Bitcoin’s sharp correction from $110,000 to round $80,000 is linked to heavy promoting by early whales with value bases close to $16,000. CryptoQuant CEO Ki Younger Ju notes that on-chain metrics point out Bitcoin is now within the “shoulder” section of its cycle, suggesting restricted short-term upside potential.

This promoting is overwhelming institutional demand from ETFs and MicroStrategy, shaping the cryptocurrency’s 2025 outlook. In an interview with Upbit’s Upbitcare, Ju offers a>Early Bitcoin Whales Gas Promoting Strain

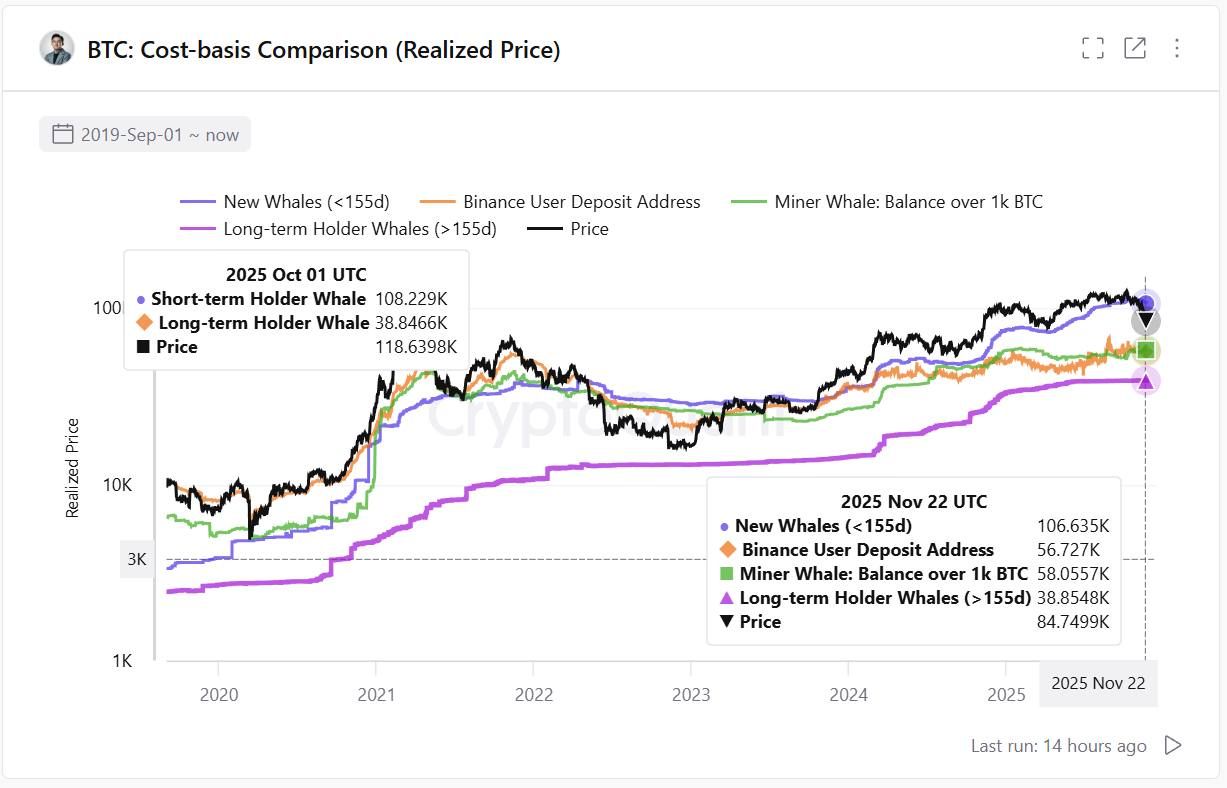

Ki Younger Ju explains that as we speak’s market is formed by a contest between two predominant whale teams. Legacy whales, holding Bitcoin with a mean value foundation close to $16,000, have begun to appreciate hefty income, promoting at a fee measured in a whole lot of hundreds of thousands of USD every day. This persistent promoting has exerted intense downward strain on Bitcoin’s value.

On the similar time, institutional whales by way of spot Bitcoin ETFs and MicroStrategy have collected important positions. But, their shopping for energy has not matched the size of early whales’ sell-offs. In response to Ju, wallets holding over 10,000 BTC for greater than 155 days usually have a mean value foundation of round $38,000. Binance merchants entered positions round $50,000, so many market individuals are in revenue and may promote if wanted.

Price foundation comparability throughout totally different Bitcoin holder classes. Supply: CryptoQuant

The CryptoQuant CEO factors out that spot ETF and MicroStrategy inflows had boosted the market earlier in 2025. Nevertheless, these flows have now declined. Outflows have began to dominate the market panorama. For instance, knowledge from Farside Buyers confirmed Bitcoin ETFs recorded $42.8 million in web inflows on November 26, 2025, lifting cumulative inflows to $62.68 billion. Regardless of these figures, the sustained promoting from early whales outweighs institutional accumulation.

