BTC retreated to $95K, largely because of the Bybit hack and Fed charge jitters, each of which shook market confidence.

Crypto Market Reels as Bitcoin Drops to $95K Following Bybit Hack and Fed Hypothesis

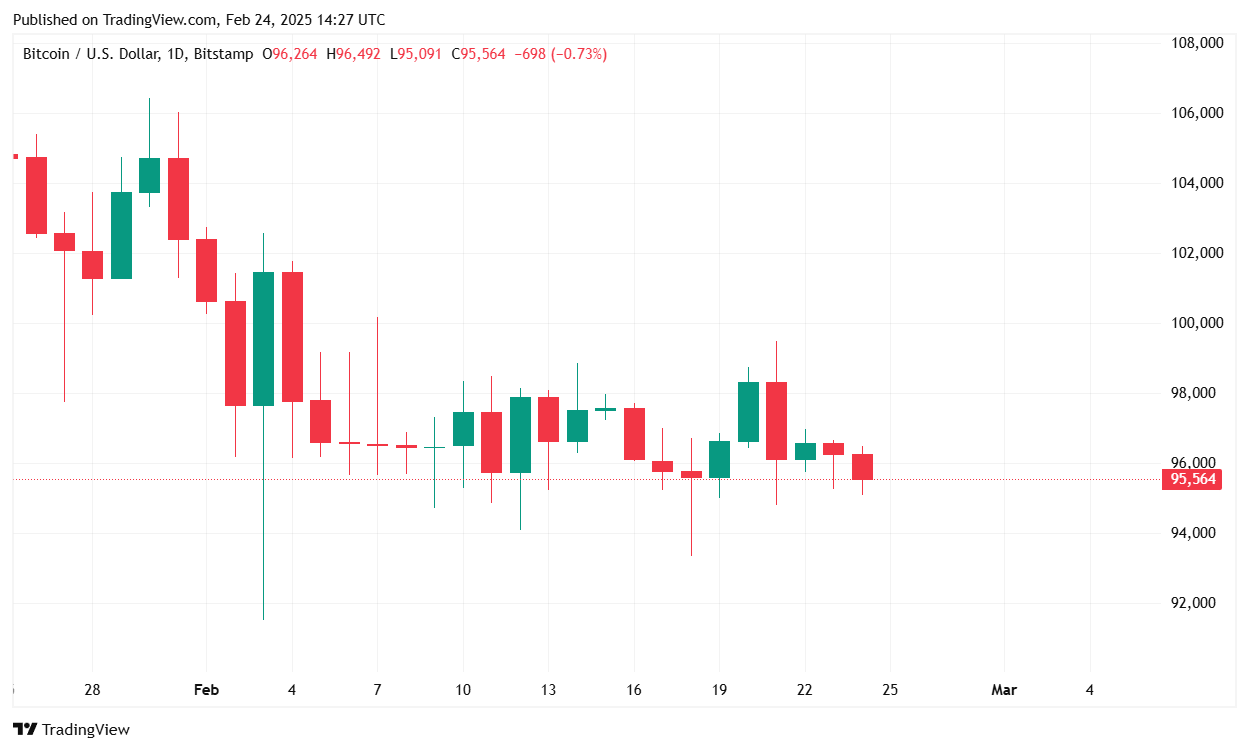

Bitcoin (BTC) is navigating a turbulent market panorama, with value fluctuations pushed by a historic trade hack and ongoing uncertainty surrounding U.S. Federal Reserve insurance policies. On the time of reporting, BTC is buying and selling at $95,505.39, reflecting a 0.49% decline over the previous 24 hours and a 1.26% drop over the previous week, based on information from Coin Market Cap.

(BTC value / Tradingview)

Market Efficiency and Key Metrics

24-Hour Value Vary: Bitcoin’s value has oscillated between $95,120.85 and $96,503.45, indicating a point of volatility.

Buying and selling Quantity: BTC’s 24-hour buying and selling quantity surged 69.77% to $25.72 billion. Whereas this marks a major improve, such spikes are anticipated following weekends when buying and selling exercise usually slows.

Market Capitalization: Bitcoin’s whole market cap at the moment sits at $1.89 trillion, down 0.58% from yesterday.

