Spot Bitcoin exchange-traded fund inflows shot up greater than 580% this week, as one analyst identified that whales had been loading up on Bitcoin at a tempo akin to the lead-up to the 2020 rally.

Over the previous week, inflows into the 12 spot Bitcoin ETFs reached $2.13 billion, following six consecutive days of constructive inflows. This marks the primary time weekly inflows into Bitcoin ETFs have surpassed the $2 billion mark since March 2024.

Whole web inflows throughout Bitcoin ETFs have hit a document $20.94 billion. That’s a milestone that took gold ETFs years to realize, in keeping with Bloomberg’s Eric Balchunas. Bitcoin merchandise took lower than a 12 months.

Weekly inflows hit their excessive on Oct. 14, with $555.86 million flowing into the ETFs, however by Oct. 18, the tempo slowed down, dipping to $273.71 million, in keeping with SoSoValue information.

Not one of the funds noticed unfavourable flows on the final buying and selling day, with ARK 21Shares’ ARKB main the pack. The inflows recorded had been as follows:

- ARK 21Shares’ ARKB, $109.86 million, 7-day influx streak.

- BlackRock’s IBIT, $70.41 million, 5-day influx streak.

- Bitwise’s BITB, $35.96 million.

- VanEck’s HODL, $23.34 million.

- Constancy’s FBTC, $18.0 million, 6-day influx streak.

- Invesco’s BTCO, $16.11 million.

- Franklin Templeton’s EZBC, Knowledge Tree’s BTCW, Grayscale’s GBTC and BTC, and Hashdex’s DEFI noticed no flows.

You may also like: Spot Bitcoin ETFs document over $2.1b inflows in five-day streak, breaking $20b mark

Whale accumulation intensifies

This week’s inflows into Bitcoin (BTC) merchandise sign sturdy demand amongst retail and institutional traders and got here alongside an attention-grabbing accumulation sample famous amongst whales.

