Main cryptocurrency Bitcoin (BTC) briefly fell beneath the essential $90,000 mark throughout Monday’s intraday buying and selling session, marking its first dip beneath this help degree in two months.

This worth dip comes amid a broader market decline and sentiment shifts from bullish to bearish. As of this writing, the king coin trades at $92,385, rebounding 4% from the day’s low of $89,028. With waning shopping for strain, the coin may prolong its decline within the quick time period.

Bitcoin Continues to Face Bearish Strain

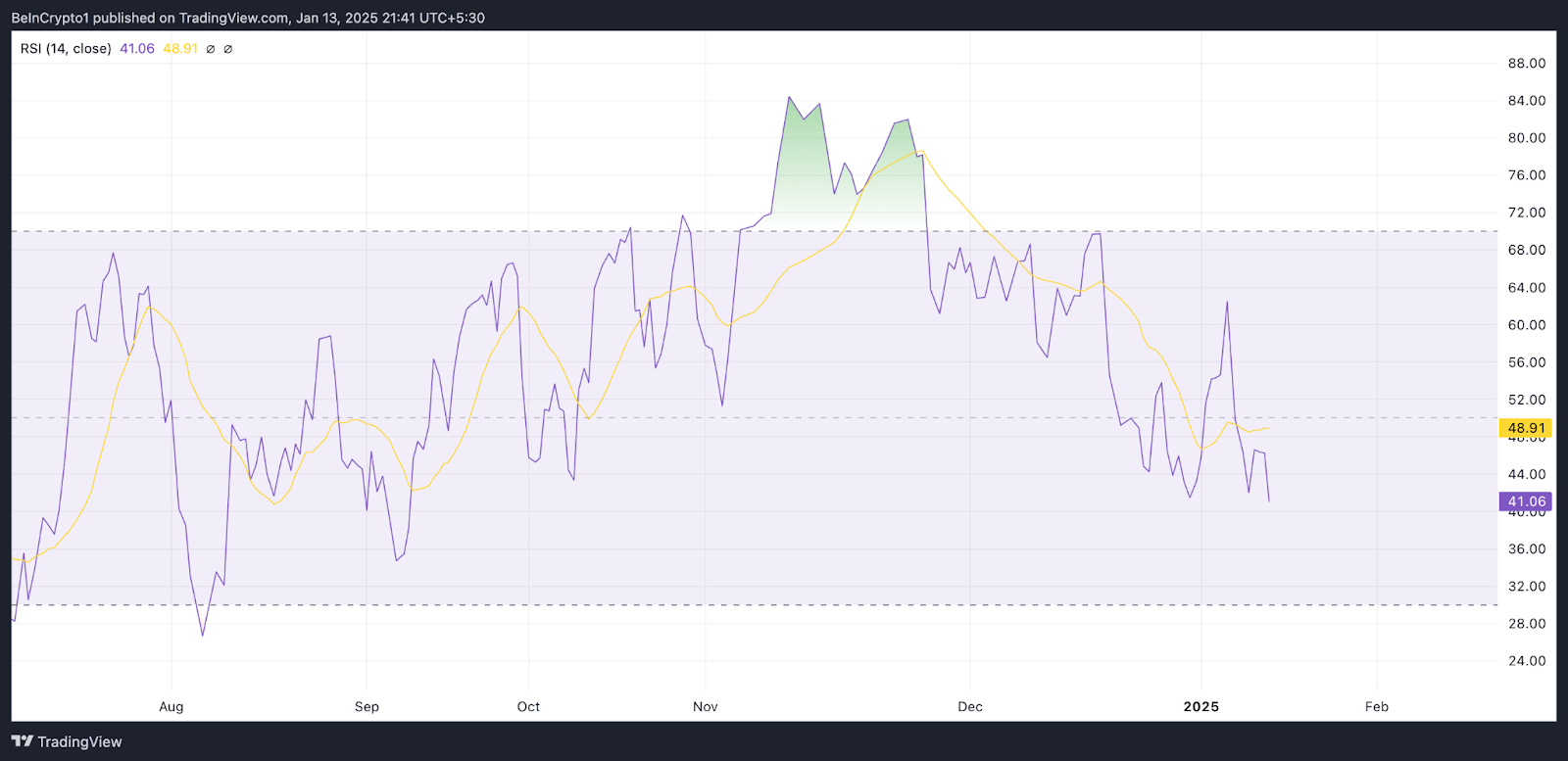

Bitcoin’s Relative Energy Index (RSI), assessed on a one-day chart, confirms this bearish outlook. As of this writing, this momentum indicator, which measures an asset’s oversold and overbought market situations, is in a downward development at 41.06.

Additional, BTC presently trades beneath the dots of its Parabolic Cease and Reverse (SAR). This indicator tracks an asset’s worth tendencies and identifies potential reversals by plotting dots above or beneath an asset’s worth.

When the asset’s worth trades above the SAR dots, it suggests it’s in an uptrend, signaling bullish momentum. Conversely, if the worth is beneath the SAR dots, it signifies a downtrend or {that a} bearish reversal could also be underway.

BTC’s Parabolic SAR indicator displays the bearish sentiment in the direction of it amongst market contributors, hinting at extra decline within the quick time period.

BTC Worth Prediction: Coin Teeters Between $85,000 Help and $102,000 Rally Potential

A resurgence in selloffs will push BTC’s worth again beneath $90,000. On this situation, it may plummet to help at $85,224.

Nevertheless, if Bitcoin maintains its present uptrend, it may breach the resistance at $95,513 and rally towards $102,538