On Monday, the USA and China agreed to a 90-day tariff aid deal. The announcement triggered renewed optimism throughout world monetary markets, with crypto markets additionally benefiting from the sentiment shift.

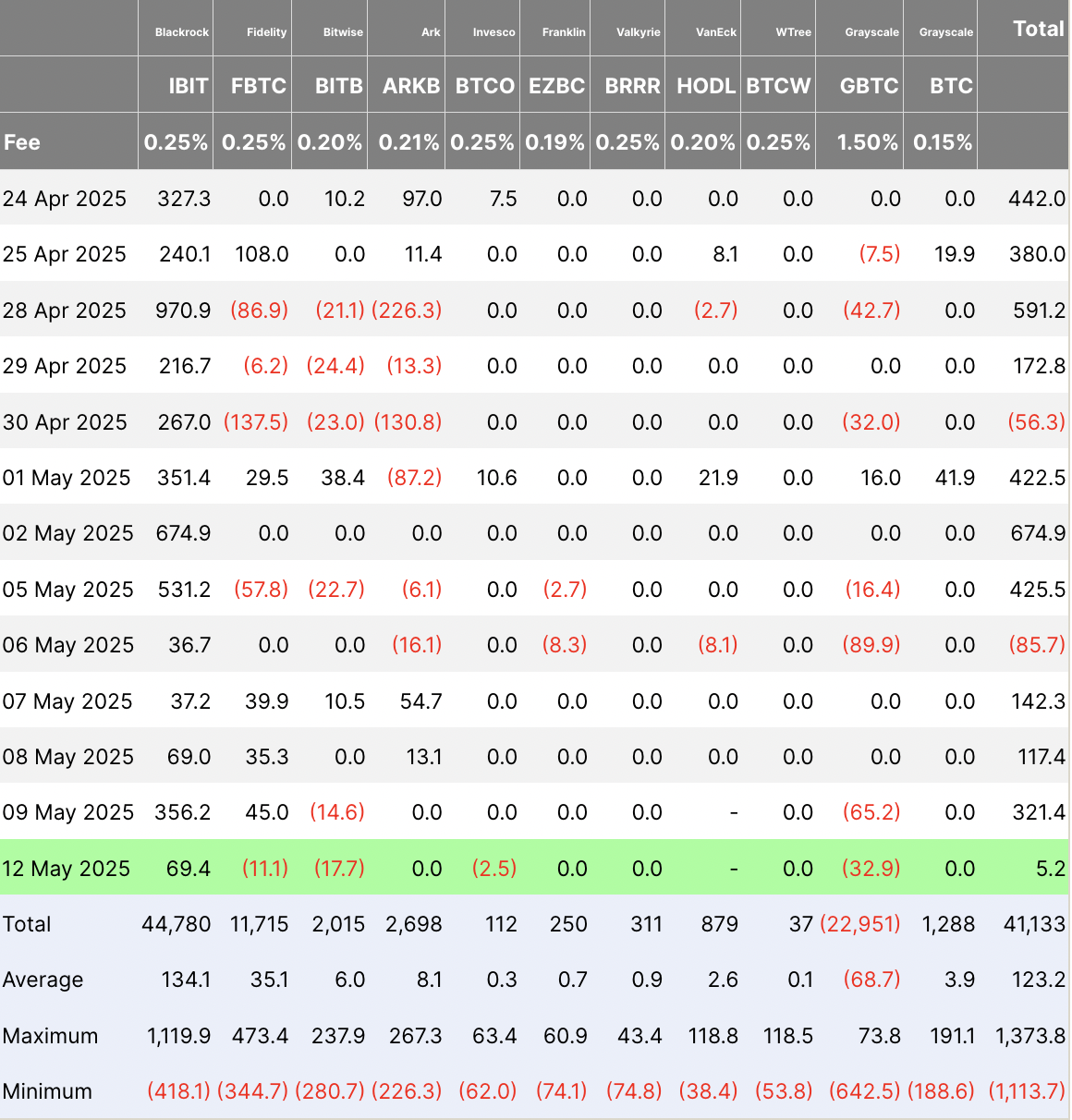

Nevertheless, this translated to simply $5 million in internet inflows into the Bitcoin ETF market, its lowest single-day complete influx since April 14.

