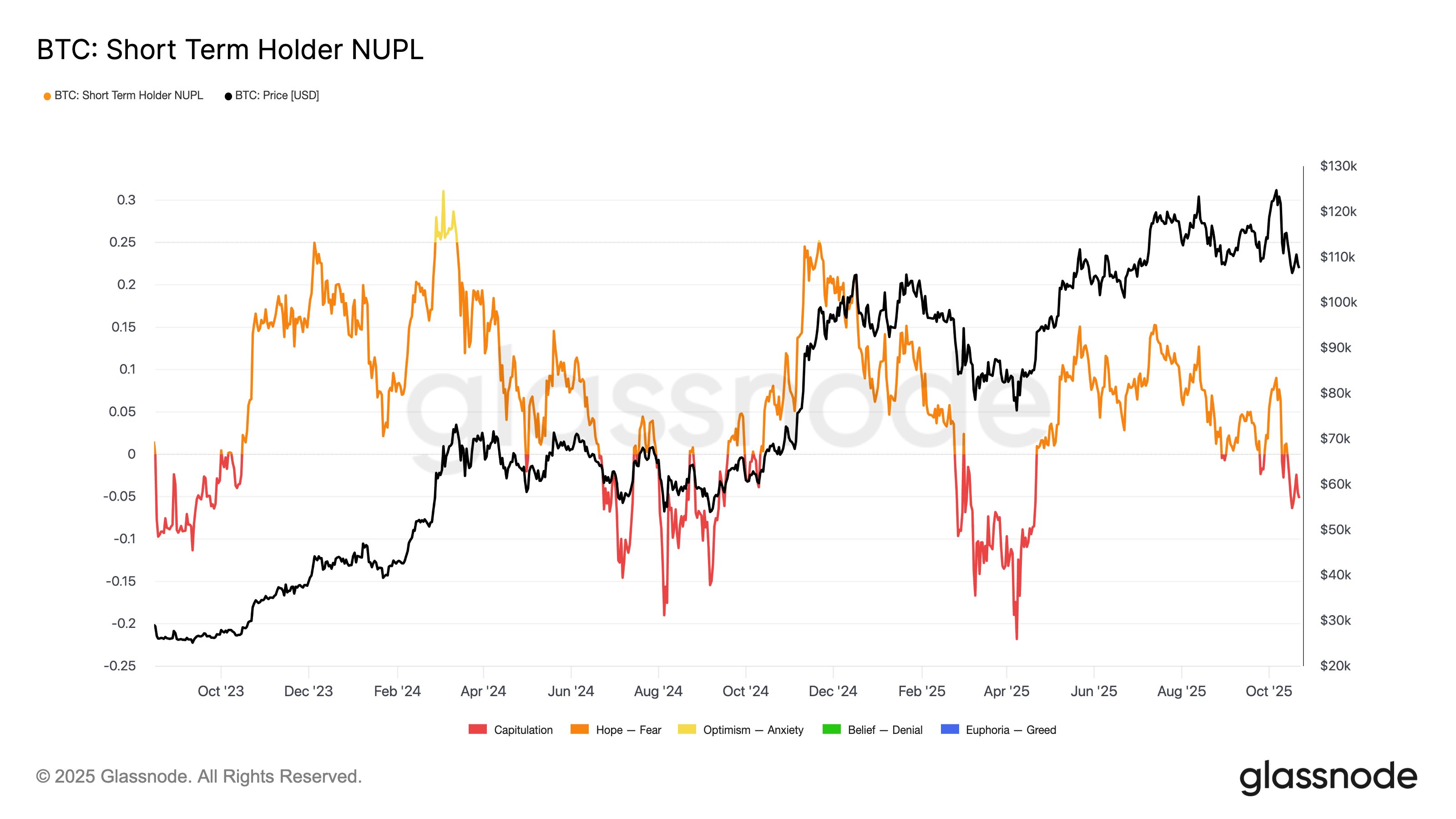

The 0.95 quantile isn’t the one degree that Bitcoin has misplaced through the current drawdown; its worth has additionally dropped beneath the typical value foundation of the short-term holders (STHs) situated at $113,100. STHs right here seek advice from the BTC traders who bought their cash inside the previous 155 days.

This group is taken into account to symbolize the delicate facet of the market, inclined to creating panic strikes throughout occasions of volatility. With BTC dropping beneath the price foundation of the cohort, its members are actually underwater. “Traditionally, this construction typically precedes the onset of a mid-term bearish section, as weaker fingers start to capitulate,” famous Glassnode.

In an X submit, the analytics agency has shared a chart that places into perspective the online unrealized loss held by the Bitcoin STHs proper now.

BTC Value

Bitcoin hasn’t been capable of maintain a restoration just lately as its worth continues to be buying and selling round $109,100.

Featured picture from Dall-E, Glassnode.com, chart from TradingView.com