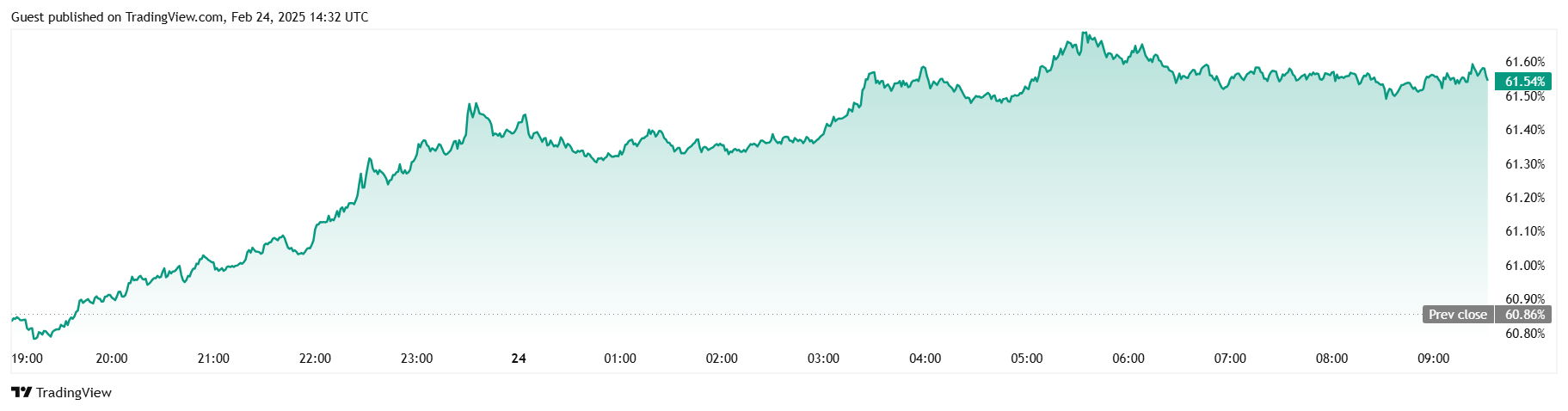

BTC Dominance: Bitcoin dominance has elevated to 61.5%, up by 1.12% during the last 24 hours. This rise is partly attributed to BTC gaining floor on ETH and SOL following the fallout from the Libra debacle and the Bybit hack.

(BTC dominance / Buying and selling View)

Futures Market: BTC futures open curiosity has climbed 2.24% to $59.61 billion, signaling elevated hypothesis and leveraged positioning.

Liquidation Knowledge: Whole BTC liquidations stay comparatively low at $2.71 million. Lengthy positions confronted the brunt of the liquidations, totaling $2.68 million, whereas quick liquidations had been minimal at $27,280.

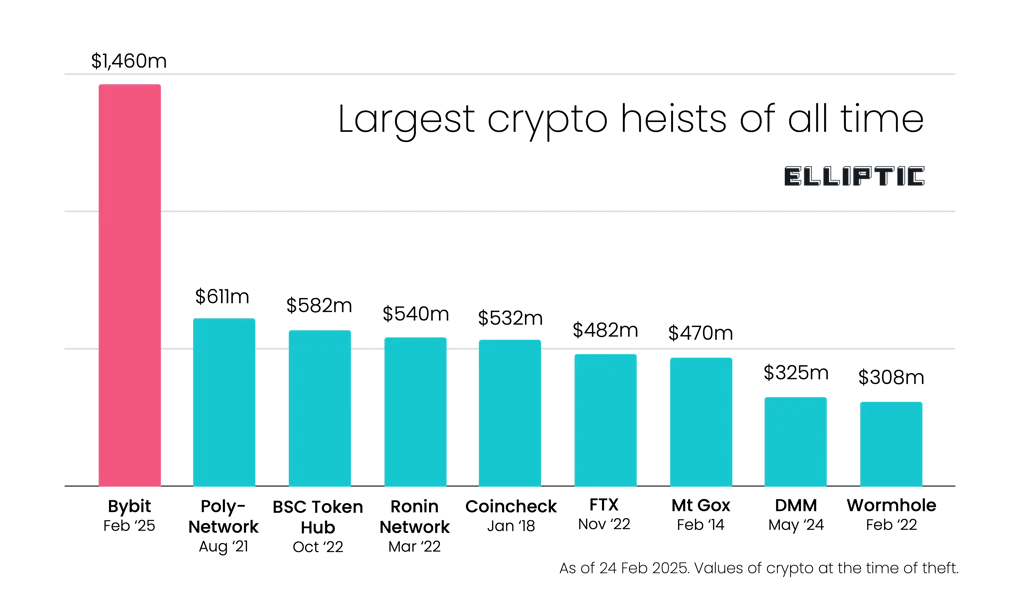

Bybit Hack and Its Market Influence

On Friday, Dubai-based crypto trade Bybit, suffered a staggering $1.46 billion hack, marking the biggest crypto heist in historical past. Analysts have attributed the assault to North Korea’s notorious Lazarus Group, which has stolen over $6 billion in digital belongings since 2017, reportedly funneling the proceeds into the nation’s ballistic missile program.

