Bitcoin beneath $86k displays elevated worth volatility. Nonetheless, will the rising whales holding set off a triangle breakout run to $95k?

Breaking beneath the $86,000 mark, Bitcoin is buying and selling at a market worth of $85,982. Over the previous 24 hours, the most important cryptocurrency out there has taken a success of 1.6%.

Nonetheless, the continuing inflows into Bitcoin ETFs, coupled with rising acceptance amongst high U.S. firms, sign a possible rally. Will this result in a reclaiming of the $100,000 mark?

Whales Develop Bitcoin Holding By 129k BTC

Regardless of the volatility, crypto whales are rising their Bitcoin holdings. Based on Glassnode information, the change within the place of whales over the previous 30 days reveals an addition of 129,000 BTC since March 11.

This marks one of many strongest accumulations by crypto whales since August 2024. With newfound confidence among the many whales, a BTC worth rally is prone to acquire momentum.

Bitcoin Spot ETFs in a Contemporary Influx Cycle

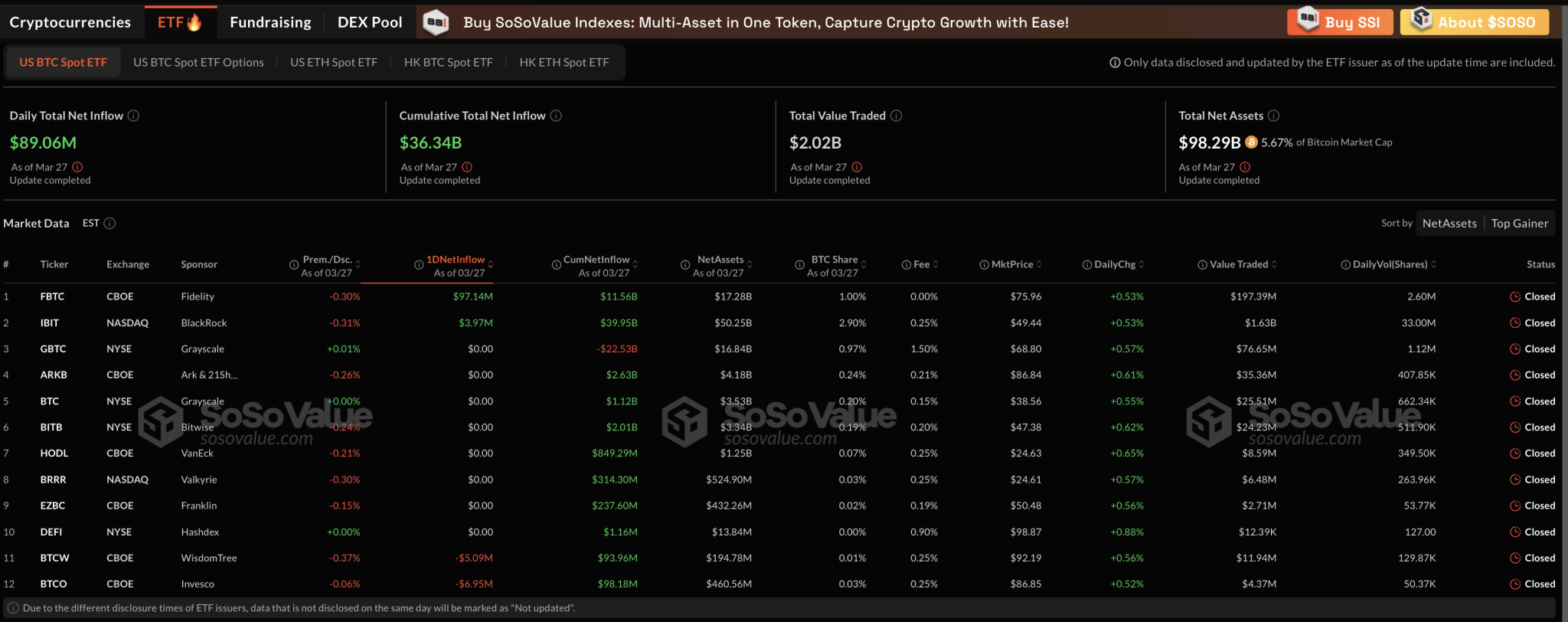

Amid the rising whale holdings, U.S. Bitcoin spot ETFs recorded a complete web influx of $89.09 million on March 27. Out of the 12 registered Bitcoin ETFs, Constancy noticed an influx of $97.14 million, whereas BlackRock recorded $3.97 million.

Nonetheless, the $5.09 million outflow from Vision3 and the $6.95 million outflow from Invesco restricted the overall influx, holding it just below $90 million. Over the previous 10 buying and selling days, Bitcoin ETFs have skilled a steady streak of inflows.

As this development strengthens, rising institutional demand is predicted to gasoline the Bitcoin rally.

Bitcoin ETFs

Bitcoin Worth Nears Triangle Breakout, Eyes $95k

On the every day chart, Bitcoin’s worth motion reveals a bearish turnaround inside a symmetrical triangle sample, testing the 61.80% Fibonacci degree at $86,146. At the moment, the pullback is discovering assist on the 100-EMA line, close to $85,760.

Moreover, the declining development has resulted in a bearish crossover within the MACD and sign strains, with a brand new streak of bearish histograms. Nonetheless, Bitcoin has skilled lower cost rejections from the 61.80% Fibonacci degree twice prior to now 48 hours.

This implies the opportunity of a bullish comeback that might push the worth above the overhead trendline. If this occurs, a bullish breakout rally is prone to attain the 78.60% Fibonacci degree, near the $95,000 mark.

On the flip facet, a bearish continuation, compromising the bullish dominance on the assist trendline, might take a look at the 50% Fibonacci degree, which is close to the $80,000 mark.

GameStop to Begin Accumulating Bitcoin

Within the latest information of Bitcoin adoption, GameStop, the American online game retailer, introduced an up to date funding. GameStop revealed plans so as to add Bitcoin to its treasury reserve property.

On March 27, GameStop introduced the pricing of $1.3 billion price of convertible senior notes as a part of a non-public providing. The providing is meant to lift funds for Bitcoin purchases.

Priced at $1,000 per notice, purchasers will obtain a conversion charge of 33.4970 shares, representing a 35.14% premium to GameStop’s present inventory worth of $22.09.

Following GameStop’s preliminary announcement on March 25 about including Bitcoin to its funding coverage, GameStop’s share worth surged by 11.65%, including $1.65 billion to its market cap in a single day.