Tariff tensions contribute to main liquidation occasion within the crypto market as Bitcoin leads the decline.

Key Takeaways

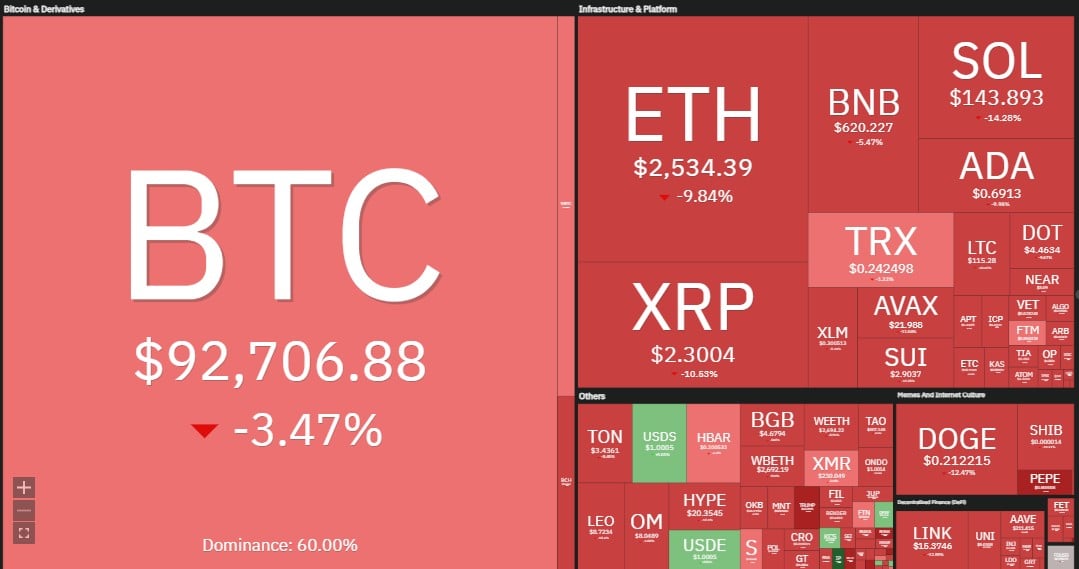

- Bitcoin worth is down 3.9% as a result of new tariffs from President Trump.

- The crypto market skilled a $110 billion loss immediately.

Bitcoin fell 3.9% immediately to a three-week low after President Trump introduced new tariffs on imports from Canada and Mexico, deepening a broader crypto market selloff that erased greater than $110 billion in worth.

The most important digital asset traded round $92,400, its lowest stage since February 2, with the decline accelerating after Trump confirmed tariffs on Mexican and Canadian imports “are going ahead.”

Trump signed government orders on February 1 imposing a 25% tariff on all merchandise imported from Canada and Mexico, with a decrease 10% charge on Canadian power sources.

The administration cited a “nationwide emergency” associated to unlawful immigration and drug trafficking, together with fentanyl, as justification for the measures. The tariffs are scheduled to begin to apply on March 4, 2025.

The market-wide downturn affected main crypto belongings, with Solana dropping 14%, XRP falling round 10%, and Ethereum declining practically 10%. BNB noticed a extra ‘modest’ lower of 5.5%.

The $110 billion in market-wide liquidations represents one of many largest dollar-volume declines in crypto market historical past.