(Bybit hack in comparison with earlier hacks / elliptic.co)

The stolen belongings, largely ether (ETH), are being transformed into bitcoin, possible utilizing unregulated companies reminiscent of eXch, with additional obfuscation by way of mixers anticipated. This conversion development has possible contributed to bitcoin’s growing dominance as buyers shift belongings away from ETH, which was extra instantly impacted by the hack.

Fed Charge Uncertainty Provides to Market Volatility

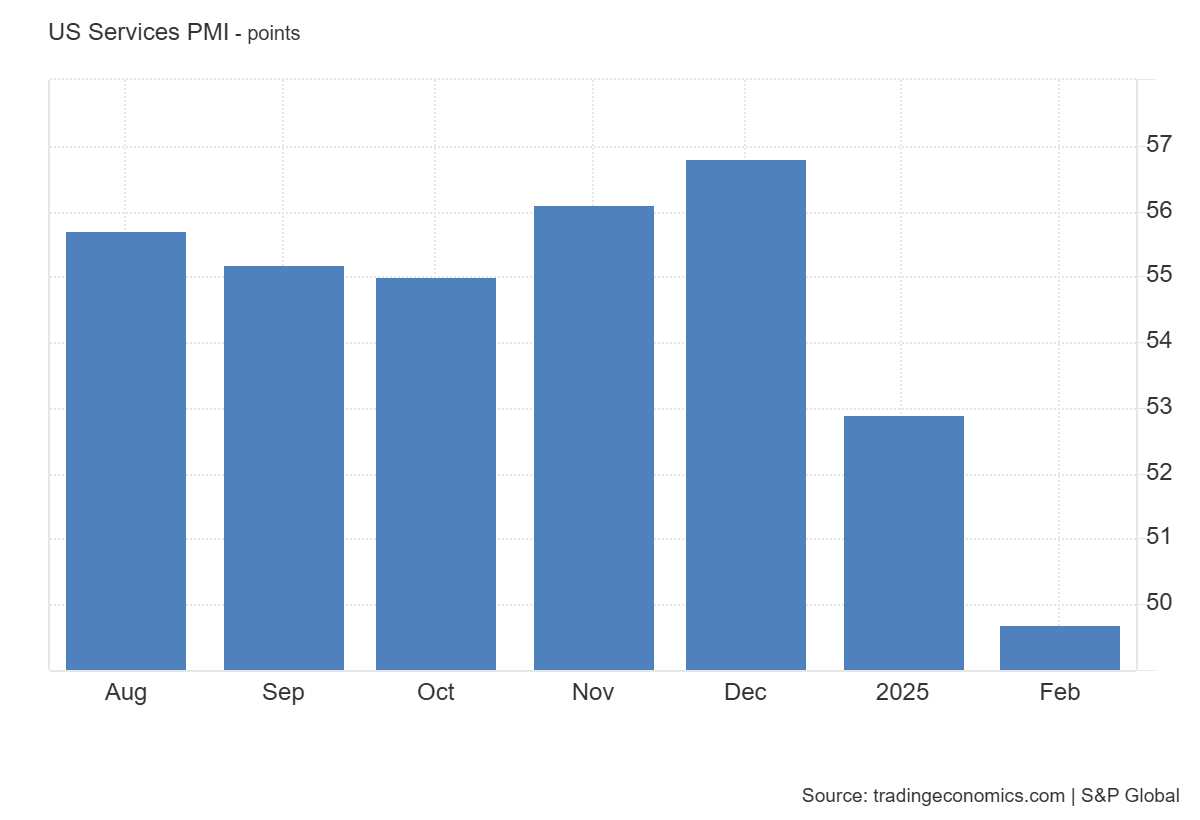

Current information exhibits a slowdown in U.S. enterprise exercise, with the S&P International US Companies PMI dropping to 49.7 in February of 2025 from 52.9 in January. The dip was counter to expectations that it will rise by 53 and is a sign of financial contraction.

(U.S. Companies PMI dipped in February / tradingeconomics.com)

In the meantime, the Fed stays cautious, emphasizing the necessity to mitigate inflationary pressures. Elements reminiscent of persistent inflation, authorities cuts, and tariffs are complicating financial situations, growing volatility in conventional and crypto markets alike.

Market Outlook

With bitcoin dominance rising and futures open curiosity growing, merchants seem like positioning for potential short-term beneficial properties. Nonetheless, the Bybit hack’s ongoing ramifications and macroeconomic uncertainties might preserve BTC below strain within the close to time period.

If BTC holds above the $95,000 help degree, a rebound towards $97,000 is feasible. On the draw back, failure to keep up this threshold might result in additional declines, with $93,500 rising as a key help degree. General, market sentiment stays cautious, with merchants balancing bullish long-term prospects in opposition to short-term headwinds.