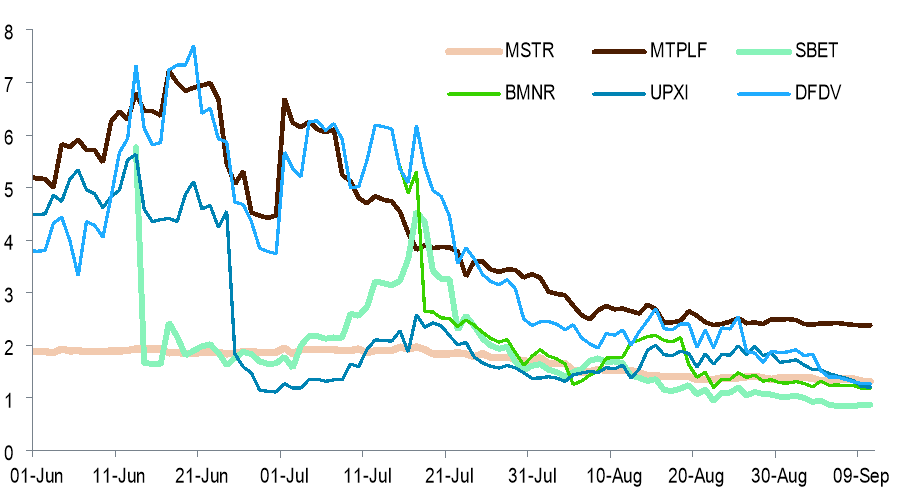

Analysis from London-based Customary Chartered Financial institution reveals that changed internet asset values (mNAVs) for bitcoin treasury firms are trending downward.

BTC Takes A Breather as DATs Wrestle

Michael Saylor’s Technique (Nasdaq: MSTR) simply introduced one other 525 bitcoin ( BTC) buy on Monday, bringing the agency’s stash to 638,985 BTC, however MSTR’s mNAV dipped to 1.47. And now, one among Customary Chartered Financial institution’s analysis divisions says decrease mNAVs are dogging digital asset treasury firms (DATs) and stalling “recent shopping for,” which can clarify why bitcoin’s latest rally seems to have taken a breather.

(Chart exhibiting the ratio of enterprise worth to crypto holdings for chosen DATs corresponding to MSTR / Customary Chartered Analysis)

On the planet of DATs, mNAV merely refers to an organization’s enterprise worth in relation to the greenback quantity of its bitcoin holdings. There was a time when bitcoin DATs like Technique loved mNAVs as excessive as 3.00, which means MSTR was valued at thrice the market worth of its BTC reserve.

However now, with lots of of firms leaping onto the DAT bandwagon, these mNAVs are whittling right down to the 1.00 stage, and Customary Chartered says at that threshold, it will likely be troublesome for DATs to proceed shopping for extra bitcoin.

“Digital asset treasuries (DATs) have struggled just lately. Share costs have fallen on the again of decrease mNAVs,” mentioned Geoffrey Kendrick, head of digital property analysis at Customary Chartered financial institution in a Monday e-newsletter. “A better mNAV means a enterprise is extra sustainable, and means extra cash can, and can, be bought. A decrease mNAV means the other.”