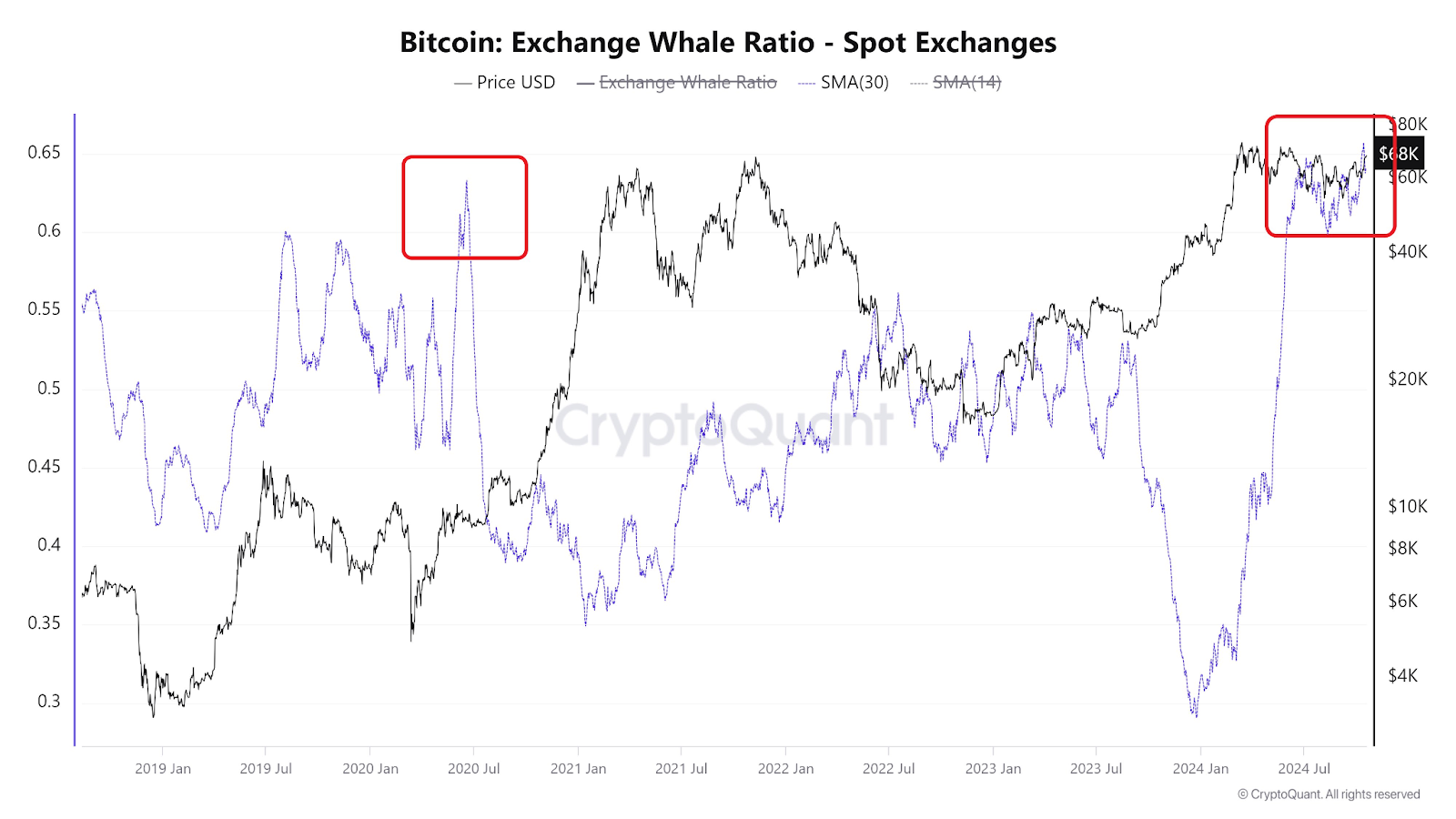

On X, CryptoQuant creator Woominkyu identified that the Bitcoin whale ratio on spot exchanges is trying rather a lot prefer it did again in July 2020, proper after the COVID crash. In line with the chart he shared, that’s when a serious Bitcoin rally took off — hinting that whales may be gearing up for an additional long-term value surge. (See under.)

Spot change whale ratio for Bitcoin | Supply: Woominkyu

The same accumulation sample was additionally noticed amongst newer whales by fellow analyst and CryptoQuant CEO Ki-Younger Ju, who wrote in an Oct 16 X publish that new whale wallets with a mean coin age of underneath 155 days reached a brand new excessive of 1.97 million BTC. (See under.)

New whale wallets now maintain 1.97M #Bitcoin.

Every has over 1K BTC, common coin age underneath 155 days, excluding change and miner wallets, doubtless custodial.

Their BTC steadiness surged 813% YTD, taking on 9.3% of the full provide, valued at $132B right this moment. pic.twitter.com/pxq0tcqMuW

— Ki Younger Ju (@ki_young_ju) October 16, 2024

Whales are sometimes called “good cash” as a result of they have a tendency to purchase throughout market dips and maintain by way of the ups and downs, utilizing their deep pockets and strategic timing to make calculated strikes. Their actions can typically sign the place the market may be heading subsequent, as they normally place themselves forward of massive value shifts.

Whereas the uptick in whale accumulation has ignited hopes of a forthcoming rally, a number of market analysts are additionally anticipating the bellwether to succeed in a brand new all-time excessive quickly buoyed by the upcoming U.S. presidential elections as a possible catalyst.

Pseudonymous dealer Crypto Raven identified that polls present growing odds for Republican candidate Donald Trump successful the November elections, which might be simply the push BTC must hit new highs. As Raven put it, “every thing goes this clean, we might purpose for the moon.”

On a extra bullish notice, Bitwise CIO Matt Hougan predicts Bitcoin will hit six figures, pushed not simply by the upcoming elections, but additionally by a surge in institutional demand and different macroeconomic components.

At press time, the flagship cryptocurrency was buying and selling at $68,280, up 8.5% over the previous week.

Learn extra: Spot Bitcoin ETFs see 4 straight days of inflows, surpassing $1.6b, Ether ETFs rebound