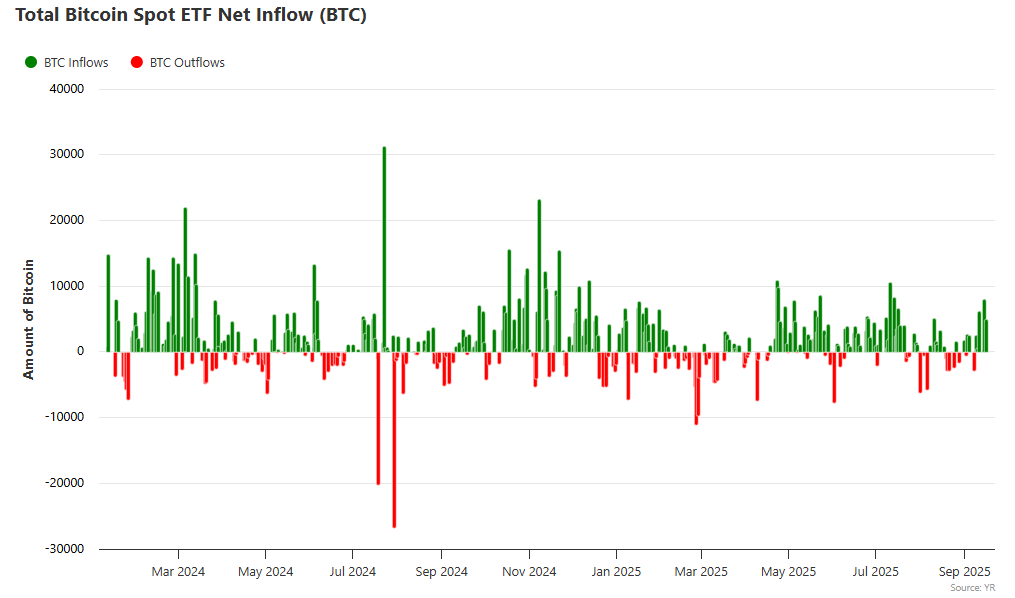

Bitcoin ETF outflows reached $51 million on September 17, and this marks the primary main withdrawal after seven straight days of inflows as institutional buyers quickly repositioned their cryptocurrency holdings. The huge Bitcoin ETF outflows sign a shift in market sentiment proper now, whereas Ethereum ETF merchandise additionally skilled some promoting strain with $1.89 million in withdrawals in the course of the second day in a row of outflows.

Bitcoin ETF Outflows, Ethereum ETF Strain, Fed Coverage Impression

Main Bitcoin ETF Outflows Dominate Buying and selling

So proper now, Constancy FBTC really led the Bitcoin ETF outflows with $116.03 million in withdrawals, and this was adopted by Grayscale GBTC‘s $62.64 million exit. The institutional buyers’ retreat additionally included ARK & 21Shares ARKB with $32.29 million in outflows together with Bitwise BITB recording $12.58 million in withdrawals.

Regardless of all of the widespread promoting, BlackRock IBIT managed to tug in $149.73 million in inflows whereas Grayscale BTC additionally added $22.54 million. Complete buying and selling quantity in Bitcoin ETF merchandise really reached $4.24 billion with whole web belongings of $152.45 billion, and this represents 6.62% of Bitcoin’s market cap proper now.

Ethereum ETF Markets Face Related Strain

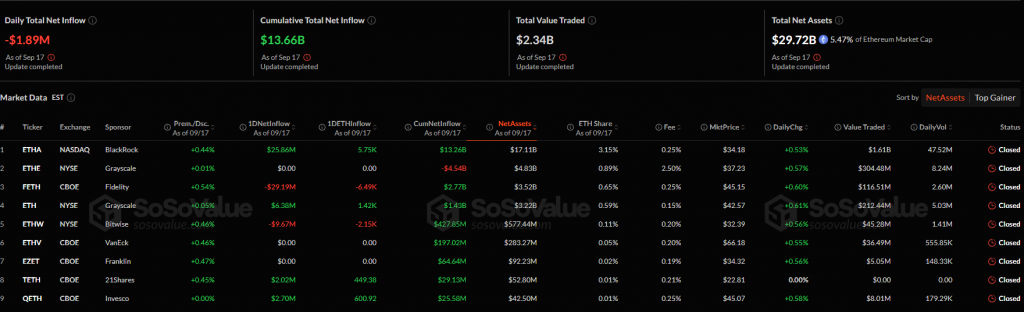

The crypto market turbulence prolonged to Ethereum ETF merchandise too, with Constancy’s FETH main outflows at $29.19 million. Bitwise ETHW additionally recorded $9.67 million in withdrawals, although some funds confirmed resilience towards the promoting strain that was occurring.

BlackRock ETHA really posted $25.86 million in inflows, whereas Grayscale ETH added $6.38 million. Smaller positive factors got here from Invesco QETH and 21Shares with $2.70 million and $2.02 million respectively. Complete Ethereum ETF buying and selling quantity surged to $2.34 billion, together with web belongings reaching $29.72 billion.

Fed Coverage Creates Market Uncertainty

The Bitcoin ETF outflows and Ethereum ETF withdrawals occurred amid broader issues about Fed coverage modifications affecting threat belongings. Regardless of some preliminary fears that cryptocurrency markets would battle after the Fed fee minimize, each Bitcoin and Ethereum really confirmed resilience with elevated buying and selling volumes.

Bitcoin buying and selling reached $60.878 billion in every day quantity, climbing greater than $20 billion in a single day, whereas Ethereum’s buying and selling quantity jumped to $44.462 billion. This exercise means that whereas institutional buyers are taking earnings via Bitcoin ETF outflows, retail and different market individuals stay engaged proper now.

The market dynamics replicate how rapidly institutional sentiment can shift within the crypto market, with Bitcoin ETF outflows representing profit-taking conduct moderately than basic bearishness on digital belongings on the time of writing.