Revenue-Taking Slows Bitcoin ETF Demand

As buying and selling exercise rocketed on Monday, BTC soared to an intraday excessive of $105,819. Nevertheless, profit-taking quickly adopted, inflicting the main coin to shed a few of its beneficial properties and shut at $102,729.

The dip beneath the psychologically important $105,000 threshold dampened institutional enthusiasm, discouraging massive capital inflows into spot Bitcoin ETFs. In consequence, internet inflows into the ETF market stalled at simply $5.2 million on Monday, representing the bottom single-day complete influx since April 14.

Day by day Complete Web Influx. Supply: Farside

BlackRock’s iShares Bitcoin Belief (IBIT) recorded the best each day influx amongst all issuers. On Monday, the fund’s internet influx was $69.41 million, bringing its complete historic internet influx to $44.78 billion.

In the meantime, Grayscale’s Bitcoin Belief ETF (GBTC) recorded the best internet outflow amongst all issuers on Monday, with $32.92 million leaving the fund. GBTC’s complete historic internet inflows stand at $22.95 billion as of this writing.

The pullback indicators that institutional buyers could also be holding again till BTC reclaims or stabilizes above key resistance ranges.

Bitcoin Cools Off After Temporary Surge to $105,000

At press time, BTC trades at $102,367, down 2% over the previous 24 hours. On Monday, the coin briefly surged to a three-month excessive of $105,819 following the US-China commerce settlement information. Nevertheless, the rally was short-lived, as profit-taking by merchants triggered a pullback, inflicting BTC to shut beneath the psychological $105,000 value mark.

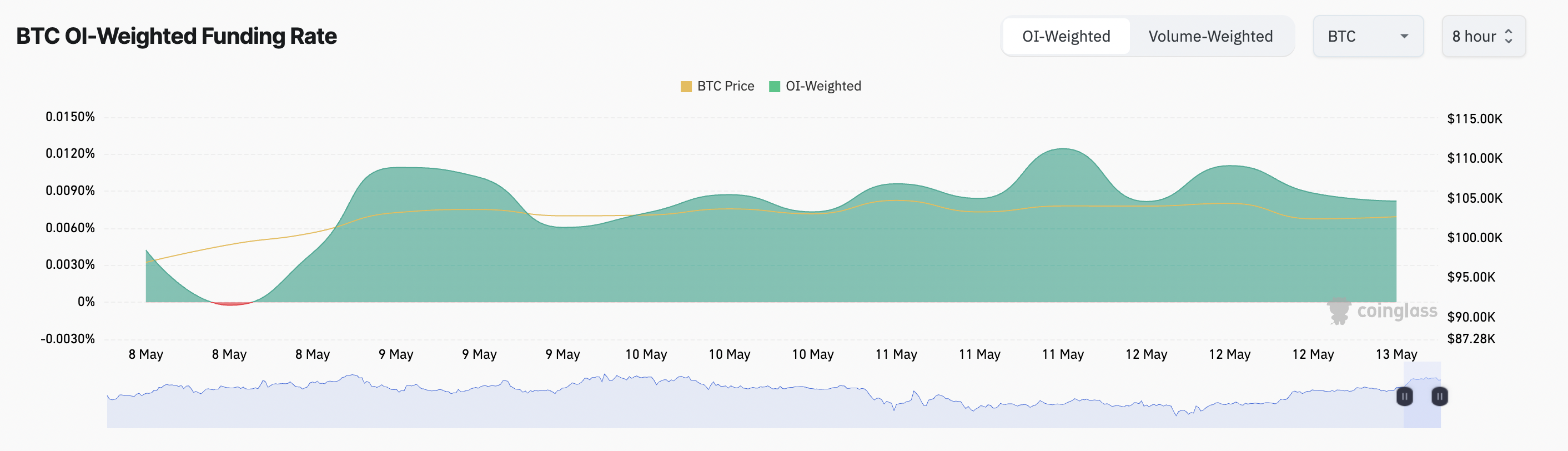

Whereas the dip indicators near-term promoting strain, market sentiment stays optimistic. That is mirrored by BTC’s funding fee, which stays constructive, suggesting that merchants proceed to guess on a sustained rally, regardless of the non permanent retreat.

