Bitcoin’s (BTC) market dominance has surged to 64%, reaching its highest degree in over 4 years.

Nevertheless, specialists stay divided on what this implies for the longer term. Some predict an impending altcoin season, and others warning that Bitcoin’s dominance might proceed to suppress altcoins.

What Does Bitcoin’s Rising Dominance Imply?

For context, Bitcoin dominance (BTC.D) refers back to the proportion of the entire cryptocurrency market capitalization that BTC holds. It’s a key indicator of Bitcoin’s market energy relative to different cryptocurrencies. A rising dominance means that Bitcoin is outperforming altcoins, whereas a lower might sign rising curiosity or funding in different digital property.

The metric has been steadily growing since late 2022. As of the most recent information, it surged to 64%, marking highs final seen in early 2021.

Bitcoin Dominance Efficiency. Supply: TradingView

Notably, Benjamin Cowen, founding father of Into The Cryptoverse, highlighted that the quantity is far increased when excluding stablecoins.

“Excluding secure cash, Bitcoin dominance is now at 69%,” Cowen revealed.

The rise in Bitcoin dominance has sparked debate amongst analysts about its implications for altcoins. Cowen believes there can be a correction or downward motion in altcoins earlier than any substantial good points might be anticipated out there. This means that the altcoin season might not be imminent but.

“I feel ALT/ BTC pairs must go down earlier than they’ll go up,” he said.

Nordin, founding father of Nour Group, additionally expressed warning. He confused that Bitcoin dominance is nearing the degrees seen in the course of the peak of the 2020 bear market.

“This isn’t only a BTC transfer. Its capital rotating out of alts,” he famous.

Furthermore, Nordin warned {that a} break above 66% might intensify promoting stress on altcoins. This, in flip, might delay the altcoin season.

“Bitcoin dominance again to 64%. No Alt seasons in 2024 or 2025,” analyst, Alessandro Ottaviani, predicted.

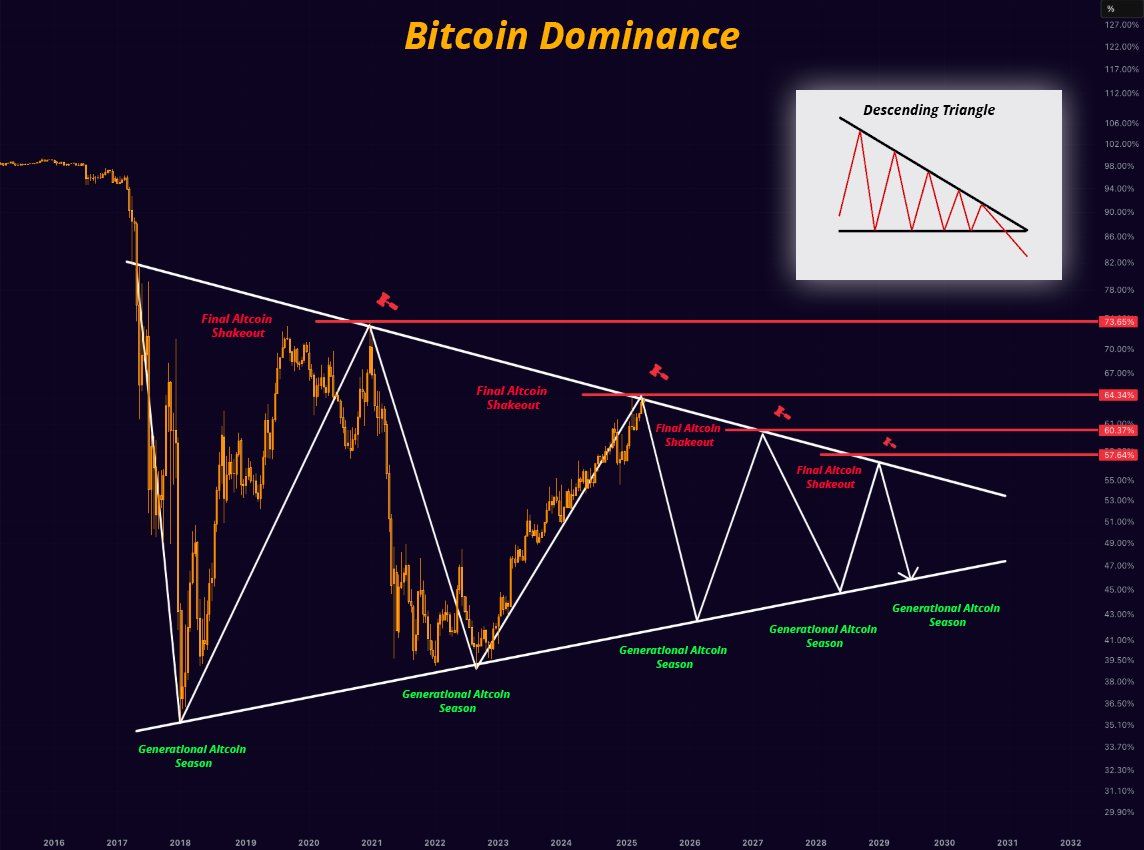

Then again, analyst Mister Crypto predicts that Bitcoin’s dominance might observe a long-term descending triangle sample. A descending triangle usually suggests bearish momentum, the place the worth or dominance steadily decreases as decrease highs are fashioned.

Nevertheless, this might extend its market management earlier than a broader correction permits altcoins to realize traction.

Bitcoin Dominance Prediction. Supply: X/Mister Crypto

One other analyst talked about that Bitcoin dominance is at present testing the resistance zone between 64% and 64.3%. Subsequently, a doable retracement could also be on the horizon. Ought to this retracement happen, altcoins might start to realize traction, with some probably rising as high performers out there as capital shifts away from Bitcoin.

“Nevertheless, a breakout from this zone might imply additional declines for alts,” the analyst remarked.

Lastly, Junaid Dar, CEO of Bitwardinvest, supplied a extra optimistic view. Based on Dar’s evaluation, if Bitcoin’s dominance drops beneath 63.45%, it might set off a robust upward motion in altcoins. This, he believes, would create a great alternative to revenue from altcoin positions.

“For now, alts are caught. Only a matter of time,” Dar added.

Tether Dominance Alerts Potential Altcoin Season

In the meantime, many analysts imagine that the developments in Tether dominance (USDT.D) sign a possible altcoin season. From a technical evaluation standpoint, USDT.D has reached a resistance zone and could also be due for a correction, suggesting the opportunity of capital flowing from USDT into altcoins.

“The USDTD is in a rejection zone, so long as it doesn’t shut above 6.75% it is going to be favorable for the market,” a technical analyst wrote.

USDT Dominance Efficiency. Supply: X/TheCryptoLemon

One other analyst additionally confused that the USDT.D and USD Coin dominance (USDC.D) have reached resistance, forecasting an incoming altcoin season. Doğu Tekinoğlu drew related conclusions by observing the mixed chart of BTC.D, USDT.D, and USDC.D.

As Bitcoin’s dominance climbs, buyers are intently monitoring these technical and on-chain alerts. The interaction between Bitcoin’s energy and stablecoin dynamics might dictate whether or not altcoins stage a comeback this summer time or face additional consolidation. For now, Bitcoin’s grip available on the market stays agency.