Overview of Market Metrics

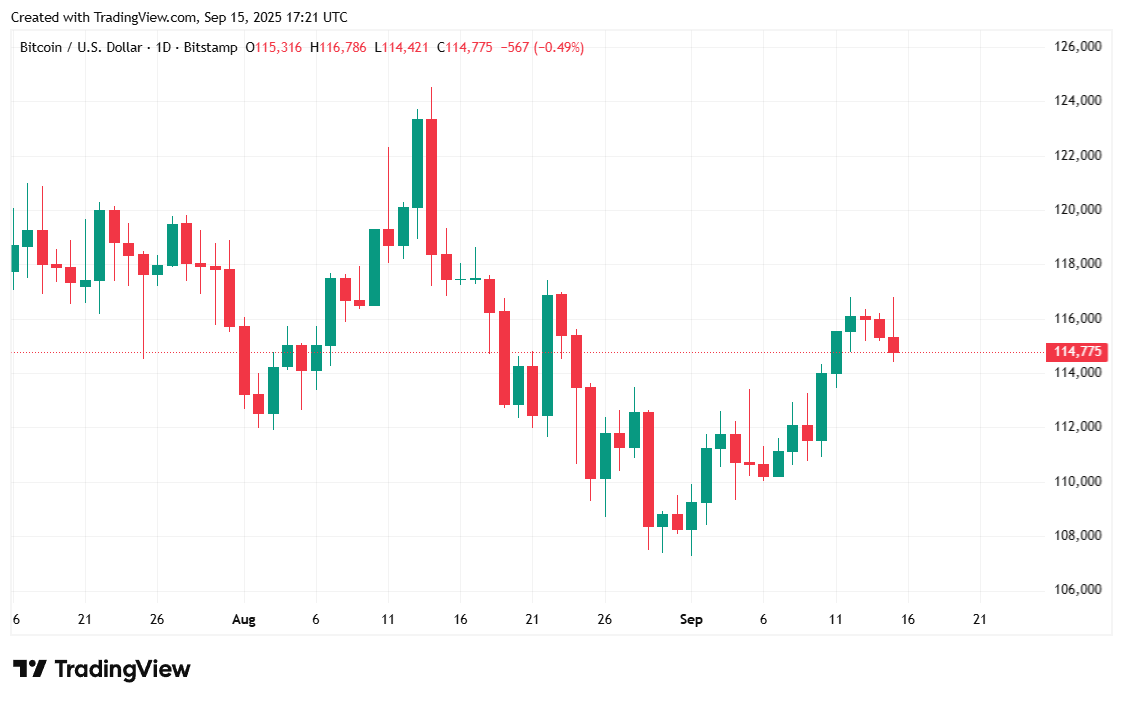

Bitcoin was priced at $114,883.07 on the time of reporting, principally flat however down barely by 0.56% over 24 hours based on Coinmarketcap. The digital asset has traded between $114,461.06 and $116,747.88 since Sunday.

( Bitcoin worth / Buying and selling View)

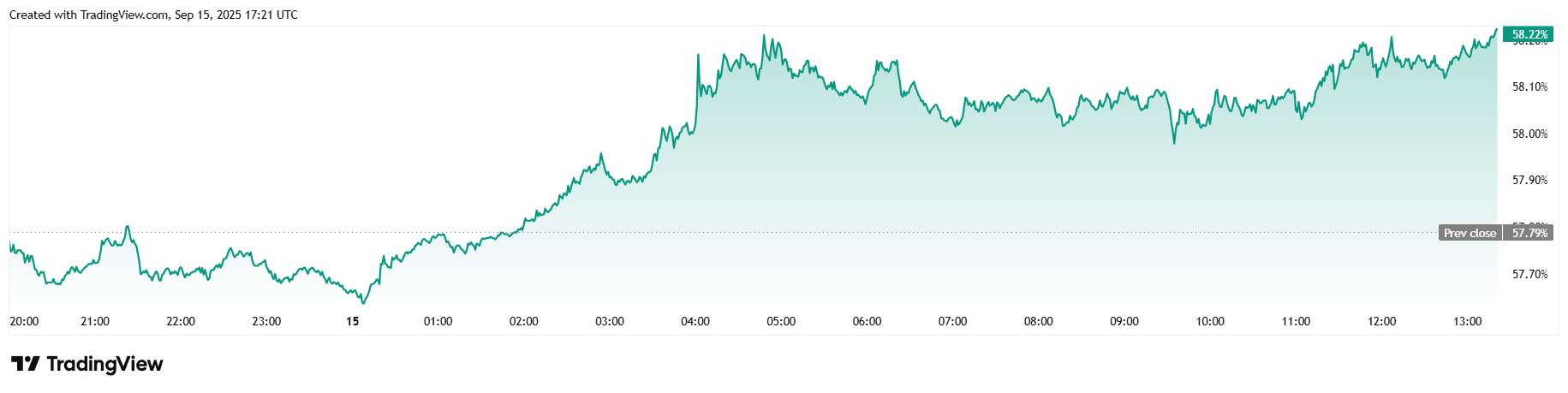

Twenty-four-hour buying and selling quantity climbed 55.56% to $49.79 billion after the weekend, an anticipated post-Sunday soar. Market capitalization was comparatively flat, dipping 0.56% in tandem with worth to achieve $2.28 trillion. Bitcoin dominance, nevertheless, noticed a 0.73% uptick since yesterday, inching as much as 58.22%.

( BTC dominance / Buying and selling View)

Whole bitcoin futures open curiosity was additionally principally unchanged over 24 hours, down barely by 0.22% at $83.12 billion based on Coinglass. Bitcoin liquidations have been sitting at a grand whole of $45.92 million, with lengthy liquidations contributing $35.22 million to that determine whereas shorts made up the remaining $10.70 million.