Market Cycle Evaluation Alerts Restricted Upside

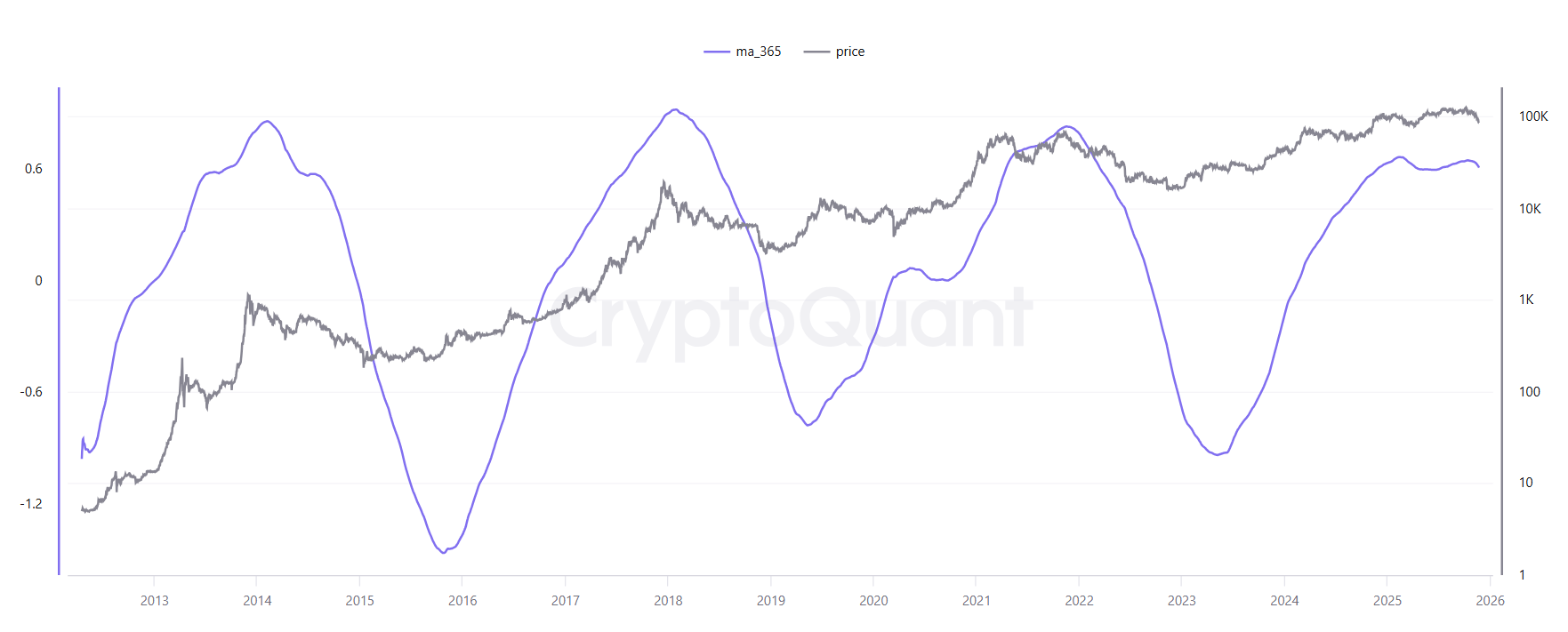

On-chain profit-and-loss metrics provide essential insights into market cycles. Ju’s evaluation utilizing the PnL index with a 365-day shifting common reveals that the market has entered a “shoulder” section. This late-cycle standing signifies constrained progress potential and elevated danger of a correction.

The valuation multiplier displays a neutral-to-flat outlook. In earlier cycles, every new greenback drove amplified market-cap progress. Now, that multiplier impact has pale. This implies market leverage is much less environment friendly, and the construction doesn’t assist important positive factors.

PnL index exhibiting Bitcoin’s present cycle place. Supply: CryptoQuant

Ju doesn’t anticipate a dramatic 70-80% crash. Nonetheless, he considers corrections as much as 30% cheap. A drop from $100,000 may imply Bitcoin falling to about $70,000. He makes use of knowledge from OKX futures long-short ratios, change leverage ratios, and buy-sell circulation patterns to assist this view.

Ju underscores the significance of a goal=”_blank” rel=”noopener”>current submit, he urged merchants to make use of metrics for conviction, not hypothesis. His focus stays on decoding on-chain knowledge, change exercise, and market construction.

By no means commerce with out knowledge. pic.twitter.com/JnAtLwpdGa

— Ki Younger Ju (@ki_young_ju) November 27, 2025

This complete evaluation offers a grounded evaluation based mostly on on-chain proof. As early Bitcoin whales proceed to promote at income, establishments face a harsh local weather. With excessive leverage ratios, impartial valuation multipliers, and a late-cycle stance, the market has restricted potential for a significant rally within the close to future.