BTC Funding Price. Supply: Coinglass

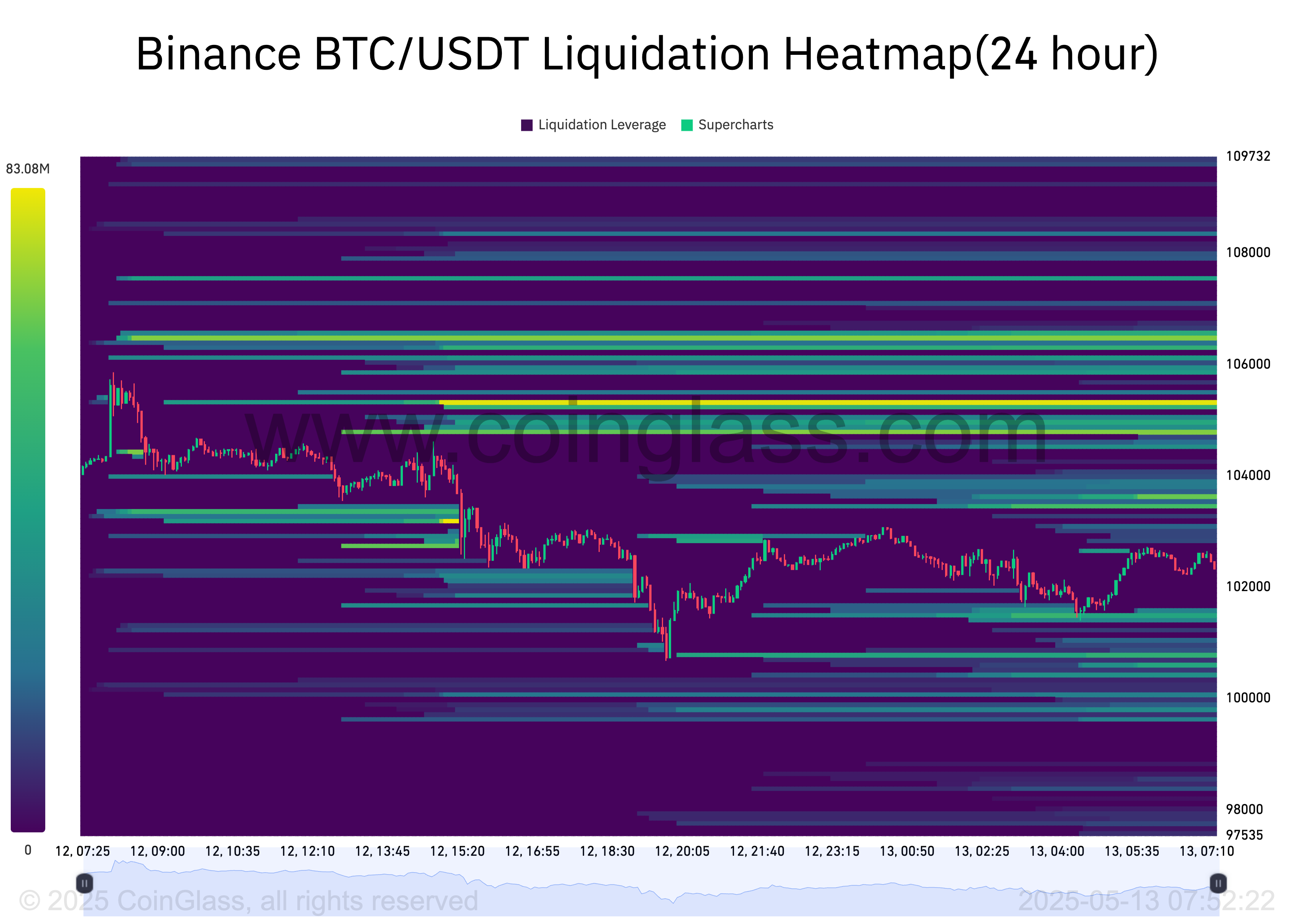

Furthermore, a have a look at the BTC liquidation heatmap reveals a big focus of liquidity across the $105,337 degree.

BTC Liquidity Heatmap. Supply: Coinglass

The heatmap highlights potential value zones the place large-scale liquidations might happen, offering merchants perception into high-liquidity areas.

These zones, marked in yellow, point out that if BTC resumes its upward momentum, it might probably breach the $105,000 degree, assuming the present bullish setup holds. In such a state of affairs, merchants holding quick positions might face a brief squeeze.